Our strength is in serving private clients in the $1-$10 million private client market segment, which contributed approximately 66% and 68% of our real estate brokerage commissions during the three months ended September 30, 2018 and 2017, respectively, and approximately 65% and 69% of our real estate brokerage commissions during the nine months ended September 30, 2018 and 2017, respectively. The following tables set forth the number of transactions, sales volume and revenues by commercial real estate market segment for real estate brokerage:

| Three Months Ended September 30, | ||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | Change | ||||||||||||||||||||||||||||||||||

| Real Estate Brokerage | Number | Volume | Revenues | Number | Volume | Revenues | Number | Volume | Revenues | |||||||||||||||||||||||||||

| (in millions) | (in thousands) | (in millions) | (in thousands) | (in millions) | (in thousands) | |||||||||||||||||||||||||||||||

| <$1 million |

268 | $ | 166 | $ | 7,224 | 259 | $ | 166 | $ | 7,032 | 9 | $ | — | $ | 192 | |||||||||||||||||||||

| Private client market ($1 - $10 million) |

1,352 | 4,382 | 125,898 | 1,282 | 3,906 | 115,959 | 70 | 476 | 9,939 | |||||||||||||||||||||||||||

| Middle market (³$10 - $20 million) |

119 | 1,581 | 31,158 | 94 | 1,284 | 24,505 | 25 | 297 | 6,653 | |||||||||||||||||||||||||||

| Larger transaction market (³$20 million) |

70 | 3,169 | 27,700 | 62 | 2,644 | 21,861 | 8 | 525 | 5,839 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| 1,809 | $ | 9,298 | $ | 191,980 | 1,697 | $ | 8,000 | $ | 169,357 | 112 | $ | 1,298 | $ | 22,623 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||

| 2018 | 2017 | Change | ||||||||||||||||||||||||||||||||||

| Real Estate Brokerage | Number | Volume | Revenues | Number | Volume | Revenues | Number | Volume | Revenues | |||||||||||||||||||||||||||

| (in millions) | (in thousands) | (in millions) | (in thousands) | (in millions) | (in thousands) | |||||||||||||||||||||||||||||||

| <$1 million |

764 | $ | 489 | $ | 20,819 | 762 | $ | 472 | $ | 20,110 | 2 | $ | 17 | $ | 709 | |||||||||||||||||||||

| Private client market ($1 - $10 million) |

3,819 | 12,038 | 350,062 | 3,628 | 11,184 | 328,177 | 191 | 854 | 21,885 | |||||||||||||||||||||||||||

| Middle market (³$10 - $20 million) |

350 | 4,789 | 85,984 | 258 | 3,501 | 64,047 | 92 | 1,288 | 21,937 | |||||||||||||||||||||||||||

| Larger transaction market (³$20 million) |

213 | 8,846 | 79,280 | 162 | 6,607 | 59,735 | 51 | 2,239 | 19,545 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| 5,146 | $ | 26,162 | $ | 536,145 | 4,810 | $ | 21,764 | $ | 472,069 | 336 | $ | 4,398 | $ | 64,076 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

We continue to increase our presence in the United States and Canada through execution of our growth strategies by targeting markets based on population, employment, level of commercial real estate sales, inventory and competitive opportunities where we believe the markets will benefit from our business model. For the nine months ended September 30, 2018, we completed acquisitions that expanded our presence in the financing market in the Midwest and in the real estate brokerage market in Canada. We also added commercial mortgage servicing to the financing services.

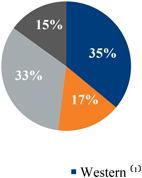

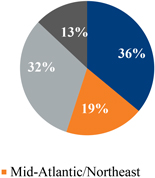

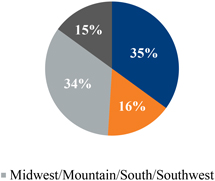

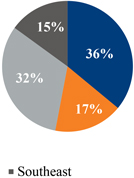

The following charts set forth the percentage of transactions by region for real estate brokerage.

| Three Months Ended September 30, |

Nine Months Ended September 30, | |||||

| 2018 |

2017 |

2018 |

2017 | |||

|

|

|

|

| |||

| (1) | Includes our Canadian operations, which represented less than 1% of our total revenues in each period presented. |

28