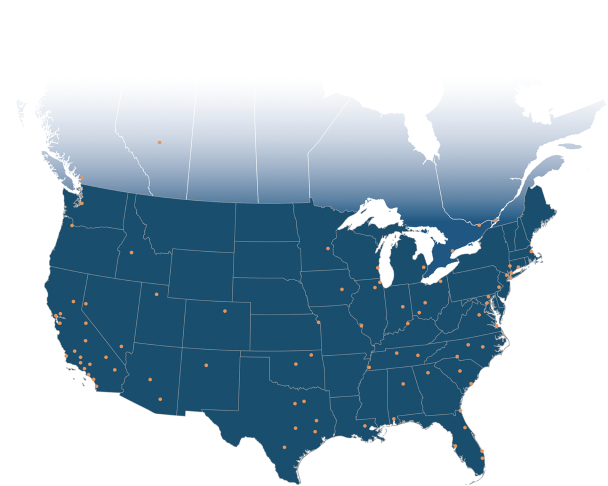

Below is a map reflecting the geographic location of our 82 offices as of December 31, 2021.

Commercial Real Estate Investment Brokerage

Our primary business and source of revenue is the representation of commercial property owners as their exclusive investment broker in the sale of their properties. Our investment sales professionals also represent buyers in fulfilling their investment real estate acquisition needs. Commissions from real estate investment brokerage sales accounted for approximately 90% of our revenues in 2021. Sales are generated by maintaining relationships with property owners, providing market information and trends to them during their investment or “hold” period and being selected as their representative when they decide to sell, buy additional property or exchange their property for another property. We collect commissions upon the sale of each property based on a percentage of sales price. These commission percentages are typically inversely correlated with sales price and thus are generally higher for smaller transactions.

We underwrite, value and market properties to reach the largest and most qualified pool of buyers. We offer our clients the industry’s largest team of investment sales professionals, who operate with a culture and policy of information sharing powered by our proprietary system, MNet, which enables real-time buyer-seller matching. We use a proactive marketing campaign that leverages the investor relationships of our entire sales force, direct marketing and a suite of proprietary

web-based

tools that connects each asset with the right buyer pool. We strive to maximize value for the seller by generating high demand for each property. Our approach also provides a diverse, consistently underwritten inventory of investment real estate for buyers. When a client engages one of our investment sales professionals, they are engaging an entire system, structure and organization committed to maximizing value for them. 6