Notice of 2024 Annual Meeting of Stockholders and Proxy Statement

Marcus & Millichap, Inc.

May 2, 2024, 2:00 p.m. Pacific Time

A Different Kind of Brokerage

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of 2024 Annual Meeting of Stockholders and Proxy Statement

Marcus & Millichap, Inc.

May 2, 2024, 2:00 p.m. Pacific Time

A Different Kind of Brokerage

23975 Park Sorrento, Suite 400

Calabasas, California 91302

(818) 212-2250

March 22, 2024

Dear Stockholder:

We are pleased to invite you to attend the 2024 Annual Meeting of Stockholders of Marcus & Millichap, Inc., which will be held virtually on May 2, 2024.

We are furnishing our proxy materials to stockholders primarily over the Internet. This process expedites stockholders’ receipt of proxy materials, while significantly lowering the costs of our annual meeting and conserving natural resources. On March 22, 2024, we mailed to our stockholders a notice containing instructions on how to access our Proxy Statement and 2023 Annual Report to Stockholders and to vote online. The notice also included instructions on how you can receive a paper copy of your annual meeting materials. If you received your annual meeting materials by mail, the Proxy Statement, 2023 Annual Report to Stockholders, and proxy card were enclosed.

At this year’s annual meeting, the agenda includes the following items:

| Agenda Item | Board Recommendation | |

| 1. Election of directors |

FOR | |

| 2. Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024 |

FOR | |

| 3. Advisory vote to approve executive compensation |

FOR | |

| 4. Approval of the Amended and Restated 2013 Omnibus Equity Incentive Plan |

FOR | |

| 5. Approval of the Amended and Restated 2013 Employee Stock Purchase Plan |

FOR | |

Details regarding the meeting and the business to be conducted are more fully described in the accompanying Notice of 2024 Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. Whether or not you plan to attend the annual meeting, I hope you will vote as soon as possible. You may vote over the Internet before or at the annual meeting or, if you receive your proxy materials by U.S. mail, you also may vote by mailing a proxy card or voting by telephone. Please review the instructions on the notice or on the proxy card regarding your voting options.

Sincerely yours,

Hessam Nadji

President and Chief Executive Officer

Table of Contents

March 22, 2024

Notice of 2024 Annual Meeting of Stockholders

TO BE HELD ON MAY 2, 2024

| Date and Time | Virtual Meeting | Record Date | ||

| Thursday, May 2, 2024, 2:00 p.m. Pacific Time |

Via the Internet https://web.lumiagm.com/204691330 (password: Mm2024) |

March 12, 2024 | ||

The 2024 Virtual Annual Meeting of Stockholders (“Annual Meeting”) of Marcus & Millichap, Inc. (“Marcus & Millichap,” “MMI,” or the “Company”) will be held as a virtual-only meeting on Thursday, May 2, 2024 at 2:00 p.m. Pacific Time. The platform for the virtual Annual Meeting includes functionality that affords validated stockholders substantially the same meeting participation rights and opportunities they would have at an in-person meeting. Once admitted to the Annual Meeting, stockholders may view reference materials, submit questions, and vote their shares by following the instructions that will be available on the Annual Meeting website.

Agenda

At the Annual Meeting, stockholders will be asked to vote on the following proposals:

| PROPOSAL | BOARD VOTING RECOMMENDATION |

PAGE REFERENCE (FOR MORE DETAIL) | ||||||||

| Management Proposals |

||||||||||

| Elect three Class II Directors nominated by our Board of Directors, each to serve for a three-year term |

|

|

FOR each nominated Director |

|

7 | |||||

| Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024 |

|

FOR | 29 | |||||||

| Advisory vote to approve executive compensation |

|

FOR | 31 | |||||||

| Approval of the Amended and Restated 2013 Omnibus Equity Incentive Plan |

|

FOR | 63 | |||||||

| Approval of the Amended and Restated 2013 Employee Stock Purchase Plan |

|

FOR | 79 | |||||||

Other Important Information

Stockholders will also transact such other business as may properly come before the annual meeting (including adjournments and postponements).

You are entitled to participate in the Annual Meeting if you were a stockholder as of the close of business on March 12, 2024, the record date, or hold a legal proxy for the Annual Meeting provided by your bank, broker, or other nominee.

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 1

It remains very important that your shares are represented and voted at the Annual Meeting. We therefore strongly encourage you to vote in advance of the Annual Meeting. See “Voting Methods” on the next page for instructions for various voting methods.

By Order of the Board of Directors,

Hessam Nadji

President and Chief Executive Officer

Calabasas, California

March 22, 2024

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 2, 2024: The Notice of 2024 Annual Meeting of Stockholders the Proxy Statement and the 2023 Annual Report to Stockholders are available at http://www.astproxyportal.com/ast/18576.

|

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 2

Voting Methods

| Before the Annual Meeting | During the Annual Meeting | |||||||||

| Vote by Internet | Vote by Phone | Vote by Mail | Vote by Internet | |||||||

|

|

|

|

|||||||

| Go to www.voteproxy.com until 11:59 p.m. Eastern Time on May 1, 2024. | Call toll-free 1 (800) 776-9437 in the United States or 1 (201) 299-4446 from foreign countries until 11:59 p.m. Eastern Time on May 1, 2024. | Complete, sign, and date the proxy card/voting instruction card and return it in the postage-paid envelope that is enclosed with your proxy materials. | Go to https://web.lumiagm.com/204691330 and vote during the Annual Meeting by entering the 11-digit control number included in your proxy materials and the password “Mm2024” and following the instructions on the Annual Meeting website. | |||||||

As noted above, we strongly encourage you to vote in advance of the Annual Meeting by using one of the methods set forth above under “Before the Annual Meeting”, whether or not you plan to attend the Annual Meeting. You have the right to revoke your proxy before it is exercised at the Annual Meeting at any time before the polls close by submitting a later-dated proxy card/voting instruction card, by attending the Annual Meeting virtually and voting by Internet, by delivering instructions to our Corporate Secretary before the Annual Meeting, or by voting again using the Internet or by telephone before the cut-off time. Your latest Internet or telephone proxy is the one that will be counted. If you hold shares through a broker, bank, or other nominee, you may revoke any prior voting instructions by contacting that firm.

List of Stockholders

The names of stockholders of record entitled to vote will be available for inspection by stockholders of record for ten (10) days prior to the Annual Meeting and during the virtual Annual Meeting. If you are a stockholder of record and want to inspect the stockholder list, please send a written request to our Corporate Secretary at 23975 Park Sorrento, Suite 400, Calabasas, California 91302, or Steve.DeGennaro@marcusmillichap.com to arrange for electronic access to the stockholder list.

Internet Availability of Proxy Materials

We are furnishing proxy materials to our stockholders primarily via the Internet. On March 22, 2024, we mailed most of our stockholders as of the record date, a Notice Regarding the Availability of Proxy Materials (“Notice of Internet Availability”) containing instructions on how to access and review all the important information contained in our proxy materials, including our Proxy Statement and our 2023 Annual Report to Stockholders. The Notice of Internet Availability also instructs you on how to vote via the Internet. Other stockholders, in accordance with their prior requests, have been mailed paper copies of our proxy materials, and a proxy card or voting form.

Internet distribution of our proxy materials is designed to expedite receipt by stockholders, lower the cost of the annual meeting, and conserve natural resources. However, if you would prefer to receive paper copies of proxy materials, please follow the instructions included in the Notice of Internet Availability.

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 3

Letter from the CEO & Chair of the Board

To our Stockholders:

MMI remained resilient and continued to make progress toward our long-term goals despite significant market headwinds experienced across the U.S. commercial real estate industry last year. The real estate market faced declining transaction volume resulting from the most aggressive Federal Reserve tightening policy in 40 years, culminating in interest rate increases of 525 basis points in 18 months. An already constrained lending environment was further exacerbated by the regional banking crisis. Although the broader economy performed well, interest rate volatility presented challenges for transaction closings with widening bid-ask spreads and higher borrowing costs. According to CoStar and MSCI, 2023 U.S. commercial real estate transaction volume declined by an estimated 55% compared to prior year.

In this environment, our team delivered revenue of $646 million and a net loss of $34 million, which largely reflects the impact of a 39% decline in total transactions. Our earnings were particularly pressured by expenses related to capital invested in top talent acquisition and retention, technological innovations and expanding our technology platform. We believe these investments will be instrumental in helping us lead in the recovery and long-term growth. We believe the company is well positioned to not only withstand the current market dislocation but to leverage the downturn to our advantage. We ended the year with $407 million in cash, cash equivalents, and marketable debt securities, available-for-sale.

In 2023, our management team adopted a range of strategic measures to mitigate the impact of the market disruption while also strengthening the MMI platform. We implemented cost control initiatives aimed at reducing the interim impact of lower revenue while continuing to make well-underwritten investments essential to long-term growth. Focusing on our people, we continued to provide broker training, retention of top producers and recruitment of experienced professionals and teams. We prioritized enhancing our ability to serve client needs by expanding marketing efforts, further integrating our auction teams into the sales process and leveraging technology. These combined efforts resulted in over 7,000 closings and nearly $45 billion

in volume, keeping MMI as the top ranked brokerage firm by transactions last year.

Our commitment to strategic capital allocation that best aligns with the long-term interests of our stockholders remains constant. In 2023, we returned $20 million to stockholders in the form of dividends and another $39 million through share repurchases. We concluded the year with $72 million of share repurchase authorization remaining under our current program which is inclusive of the additional $70 million authorization that was announced in May. Recruitment and retention of top producers remains a key priority for our core business. Concurrently, we have aggressively explored several adjacent growth opportunities to further diversify our business geographically and to expand into complementary services. Although these transactions did not close due to a valuation gap, we continue to develop our pipeline and actively evaluate strategic acquisition opportunities.

Industry Position

The company’s leading position in investment sales and financing was accomplished through the efforts of our 1,783 member strong salesforce, the largest in our industry. Whether it was our participation in major industry conferences, our client webcasts which drew over 40,000 investors or providing insightful research and analysis, we are proud of the client guidance and touchpoints our team delivered at a difficult time for most investors. As we have highlighted in the past, we believe that the private client segment of the market will lead the turnaround and we feel confident in our positioning when activity inevitably does pick up.

Market Environment

We believe the Federal Reserve’s decision to pause interest rate hikes and turn to a more dovish stance has increased the market’s confidence in a soft landing for the economy. Despite ongoing challenges in the form of wide bid-ask spreads and tighter lending standards, clarity on interest rates and price adjustments are expected to provide positive tailwinds to the market in the second half of the year. Other factors such as distress in some sectors and debt maturities could also provide additional catalysts for activity.

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 4

Looking Forward

As we turn to 2024 and beyond, MMI will stay the course and maintain the laser focus that has enabled our company to persist and thrive through multiple cycles since our founding over 50 years ago. We will strive to continue to drive operational excellence and refine our strategic capital allocation policy all with the goal of serving our clients and stockholders in the best way possible. Progress was made in 2023 to position our company for the eventual market recovery, and we will continue our efforts in strengthening our resilience and competitiveness going forward.

We thank our team for their hard work and our stockholders for their confidence in us over the past year and look forward to our continued partnership.

Sincerely,

Hessam Nadji

President, Chief Executive Officer

George M. Marcus

Chair of the Board of Directors

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This letter includes forward-looking statements, including statements regarding the company’s business outlook, strategies and industry position, and the market environment. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Please see our 2023 Annual Report on Form 10-K, which was filed with the SEC on February 27, 2024, for more information regarding the factors that could cause such differences. Forward-looking statements speak only as of the date of this letter. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable laws.

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 5

About Marcus & Millichap

Marcus & Millichap, Inc. (“MMI”) is a leading national real estate services firm specializing in commercial real estate investment sales, financing services, research, and advisory services. We are the leading national investment brokerage company in the $1 million to $10 million private client market segment. This is the largest and most active market segment and comprised approximately 80% of total U.S. commercial property transactions greater than $1 million in the marketplace in 2023.

As of December 31, 2023, we had 1,783 investment sales and financing professionals that are primarily exclusive commission-based independent contractors who provide real estate investment brokerage and financing services to sellers and buyers of commercial real estate in over 80 offices in the United States and Canada. In 2023, we closed 7,546 sales, financing, and other transactions with total sales volume of approximately $43.6 billion.

We service clients by underwriting, marketing, selling, and financing commercial real estate properties in a manner that maximizes value for sellers, provides buyers with the largest and most diverse inventory of commercial properties, and secures the most competitive financing from lenders for borrowers.

We were founded in 1971 in the western United States, and we continue to increase our presence throughout North America through execution of our growth strategies by targeting markets based on population, employment, level of commercial real estate sales, inventory, and competitive landscape opportunities where we believe the markets will benefit from our business model. We have grown to have offices in 34 states across the United States and in four provinces in Canada.

Company Overview

At Marcus & Millichap, our commitment is to help our clients create and preserve wealth by providing them with the best real estate investment sales, financing, research, and advisory services.

| National Platform Focused on

| ||

| ◾ Over 50 years of experience dedicated to perfecting real estate investment brokerage ◾ Designed to maximize real estate value, facilitate investment options by geography and property type, and create liquidity for investors | ||

| Market Leader in the Private Client Market Segment

| ||

| ◾ Only national brokerage firm predominantly focused on servicing the Private Client Market segment which consistently accounts for 80%+ of CRE transactions in the U.S. ◾ Private client business has been supplemented with penetration in larger transactions and institutional clients for over a decade | ||

| Platform Built for Maximizing Investor Value

| ||

| ◾ Marcus & Millichap Capital Corporation (“MMCC”), Research & Advisory support client dialogue, financing, strategy, and sales execution ◾ Culture and policy of information sharing is key to maximizing investor value | ||

| Management With Significant

| ||

| ◾ Non-competitive management with extensive investment brokerage experience, committed to training, coaching, and supporting investment sales professionals ◾ Culture creates a competitive advantage through agent retention and better client results | ||

| Well-Positioned to Execute on Strategic Growth Plan

| ||

| ◾ Positioned to increase Private Client Market segment share, expand presence in specialty niches/larger transaction business, and grow the MMCC division ◾ Strong balance sheet with no debt provides financial flexibility to pursue strategic acquisitions | ||

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 6

PROPOSAL 1: Election of Directors

We are asking our stockholders to vote “FOR” three nominees to election as Class II Directors, each to serve on our Board of Directors (the “Board,” and each member a “Director”) for a three-year term until the 2027 Annual Meeting of Stockholders or until his or her successor is elected and qualified or, if earlier, the Director’s death, resignation, or removal.

Nominees and Continuing Directors

The following table sets forth information regarding the nominees standing for election at the Annual Meeting and our continuing Directors.

| Nominee or Director Name |

Class | Election Year |

Age | Position(s) | Director Since |

|||||||

| Nominees: | ||||||||||||

| Collete English Dixon | II | 2024 | 66 | Director | 2021 | |||||||

| Lauralee E. Martin | II | 2024 | 73 | Director | 2019 | |||||||

| Nicholas F. McClanahan | II | 2024 | 79 | Director | 2013 | |||||||

| Continuing Directors: | ||||||||||||

| George M. Marcus | III | 2025 | 82 | Director, Founder, Chair of the Board |

1971 | |||||||

| George T. Shaheen | III | 2025 | 79 | Director | 2013 | |||||||

| Don C. Watters | III | 2025 | 81 | Director, Lead Independent Director |

2013 | |||||||

| Norma J. Lawrence | I | 2026 | 69 | Director | 2013 | |||||||

| Hessam Nadji | I | 2026 | 58 | Director, President, Chief Executive Officer | 2016 |

| Recommendation of the Board

Provided that there is a quorum at the Annual Meeting, Directors are elected by a plurality of the votes cast by the stockholders entitled to vote at such election. Accordingly, subject to our Director Resignation Policy described in the “Corporate Governance” section below, the three nominees receiving the highest number of affirmative votes will be elected.

The individuals named as proxyholders will vote your shares for the election of these three nominees unless you direct them to withhold your vote. If any nominee is unable to serve or for good cause will not serve as a Director, the individuals named as proxyholders may vote for a substitute nominee. |

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH NOMINEE FOR DIRECTOR. |

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 7

Election of Directors

Nominee Selection Process

The Board is responsible for nominating persons for election as Directors of the Company. Our Board has delegated responsibility for identifying and evaluating individuals as members of the Board to our Nominating and Corporate Governance Committee.

| 1 Identify the |

Our Nominating and Corporate Governance Committee is charged with identifying, evaluating, and recommending director nominees to the full Board.

When seeking new director candidates, the Nominating and Corporate Governance Committee will consider potential candidates for directors submitted by Board members, members of our management, and our stockholders. The Nominating and Corporate Governance Committee does not evaluate candidates differently based upon the source of the nominee. |

|||||

|

||||||

| 2 Confirm Candidate |

Once a candidate has been identified, our Nominating and Corporate Governance Committee will confirm that the candidate meets the following general criteria:

◾ Nominees should have a reputation for integrity, honesty, and adherence to high ethical standards;

◾ Nominees should have demonstrated business acumen, experience, and ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company and should be willing and able to contribute positively to the decision-making process of the Company;

◾ Nominees should have a commitment to understand the Company and its industry and to regularly attend and participate in meetings of the Board and its committees;

◾ Nominees should have the interest and ability to understand the sometimes-conflicting interests of the various constituencies of the Company, which include stockholders, employees, customers, governmental units, creditors, and the general public, and to act in the interests of all stockholders; and,

◾ Nominees should not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all the Company’s stockholders and to fulfill the responsibilities of a director.

While we do not have a formal diversity policy for Board membership, we look for potential candidates that help ensure that the Board has a wide range of perspectives and backgrounds, and we understand the benefits of seeking qualified candidates reflecting the diversity in our community to include in the pool from which we select new Board members.

We also look for financial oversight experience, financial community experience, and a good reputation with the financial community; business management experience; business contacts, business knowledge, and influence that may be useful to our business; and knowledge about our industry. |

|||||

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 8

Election of Directors

| 3 Candidate |

The Nominating and Corporate Governance Committee takes such measures that it considers appropriate in connection with the evaluation of a candidate, including candidate interviews, inquiries of the person recommending the candidate, engagement of an outside search or personnel firm to gather additional information, or reliance on the knowledge of the members of the committee, the Board or management. | |||||

|

||||||

| 4 Committee |

The Nominating and Corporate Governance Committee recommends to the Board the persons to be nominated for election as directors at any meeting of stockholders and the persons to be elected by the Board to fill any vacancies on the Board, taking into consideration direct input from the Chair of the Board, the Chief Executive Officer (“CEO”), and, if one is appointed, the Lead Independent Director. | |||||

|

||||||

| 5 Stockholder Vote |

Stockholders vote on director nominees at the Annual Meeting of Stockholders. | |||||

|

||||||

| 6 Implementation |

Since 2019, two new independent Directors have been added, both of whom will continue to serve as Directors after the Annual Meeting. We believe each of our Directors brings a diverse set of skills and perspectives that add significant value to our governance and oversight. | |||||

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 9

Election of Directors

Attributes, Skills and Experience of our Nominees and Continuing Directors

The Nominating and Corporate Governance Committee is responsible for reviewing with the Board, on an annual basis, the skills and characteristics of Board members, as well as the composition of the Board as a whole. This assessment includes determining whether members of the Board may be classified as “independent” and assessing their skills and experience in the context of the needs of the Board. The assessment also includes considering the diversity of the members’ skills and experience in areas that are relevant to the Company’s business and activities, including operations, finance, marketing, and sales.

Board Composition and Diversity

|

DIVERSITY

|

50% of Directors are gender and/or racially diverse Three Directors are Female One Director is African American One Director is Middle Eastern |

TENURE

Average tenure of eight years as of the end of 2023.

| ||||||||

| 0 to 5 Years |

|

|||||||||

| 5 to 10 Years |

|

|||||||||

| > 10 Years |

|

|||||||||

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 10

Election of Directors

Background and Qualifications of Director Nominees and Continuing Directors

Set forth on the following pages are the names and ages of the Director nominees and the continuing Directors, the years they became Directors, their principal occupations or employment for at least the past five years, and the names of other public companies for which they serve as a Director or have served as a Director during the past five years. Also set forth below are the specific experiences, qualifications, or skills that led our Nominating and Corporate Governance Committee to conclude that each person should serve as a Director.

Nominees for Election for a Three-Year Term Ending with the 2027 Annual Meeting of Stockholders

| Collete English Dixon

Executive Director, Marshall Bennett Institute of Real Estate, Roosevelt University

Independent | ||||

| Director Since | Age | Committees | ||

| 2021 | 66 | Nominating and Corporate Governance | ||

Director Qualifications

| ◾ | Ms. English Dixon has extensive experience with the commercial real estate services industry and in evaluating acquisition opportunities as well as significant experience serving on the boards of several private companies. |

Experience and Biography

| ◾ | Serves as executive director of the Marshall Bennett Institute of Real Estate, Roosevelt University in Chicago. |

| ◾ | Currently serves as a managing principal of Libra Investment Group, LLC, a real estate consulting group, a position which she has held since September 2016. |

| ◾ | Previously held various key officer and management roles at PGIM Real Estate/Prudential Real Estate Investors (“PREI”), which is a business unit of Prudential Financial. |

| ◾ | In her role as executive director, vice president of transactions and as co-leader of PREI’s national investment dispositions program, she managed a number of real estate professionals and oversaw the sale of investment properties throughout the United States. |

| ◾ | Ms. English Dixon received a B.B.A. in finance and international business economics from the University of Notre Dame and an M.B.A. from Mercer University. |

| Lauralee E. Martin

Former CEO and President, Healthpeak Properties, Inc.

Independent

| ||||

| Director Since | Age | Committees | ||

| 2019 | 73 | Audit, Executive | ||

Director Qualifications

| ◾ | Ms. Martin has extensive experience with the commercial real estate services industry and in evaluating acquisition opportunities, managing banking relationships and investor relations as well as significant experience serving on the boards of other public companies. |

Experience and Biography

| ◾ | Ms. Martin served as chief executive officer and president of Healthpeak Properties, Inc. (formerly HCP, Inc.), a real estate investment trust focusing on properties serving the healthcare industry, from October 2013 to July 2016. |

| ◾ | Served as chief executive officer of the Americas Division of Jones Lang LaSalle, Inc., a financial and professional services firm specializing in real estate services and investment management, from January 2013 to October 2013. |

| ◾ | Executive vice president and chief financial officer of Jones Lang LaSalle from January 2002 and was appointed chief operating and financial officer in October 2005 and served in that capacity until January 2013. |

| ◾ | 15 years with Heller Financial, Inc., a commercial finance company with international operations, where she was vice president, chief financial officer, senior group president and president of the Real Estate group. |

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 11

Election of Directors

| ◾ | Ms. Martin currently serves on the boards of Kaiser Aluminum Corporation and QuadReal Property Group, is an advisor to Beacon Capital Partners, and previously served on the board of Healthpeak Properties, Inc., ABM Industries, KeyCorp and Gables Residential Trust. |

| ◾ | Ms. Martin received a B.A. in English from Oregon State University and an M.B.A. from the University of Connecticut. |

Nominees for Election for a Three-Year Term Ending with the 2027 Annual Meeting of Stockholders

| Nicholas F. McClanahan

Former Managing Director, Accretive Advisor Inc.

Independent | ||||

| Director Since | Age | Committees: | ||

| 2013 | 79 | Nominating and Corporate Governance (Chair), Compensation | ||

Director Qualifications

| ◾ | Mr. McClanahan possesses particular knowledge and experience in finance, capital structure, strategic planning, management and investment. |

Experience and Biography

| ◾ | Served as managing director of strategic relationships at Accretive Advisor Inc. from September 2010 to February 2012. |

| ◾ | From April 1971 through April 2006, Mr. McClanahan worked at Merrill Lynch & Co. in various positions, including as executive vice president of Merrill Lynch Canada and managing director of Merrill Lynch Private Banking Group from 2003 to 2005. |

| ◾ | Mr. McClanahan received a B.B.A. in finance from Florida Atlantic University and is a graduate of the Securities Industry Institute executive education program at The Wharton School at the University of Pennsylvania. |

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 12

Election of Directors

Directors Continuing in Office until the 2025 Annual Meeting of Stockholders

| George M. Marcus

Founder, Chair Marcus & Millichap, Inc.

Non-Independent Director | ||||

| Director Since | Age | Committees | ||

| 1971 | 82 | Executive (Chair) | ||

Director Qualifications

| ◾ | Mr. Marcus is our founder and has served as our chair of the Board since 1971. He has extensive knowledge of the Company, over 45 years of experience working in the real estate industry and significant experience serving on boards of other public companies. |

Experience and Biography

| ◾ | Founder and chair of Marcus & Millichap Company, the parent company of a diversified group of real estate service investment and development firms, including, SummerHill Housing Group, Pacific Urban Investors and Meridian Property Company. |

| ◾ | Founder and chair of the board of Essex Property Trust, a public multifamily real estate investment trust, and was one of the original directors of Plaza Commerce Bank and Greater Bay Bancorp, both of which were formerly publicly held financial institutions. |

| ◾ | Professional memberships include Real Estate Roundtable, Fisher Center for Real Estate and Urban Economics at the University of California, Berkeley and Urban Land Institute, as well as numerous other professional and community organizations. |

| ◾ | Mr. Marcus graduated with a B.S. degree in Economics from San Francisco State University in 1965, was honored as Alumnus of the Millennium in 1999, and received his honorary doctorate in 2011. In June 2019, Mr. Marcus received an honorary doctorate from the American College of Greece. He is also a graduate of Harvard Business School’s Owner/President Management Program and Georgetown University’s Leadership Program. |

| George T. Shaheen

Advisor Andersen Global

Independent | ||||

| Director Since | Age | Committees | ||

| 2013 | 79 | Audit, Compensation, Nominating and Corporate Governance | ||

Director Qualifications

| ◾ | Mr. Shaheen has extensive experience as a senior executive and director of numerous companies, and he possesses significant business and leadership knowledge and experience. |

Experience and Biography

| ◾ | Currently serves as a director of NetApp, Inc., [24]7.ai, and Green Dot Corporation, along with its wholly owned subsidiary, Green Dot Bank. |

| ◾ | Currently serves as an advisor to Andersen Global, an international tax and legal advisory firm. |

| ◾ | Previously was the chief executive officer of Siebel Systems, Inc., a CRM software company, from April 2005 until the sale of the company in January 2006. |

| ◾ | From October 1999 to April 2001, he served as the chief executive officer and chair of the board of Webvan Group, Inc. |

| ◾ | Previously was the officer and global managing partner of Andersen Consulting, which later became Accenture, from 1988 to 1999. |

| ◾ | He has served as an IT Governor of the World Economic Forum and as a member of the board of advisors for the Northwestern University Kellogg Graduate School of Management. He has also served on the board of trustees of Bradley University. |

| ◾ | Mr. Shaheen received a B.S. in marketing and an M.B.A. in management from Bradley University. Mr. Shaheen has extensive experience as a senior executive and director of numerous companies, and he possesses significant business and leadership knowledge and experience. |

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 13

Election of Directors

Directors Continuing in Office until the 2025 Annual Meeting of Stockholders

| Don C. Watters

Director Emeritus McKinsey & Company

Independent | ||||

| Director Since | Age | Committees: | ||

| 2013 | 81 | Compensation (Chair), Audit | ||

Director Qualifications

| ◾ | Mr. Watters possesses substantial knowledge and experience in strategic planning, organization, operations, and leadership of complex organizations. |

Experience and Biography

| ◾ | Mr. Watters is a director (senior partner) emeritus of McKinsey & Company, a global management consulting firm. During his 28 years with McKinsey & Company, Mr. Watters served primarily Fortune 500 sized private sector clients in over a dozen different industries on issues of strategy, organization and operations. |

| ◾ | Served on the board of directors of Merant PLC, a publicly traded company based in the United Kingdom from the late 1990s to 2004. |

| ◾ | Was on the advisory board of Cunningham Communication, Inc. Mr. Watters has served on the board of directors of numerous non-profit organizations, including the San Jose Ballet, the Tech Museum of Innovation, the American Leadership Forum Silicon Valley, the American Leadership Forum National, United Way Silicon Valley and the Bay Area Garden Railway Society, and is a member of the El Camino Hospital Board of Directors. |

| ◾ | Mr. Watters received a B.S. in engineering from the University of Michigan and an M.B.A. from Stanford University. |

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 14

Election of Directors

Directors Continuing in Office until the 2026 Annual Meeting of Stockholders

| Norma J. Lawrence

Former Partner KPMG LLP

Independent Director | ||||

| Director Since | Age | Committees | ||

| 2013 | 69 | Audit (Chair), Nominating and Corporate Governance | ||

Director Qualifications

| ◾ | Ms. Lawrence possesses particular knowledge and expertise in accounting and financial matters in the real estate industry. |

Experience and Biography

| ◾ | Ms. Lawrence previously served on the board of Broadmark Realty Capital Inc. |

| ◾ | Served as a partner in the audit department of KPMG LLP where she specialized in real estate. |

| ◾ | Ms. Lawrence was with KPMG from 1979 through 2012 and she was a member of the National Association of Real Estate Investment Trusts, the Pension Real Estate Association, the National Council of Real Estate Investment Fiduciaries, the California Society of Certified Public Accountants, and the American Institute of Certified Public Accountants, and was a member of WomanCorporateDirectors. |

| ◾ | Ms. Lawrence received a B.A. in mathematics and an M.B.A. in finance and accounting from the University of California, Los Angeles. |

| Hessam Nadji

President and CEO Marcus & Millichap, Inc.

Non-Independent | ||||

| Director Since | Age | Committees | ||

| 2016 | 58 | Executive | ||

Director Qualifications

| ◾ | Mr. Nadji has extensive knowledge of the Company and over 35 years of experience working in the real estate industry. |

Experience and Biography

| ◾ | Previously served as senior executive vice president and chief strategy officer at Marcus & Millichap, Inc. |

| ◾ | He joined the Company as vice president of research in 1996 and held various other senior management roles through the years, including chief marketing officer and head of the Company’s specialty brokerage divisions. |

| ◾ | Mr. Nadji received a B.S. in information management and computer science from City University in Seattle. |

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 15

Corporate Governance

Governance Highlights

The Board is committed to governance practices that promote long-term stockholder value and strengthen Board and management accountability to our stockholders, clients, and other stakeholders. The following table highlights many of our key governance practices.

| ◾ | Six of our eight Directors are independent |

| ◾ | We have a Lead Independent Director |

| ◾ | Separate CEO and Board Chair positions |

| ◾ | Independent standing board committees |

| ◾ | Regular meetings of our independent Directors without management present |

| ◾ | Four of our eight Directors are female and/or diverse |

| ◾ | Average Board tenure of eight years since initial public offering (as of the end of 2023) |

| ◾ | Annual Board and committee self-assessment process |

| ◾ | Strong focus on pay-for-performance |

| ◾ | Stock ownership guidelines for executive officers and Directors |

| ◾ | Policies prohibiting hedging, short selling, and pledging of our common stock |

| ◾ | Compensation recovery policy on executive compensation |

| ◾ | Review of cybersecurity, social issues, diversity, environmental sustainability, and public policy at the Board and Committee level |

Board Responsibilities and Structure

Our Board oversees, counsels, and directs management in the long-term interests of the Company and our stockholders. Among other things, the Board’s responsibilities include:

| ◾ | selecting the CEO and other executive officers; |

| ◾ | overseeing the risks that the Company faces; |

| ◾ | reviewing and approving our major financial objectives, strategic and operating plans, and other significant actions; |

| ◾ | overseeing the conduct of our business and the assessment of our business and other enterprise risks to evaluate whether the business is being properly managed; and |

| ◾ | overseeing the processes for maintaining our integrity regarding our financial statements and other public disclosures, and compliance with law and ethics. |

Board Classes

The Board is divided into three classes. Any Director appointed to fill a vacancy on the Board in a given year will stand for election at the Company’s annual meeting of stockholders in respect of the class to which the Director is appointed.

The Class I Directors are Norma J. Lawrence and Hessam Nadji, whose terms will expire at the 2026 Annual Meeting of Stockholders.

The Class II Directors are Collete English Dixon, Lauralee E. Martin, and Nicholas F. McClanahan, who are nominated to be elected at the Annual Meeting.

The Class III Directors are George M. Marcus, George T. Shaheen, and Don C. Watters, whose terms will expire at the 2025 Annual Meeting of Stockholders.

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 16

Corporate Governance

Leadership of the Board

Our Amended and Restated Bylaws (“Bylaws”) do not dictate a particular Board structure, and the Board is free to determine whether to have a Chair of the Board and, if so, to select that Chair and our CEO in the manner it considers in our best interest. Additionally, when the Chair of the Board also serves as the CEO, or is not otherwise an independent Director, the Board may designate an independent Director to act as a Lead Independent Director. Currently, the Company has a separate Chair of the Board, Lead Independent Director, and CEO.

| Chair of the Board | Lead Independent Director | Chief Executive Officer | ||

| George M. Marcus | Don C. Watters | Hessam Nadji | ||

| The responsibilities of the Chair include, among other responsibilities:

◾ Presiding over meetings of the Board

◾ Presiding over meetings of stockholders

◾ Preparing the agenda for each Board meeting

◾ In conjunction with the Compensation Committee, evaluating the performance of the CEO and reviewing CEO compensation |

The responsibilities of the Lead Independent Director include, among other responsibilities:

◾ Consulting with the Chair as to an appropriate schedule of Board meetings and providing the Chair with input as to the preparation of meeting agendas

◾ Consulting with the Chair as to the quality, quantity, and timeliness of the flow of information from Company management to the Board

◾ Acting as principal liaison between the Chair and the independent Directors

◾ Coordinating and presiding over meetings of independent Directors at which the Chair is not present

|

The responsibilities of the CEO include, among other responsibilities:

◾ Leading the affairs of the Company, subject to the overall direction and supervision of the Board and its committees

◾ Consulting and advising the Board and its committees on the business and affairs of the Company

◾ Performing such other duties as may be assigned by the Board | ||

Currently, the Board has selected George M. Marcus to hold the position of Chair of the Board. Mr. Marcus’ experience at the Company has afforded him intimate knowledge of the issues, challenges, and opportunities facing the Company’s business. Accordingly, he is well-positioned to focus the Board’s attention on the most pressing issues facing the Company.

The Board has appointed Don C. Watters as its Lead Independent Director. As Lead Independent Director, Mr. Watters oversees the executive sessions of the independent Directors and serves as a liaison between the independent Directors and the Chair of the Board.

The Board believes its administration of its risk oversight function has not affected the Board’s leadership structure.

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 17

Corporate Governance

Director Independence

The Board is currently composed of eight Directors, six of whom are independent.

Our Corporate Governance Guidelines provide that our Board must be comprised of a majority of Directors who are not current employees of the Company and otherwise meet appropriate independence standards. In determining independence, the Board considers the definition of “independence” or “independent director” in the listing standards of the New York Stock Exchange (“NYSE”), laws and regulations applicable to the Company, and other factors that contribute to effective oversight and decision-making by the Board.

The Board has undertaken a review of its composition, the composition of its committees and, in coordination with the Nominating and Corporate Governance Committee, the independence of each Director. Based upon information requested from and provided by each Director concerning his or her background, employment, and affiliations, including family relationships, the Nominating and Corporate Governance Committee has recommended that the Board determine and the Board has determined that Collete English Dixon, Norma J. Lawrence, Lauralee E. Martin, Nicholas F. McClanahan, George T. Shaheen, and Don C. Watters, representing six of our eight Directors who served during 2023, do not or did not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director and that each of these Directors is “independent,” as that term is defined under the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”) and the listing requirements and rules of the NYSE.

Transactions Considered in Independence Determinations

In making its independence determinations, the Board considered any transactions that occurred since the beginning of 2023 between the Company and entities associated with the independent Directors or members of their immediate family. All identified transactions are described below in “Certain Relationships and Related Party Transactions.”

None of our Directors are disqualified from being “independent” under the NYSE objective standards, except for Mr. Nadji, our CEO. However, the Board also considered any transactions in the context of the NYSE objective standards, the special standards established by the SEC for members of audit committees, the SEC and NYSE standards for compensation committee members, and the beneficial ownership of our capital stock by each non-employee director. Based on the foregoing, as required by the NYSE rules, the Board made a subjective determination that no relationships exist that, in the opinion of the Board, would impair our non-employee directors’ independence, except in the case of Mr. Marcus.

Independent Directors

|

|

| 6 of 8 Directors are Independent |

Independent Committee Leadership

| Audit Committee Chair | Independent |

| ||

| Compensation Committee Chair | Independent |

| ||

| Nominating and Corporate Governance Committee Chair | Independent |

| ||

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 18

Corporate Governance

The Board of Directors and its Committees

The Board delegates various responsibilities and authority to different Board committees. Committees regularly report on their activities and actions to the full Board. The Board currently has, and appoints the members of, a standing Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and Executive Committee.

Each of the Board committees has a written charter approved by the Board, and we post the charters on our website at https://ir. marcusmillichap.com/corporate-governance/governance-documents. Each committee can engage outside experts, advisors, and counsel to assist the committee in its work.

The following table identifies the current committee members.

Chair

Chair |

Member

Member |

| Board Members | Independent | Audit | Compensation | Nominating and Corporate Governance |

Executive | |||||

| Collete English Dixon | Yes |

|

||||||||

| Norma J. Lawrence | Yes |

|

|

|||||||

| George M. Marcus |

| |||||||||

| Lauralee E. Martin | Yes |

|

| |||||||

| Nicholas F. McClanahan | Yes |

|

|

|||||||

| Hessam Nadji |

| |||||||||

| George T. Shaheen | Yes |

|

|

|

||||||

| Don C. Watters | Yes |

|

|

|||||||

| Number of Committee Meetings Held in 2023 |

4 | 4 | 4 | 1 | ||||||

Attendance at Board, Committee, and Annual Stockholders’ Meetings

The Board and its committees meet throughout the year on a set schedule, hold special meetings, and act by written consent from time to time as appropriate. The Board held 5 meetings in 2023.

We expect each Director to attend every meeting of the Board and the committees on which he or she serves, and we encourage them to attend the annual meetings of the stockholders. None of our Directors attended fewer than 75% of the total number of meetings of the Board and committees on which he or she serves that were held during the time that he or she served on the Board or such committees during 2023. Everyone who served as a Director on the date of the 2023 Annual Meeting of Stockholders attended that meeting. We expect that all current directors will attend the upcoming Annual Meeting.

|

2023 Average Board and Committee Meeting Attendance

|

| 96%

|

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 19

Corporate Governance

Audit Committee

| Current Members

Norma J Lawrence (Chair)

Lauralee E. Martin

George T. Shaheen

Don C. Watters

Independence

The Board has affirmatively determined that each member of the Audit Committee meets the definition of “independent director” for purposes of the NYSE rules and the independence requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Board has also determined that each of Norma J. Lawrence and Lauralee E. Martin qualifies as an “audit committee financial expert” under the applicable SEC rules and regulations and that they are “financially literate” as that term is defined by the NYSE corporate governance requirements.

Meetings

The Audit Committee held 4 meetings in 2023.

Attendance |

Responsibilities

Among other responsibilities, the Audit Committee is charged by the Board with the authority and responsibility to:

◾ review and approve the selection of our independent registered public accounting firm, and approving the audit and non-audit services to be performed by our independent registered public accounting firm;

◾ monitor the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters;

◾ review the adequacy and effectiveness of our internal control policies and procedures;

◾ oversee our internal audit function;

◾ discuss the scope and results of the audit with the independent registered public accounting firm, and review with management and the independent registered public accounting firm, our interim and year-end operating results;

◾ review, with management, cybersecurity and other risks relevant to the Company’s computerized information system controls and security, and determine if any such risks and incidents should be disclosed in the Company’s periodic filings with the SEC;

◾ oversee the principal risk exposures facing the Company and the Company’s mitigation efforts in respect of such risks, including, but not limited to financial reporting risks and credit and liquidity risks; and

◾ preparing the Audit Committee Report that the SEC requires in our annual proxy statement. |

|

2023 Average Audit Committee Meeting Attendance

|

| 94%

|

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 20

Corporate Governance

Compensation Committee

| Current Members

Don C. Watters (Chair)

Nicholas F. McClanahan

George T. Shaheen

Independence

The Board has affirmatively determined that each of these Directors meets the definition of “independent director” for purposes of the NYSE rules and the independence requirements of the Exchange Act.

Meetings

The Compensation Committee held 4 meetings in 2023.

Attendance |

Responsibilities

Among other responsibilities, the Compensation Committee is charged by the Board with the authority and responsibility to:

◾ oversee our compensation policies, plans, and benefit programs;

◾ review and approve for our executive officers: annual base salary, annual cash incentives, including the specific goals and amount, equity compensation, employment agreements, severance arrangements, change in control arrangements, and any other benefits, compensation, or arrangements;

◾ administer our equity compensation plans;

◾ prepare the Compensation Committee Report that the SEC requires in our annual proxy statement; and

◾ oversee the development, implementation and effectiveness of our policies, strategies, programs, and practices relating to human capital management. |

|

2023 Average Compensation Committee Meeting Attendance

|

| 92%

|

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 21

Corporate Governance

Nominating and Corporate Governance Committee

| Current Members

Nicholas F. McClanahan (Chair)

Collete English Dixon

Norma J. Lawrence

George T. Shaheen

Independence

The Board has affirmatively determined that each of these Directors meets the definition of “independent director” for purposes of the NYSE rules and the independence requirements of the Exchange Act.

Meetings

The Nominating and Corporate Governance Committee held 4 meetings in 2023.

Attendance

|

Responsibilities

Among other responsibilities, the Nominating and Corporate Governance Committee is charged by the Board with the authority and responsibility to:

◾ identify, evaluate, and recommend to the Board for nomination candidates for membership on the Board;

◾ review with the Board on an annual basis, the independence, skills and characteristics of Board members, and the skills and characteristics of the Board as a whole, in determining whether to recommend incumbent Directors in the class subject to re-election;

◾ prepare and recommend to the Board corporate governance guidelines and policies;

◾ review and evaluate our policies and practices and monitoring our efforts and risk oversight in the areas of social issues, diversity, environmental sustainability, and public policy, and recommend changes for approval by the Board; and

◾ identify, evaluate, and recommend to the Board the chair and membership of each committee of the Board. |

|

2023 Average Nominating and Corporate Governance Committee Meeting Attendance

|

| 100%

|

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 22

Corporate Governance

Executive Committee

| Current Members

George M. Marcus (Chair)

Lauralee E. Martin

Hessam Nadji

Independence

The Board has affirmatively determined that Lauralee E. Martin meets the definition of an “independent director” for purposes of the NYSE rules and the independence requirements of the Exchange Act.

Meetings

The Executive Committee held 1 meeting in 2023.

Attendance |

Responsibilities

The Executive Committee is charged by the Board with the authority and responsibility to take any and all actions which may be taken by the Board, including acting upon recommendations of other Committees of the Board, and administering the Company’s stock plans (including the granting of stock options and stock awards thereunder), except those actions reserved by law to the full Board or as limited by the Executive Committee Charter. |

|

2023 Average Executive Committee Meeting Attendance

|

| 100%

|

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 23

Corporate Governance

Director Resignation Policy

A Director who changes the business or professional responsibility they held when they were elected to the Board, or whose personal circumstances have changed to the extent that it affects his or her ability to contribute to the Company’s continued development, should consult with the Chair of the Board and the Chair of the Nominating and Corporate Governance Committee and shall tender his or her resignation to the Board. The Nominating and Corporate Governance Committee will recommend to the Board the action, if any, to be taken with respect to the resignation. Any executive officer of the Company who serves on the Board shall submit his or her resignation to the Board at the time such officer ceases to be an executive officer of the Company.

The Board believes that term or age limits are, on balance, not the best way to maximize the effectiveness of the Board. While term limits may introduce fresh perspectives and viewpoints to the Board, they may also have the countervailing effect of causing the loss of contributions from Directors who have developed deep insight into the Company through years of experience.

As an alternative to term limits the Nominating and Corporate Governance Committee reviews the appropriateness of each Board member’s continued service every three years in connection with evaluating the appropriateness of their recommendation. Likewise, the Board does not believe that a mandatory retirement age is appropriate but will assess each Director’s ability to continue serving on the Board every three years in connection with evaluating the appropriateness of their recommendation.

Director Time Commitments

We believe that our Directors should be committed to enhancing stockholder value and should dedicate sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. We believe our Directors should not serve on an excessive number of boards of other public companies to permit them, given their individual circumstances, to perform and carry out all Director duties in a responsible manner.

Board and Committee Evaluations

The Board conducts a self-evaluation of its performance and the performance of individual Directors from time to time. The Nominating and Corporate Governance Committee is responsible for establishing the evaluation criteria and overseeing the evaluations. Each committee also evaluates its performance periodically.

Director Orientation and Continuing Education

In connection with the appointment of new members to the Board, management provides new Board members with Director orientation materials, including presentations from senior executives and Company policies. Each Director is expected to participate in continuing education programs to maintain the necessary level of expertise to perform his or her responsibilities.

CEO Evaluation and Succession Planning

The Compensation Committee conducts a review of the performance of the CEO at least annually. The Compensation Committee establishes the evaluation process and determines the specific criteria on which the performance of the CEO is evaluated. The results of the review and evaluation are communicated to the CEO by the Chair of the Board and the Chair of the Compensation Committee.

The CEO reviews succession planning and management development with the Board on an annual basis.

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 24

Corporate Governance

The Board’s Role in Risk Oversight

Our Company faces a number of risks, including operational, economic, financial, legal, regulatory, and competitive risks. Our management is responsible for the day-to-day management of the risks we face. While our Board, as a whole, has the ultimate responsibility for the oversight of risk management, it administers its risk oversight role in part through the Board committee structure, with the Audit, Compensation, and Nominating and Corporate Governance Committees being responsible for monitoring and reporting on the material risks associated with their respective subject matter areas.

| The Board | ||||

| The Board’s role in our risk oversight process includes receiving regular reports from members of senior management, as well as external advisors, on areas of material risk to us, including operational, economic, financial, legal, regulatory, cybersecurity, and competitive risks. The full Board (or the appropriate committee in the case of risks that are reviewed by a particular committee) receives these reports from those responsible for the relevant risk to better understand our risk exposures and the steps that management may take to monitor and control these exposures. When a committee receives the report, the chair of the relevant committee generally will provide a summary to the full Board at the next Board meeting, allowing the Board and its committees to coordinate the risk oversight role. | ||||

|

|

| ||

| Committee Responsibilities | ||||

| Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | ||

| The Audit Committee assists the Board in oversight and monitoring of principal risk exposures related to financial statements, legal, regulatory, cybersecurity, and other matters, as well as related mitigation efforts and receives regular reports on such matters from the Company’s Chief Information Officer and Chief Compliance Officer. | The Compensation Committee assesses, at least annually, the risks associated with our compensation policies. | The Nominating and Corporate Governance Committee assists the Board in oversight of risks that we have relative to compliance with corporate governance standards.

This includes oversight of risks related to social issues, diversity, environmental sustainability, and public policy. | ||

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 25

Corporate Governance

Cybersecurity and Risk Oversight

Cybersecurity is an important part of our risk management processes and an area of increasing focus for our Board and management.

The Role of the Board

The Audit Committee of our Board, which is comprised entirely of independent Directors, is responsible for the oversight of risks from cybersecurity threats and other risks relevant to the Company’s information technology controls and security.

At least quarterly, the Audit Committee receives an overview from management of our cybersecurity threat risk management and strategy processes covering topics such as data security posture, results from third-party assessments, progress towards pre-determined risk-mitigation-related goals, our incident response plan, and material cybersecurity threat risks or incidents and developments, as well as the steps management has taken to respond to such risks. In such sessions, the Audit Committee generally receives materials indicating current and emerging material cybersecurity threat risks, and describing the company’s ability to mitigate those risks, and discusses such matters with our Chief Information Officer.

Members of the Audit Committee are also encouraged to regularly engage in ad hoc conversations with management on cybersecurity-related news events and discuss any updates to our cybersecurity risk management and strategy programs.

Material cybersecurity threat risks are also considered during separate Board meeting discussions of important matters like risk management, operational budgeting, business continuity planning, mergers and acquisitions, brand management, and other relevant matters.

The Role of Management

Our cybersecurity risk management and strategy processes are led by our Chief Information Officer, who is ultimately responsible for our information

security program. This includes identifying threats, detecting potential attacks, and protecting all of our information assets.

Our process for identifying and assessing material risks from cybersecurity threats operates alongside our broader overall risk assessment process, covering all company risks. As part of this process, appropriate disclosure personnel collaborate with subject matter specialists, as necessary, to gather insights for identifying and assessing material cybersecurity threat risks, their severity, and potential mitigations.

Additionally, we maintain a cybersecurity-specific risk assessment process which helps identify our cybersecurity threat risks. This process also aims to provide for the availability of critical data and systems, maintain regulatory compliance, identify and manage our risks from cybersecurity threats, and protect against, detect, and respond to cybersecurity incidents. This includes periodic comparison of our processes to standards set by the National Institute of Standards and Technology.

We carry information security risk insurance that provides protection against the potential losses arising from a cybersecurity incident.

As part of our information security program, we maintain an incident response plan which coordinates the activities we take to prepare for, detect, respond to and recover from cybersecurity incidents, which include processes to triage, assess severity for, escalate, contain, investigate, and remediate the incident, as well as to comply with potentially applicable legal obligations and mitigate brand and reputational damage.

The firm’s senior executive team, inclusive of the CEO, CFO, COO, CAO and Legal, are informed about and monitor the prevention, mitigation, detection, and remediation of cybersecurity incidents through their management of, and participation in, the cybersecurity risk management and strategy processes described above, including the operation of our incident response plan.

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 26

Corporate Governance

Our Cybersecurity Oversight Structure

| The Board |

|

| Audit Committee |

|

| Chief Information Officer |

|

| Cybersecurity Team |

Corporate Governance Guidelines

We are committed to having sound corporate governance practices and have adopted formal Corporate Governance Guidelines to enhance our effectiveness.

The Nominating and Corporate Governance Committee is responsible for developing and reviewing our Corporate Governance Guidelines, and for preparing and recommending any changes to our Corporate Governance Guidelines and policies to the Board.

Having such principles is essential to running our business efficiently and maintaining our integrity in the marketplace. A copy of our Corporate Governance Guidelines is available on our website at https://ir.marcusmillichap.com/corporate-governance/governance-documents.

Code of Ethics

We strive to conduct our business with the highest integrity and standards of ethics and governance that support our values. This includes promoting fair labor practices, upholding human rights, and compliance with legal requirements, including those that address bribery and corruption. This also includes implementing policies, practices, and trainings that convey our expectations and values and meet stakeholder needs.

As part of this effort, we adopted a Code of Ethics. The Code of Ethics does not attempt to identify every possible category of ethical and legal behavior, but instead sets forth our clear expectations for ethical and honest behavior. We are committed to legal compliance, fair dealing, and addressing internal and external ethical concerns, which we do in part through our Ethics Hotline, which allows for anonymous reporting and direct communication with the Company’s Compliance Officer. Our expectations for ethics are further embedded into our practices through cross-discipline education and trainings, which are provided at the individual, office, and company-wide levels.

Our Audit Committee is responsible for reviewing and evaluating our policies and practices and monitoring our efforts in the area of ethics.

Our Code of Ethics can be found at https://ir. marcusmillichap.com/corporate-governance/governance-documents. Any amendments to the Code of Ethics, or any waivers of their requirements required to be disclosed pursuant to SEC or NYSE requirements, will be disclosed on the website.

Human Capital Oversight

Our Compensation Committee is responsible for the development, implementation and effectiveness of our policies, strategies, programs, and practices relating to human capital management including but not limited to those regarding recruiting, talent development and retention, culture, human health and safety and total rewards.

Our Nominating and Corporate Governance Committee is responsible for reviewing and evaluating our policies and practices and monitoring our efforts and risk oversight in the area of diversity.

For more information about our human capital efforts, please refer to the section entitled “Human Capital” in our Annual Report on Form 10-K for 2023.

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 27

Corporate Governance

Sustainability

We recognize that operating our business in a sustainable manner is important to our success. For this reason, we are exploring ways to address the environmental impact of our business, reduce carbon emissions, increase energy efficiency, reduce waste, and limit our consumption of natural resources.

More information on our Commitment to Sustainability policy can be found at: https://ir.marcusmillichap.com/esg/a-commitment-to-sustainability.

Commitment to People and Community – Corporate Responsibility

Marcus & Millichap maintains a Corporate Responsibility Policy. This policy memorializes our commitment to our employees, our community, and our stakeholders, as we believe taking into account the interests of our stakeholders drive the success of our business.

More information on our Corporate Responsibility Policy can be found at:

https://ir.marcusmillichap.com/esg/corporate-social-responsibility.

Communications from Stockholders and Other Interested Parties to Directors

The Board recommends that stockholders and other interested parties initiate communications with the Board, any committee of the Board, or any individual Director in writing to the attention of our Corporate Secretary at our principal executive office at 23975 Park Sorrento, Suite 400, Calabasas, CA 91302. This process will assist the Board in reviewing and responding to stockholder communications in an appropriate manner. The Board has instructed our Corporate Secretary to review such correspondence and, at the Corporate Secretary’s discretion, not to forward items if the Corporate Secretary deems them to be of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration.

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 28

PROPOSAL 2: Ratification of Appointment of Independent Registered Public Accounting Firm for 2024

Ernst & Young LLP has served as our independent registered public accounting firm since 2013. The Audit Committee has once again selected Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024. As a matter of good corporate governance, the Audit Committee is submitting its appointment to our stockholders for ratification. If the appointment of Ernst & Young LLP is not ratified by a majority of the shares of our common stock present or represented at the Annual Meeting and entitled to vote on the proposal, the Audit Committee will review its future appointment of an independent registered public accounting firm in light of that vote result.

The Audit Committee pre-approves and reviews audit and non-audit services performed by our independent registered public accounting firm, as well as the fees charged for audit services. In its pre-approval and review of non-audit services, the Audit Committee considers, among other factors, the possible effect of the performance of such services on the auditor’s independence. For additional information concerning the Audit Committee and its activities with the independent registered public accounting firm, see “Corporate Governance” and “Audit Committee Report” in this Proxy Statement.

We expect that a representative of Ernst & Young LLP will attend the Annual Meeting, and the representative will have an opportunity to make a statement if he or she so chooses. The representative will also be available to respond to appropriate questions from stockholders.

Fees Billed by Independent Registered Public Accounting Firm

The following table shows the fees and related expenses for audit and other services provided by Ernst & Young LLP in 2023 and 2022. The services described in the following fee table were approved in conformity with the Audit Committee’s pre-approval process.

| 2023 | 2022 | |||||||

| Audit Fees |

$ | 1,340,482 | $ | 1,278,537 | ||||

| Audit-Related Fees |

— | — | ||||||

| Tax Fees |

— | — | ||||||

| All Other Fees |

— | — | ||||||

|

|

|

|

|

|||||

| Total |

$ | 1,340,482 | $ | 1,278,537 | ||||

|

|

|

|

|

|||||

Audit Fees. This category includes fees for (i) the audit of our annual consolidated financial statements, (ii) reviews of our quarterly condensed consolidated financial statements, and (iii) services that are normally provided by our independent auditors in connection with statutory and regulatory filings or engagements.

Audit-Related Fees. This category includes fees for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.”

Tax Fees. This category includes fees for professional services for tax compliance, tax advice, and tax planning. These services include assistance regarding federal, state, and international tax compliance, assistance with tax reporting requirements and audit compliance, tax planning, consulting, and assistance on business restructuring.

All Other Fees. This category includes fees for products and services other than the services reported above. These services included cyber security consultation and impact analysis and environmental, social and governance framework development and materiality assessment.

The Audit Committee determined that Ernst & Young LLP’s provision of these services, and the fees that we paid for these services, are compatible with maintaining the independence of the independent registered public accounting firm. The Audit Committee pre-approved all services that Ernst & Young LLP provided for 2022 and 2023 in accordance with the pre-approval policy discussed above.

Recommendation of the Board

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2024.

Marcus & Millichap, Inc. | 2024 Proxy Statement | Page 29

Audit Committee Report

The Audit Committee of the Board consists of the four Directors whose names appear below. The Audit Committee is composed exclusively of Directors, who are independent under the NYSE listing standards and the SEC rules.

The Audit Committee’s general role is to assist the Board in monitoring the Company’s financial reporting process and related matters. Its specific responsibilities are set forth in its charter.

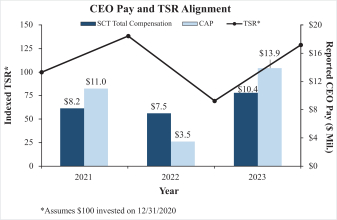

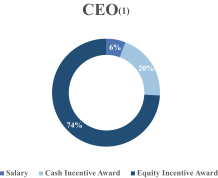

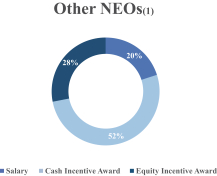

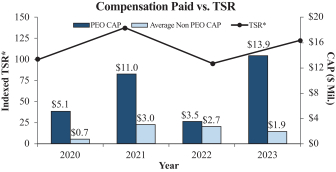

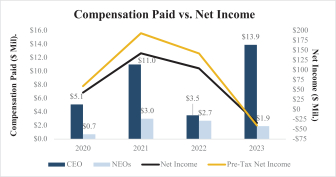

The Audit Committee has reviewed the Company’s audited financial statements for the year ended December 31, 2023, and met with management, as well as with representatives of Ernst & Young LLP, the Company’s independent registered public accounting firm, to discuss the financial statements. The Audit Committee also discussed with members of Ernst & Young LLP, the matters required to be discussed by the applicable Public Company Accounting Oversight Board and SEC requirements.