UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement | |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x |

Definitive Proxy Statement | |

| ¨ |

Definitive Additional Materials | |

| ¨ |

Soliciting Material Pursuant to §240.14a-12 | |

MARCUS & MILLICHAP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. | |||

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) |

Title of each class of securities to which transaction applies:

| |||

| (2) |

Aggregate number of securities to which transaction applies:

| |||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) |

Proposed maximum aggregate value of transaction:

| |||

| (5) |

Total fee paid:

| |||

| ¨ |

Fee paid previously with preliminary materials. | |||

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount previously paid:

| |||

| (2) |

Form, Schedule or Registration Statement No.:

| |||

| (3) |

Filing party:

| |||

| (4) |

Date Filed:

| |||

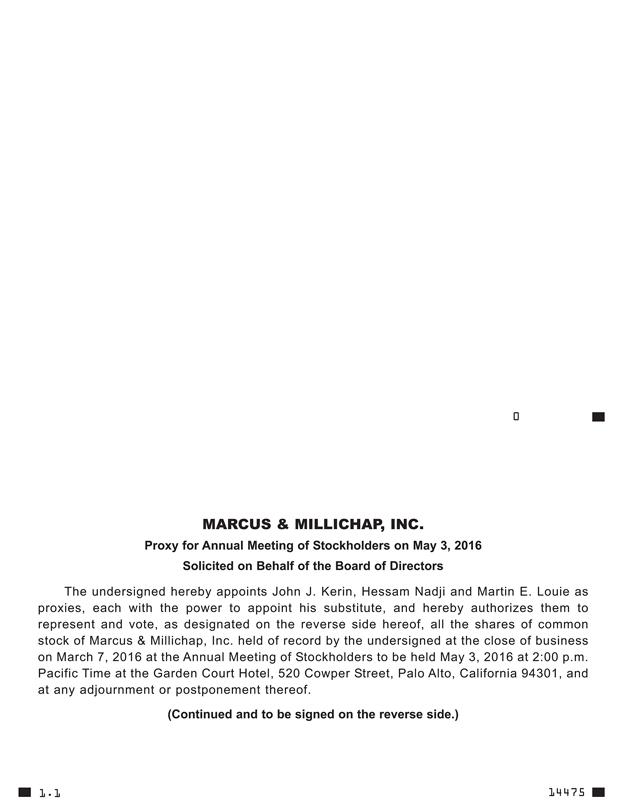

Marcus & Millichap, Inc.

23975 Park Sorrento, Suite 400

Calabasas, California 91302

(818) 212-2250

March 23, 2016

Dear Stockholder:

I am pleased to invite you to attend the 2016 Annual Meeting of Stockholders of Marcus & Millichap, Inc. The meeting will be held on Tuesday, May 3, 2016 at 2:00 p.m. local time at the Garden Court Hotel, 520 Cowper Street, Palo Alto, California 94301.

We are furnishing our proxy materials to stockholders primarily over the Internet. This process expedites stockholders’ receipt of proxy materials, while significantly lowering the costs of our annual meeting and conserving natural resources. On March 23, 2016, we mailed to our stockholders a notice containing instructions on how to access our Proxy Statement and 2015 Annual Report to Stockholders and to vote online. The notice also included instructions on how you can receive a paper copy of your annual meeting materials. If you received your annual meeting materials by mail, the Proxy Statement, 2015 Annual Report to Stockholders and proxy card were enclosed.

At this year’s annual meeting, the agenda includes the following items:

| Agenda Item | Board Recommendation | |

| Election of directors |

FOR | |

| Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2016 |

FOR | |

Details regarding the meeting and the business to be conducted are more fully described in the accompanying Notice of 2016 Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. Whether or not you plan to attend the annual meeting, I hope you will vote as soon as possible. You may vote over the Internet or in person at the annual meeting or, if you receive your proxy materials by U.S. mail, you also may vote by mailing a proxy card or voting by telephone. Please review the instructions on the notice or on the proxy card regarding your voting options. Only stockholders showing proof of ownership on the record date will be allowed to attend the meeting in person.

Sincerely yours,

John J. Kerin

President and Chief Executive Officer

23975 Park Sorrento, Suite 400

Calabasas, California 91302

(818) 212-2250

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

| TIME AND DATE |

2:00 p.m. local time on Tuesday, May 3, 2016 |

| PLACE |

Garden Court Hotel, 520 Cowper Street, Palo Alto, California 94301 |

| AGENDA |

• | Elect the three director nominees named in the Proxy Statement |

| • | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2016 |

| • | Transact such other business as may properly come before the annual meeting (including adjournments and postponements) |

| RECORD DATE |

March 7, 2016 |

| VOTING |

Please vote as soon as possible to record your vote, even if you plan to attend the annual meeting. Your broker will NOT be able to vote your shares with respect to the election of directors, unless you have given your broker specific instructions to do so. We strongly encourage you to vote. You have three options for submitting your vote before the annual meeting: |

| • | Internet |

| • | Phone |

| • |

By Order of the Board of Directors,

John J. Kerin

President and Chief Executive Officer

Calabasas, California

March 23, 2016

INTERNET AVAILABILITY OF PROXY MATERIALS

We are furnishing proxy materials to our stockholders primarily via the Internet. On March 23, 2016, we mailed most of our stockholders as of the record date a Notice Regarding the Availability of Proxy Materials (“Notice of Internet Availability”) containing instructions on how to access and review all of the important information contained in our proxy materials, including our Proxy Statement and our 2015 Annual Report to Stockholders. The Notice of Internet Availability also instructs you on how to vote via the Internet. Other stockholders, in accordance with their prior requests, have been mailed paper copies of our proxy materials and a proxy card or voting form.

Internet distribution of our proxy materials is designed to expedite receipt by stockholders, lower the cost of the annual meeting and conserve natural resources. However, if you would prefer to receive paper copies of proxy materials, please follow the instructions included in the Notice of Internet Availability.

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Stockholders to be Held on May 3, 2016:

The Notice of the 2016 Annual Meeting, the Proxy Statement and

the 2015 Annual Report to Stockholders are available at http://www.astproxyportal.com/ast/18576.

ATTENDING THE ANNUAL MEETING

| • | Doors open at 1:30 p.m. local time |

| • | Meeting starts at 2:00 p.m. local time |

| • | Proof of Marcus & Millichap, Inc. stock ownership and photo identification will be required to attend the annual meeting |

| • | You do not need to attend the annual meeting to vote if you submitted your proxy in advance of the annual meeting |

QUESTIONS

| For questions regarding | Contact: | |

| Annual meeting |

Marcus & Millichap, Inc. Attention: Martin E. Louie 23975 Park Sorrento, Suite 400 Calabasas, California 91302 (818) 212-2250 | |

| Stock ownership for registered holders |

American Stock Transfer & Trust Company, LLC 6201 15th Avenue, 3rd Floor Brooklyn, NY 11219 (800) 937-5449 www.amstock.com | |

| Stock ownership for beneficial holders |

Please contact your broker, bank, or other nominee | |

Marcus & Millichap, Inc. 23975 Park Sorrento, Suite 400

Calabasas, California 91302

(818) 212-2250

PROXY STATEMENT

Our Board of Directors (the “Board”) solicits your proxy for the 2016 Annual Meeting of Stockholders and any postponement or adjournment of the meeting for the matters set forth in “Notice of 2016 Annual Meeting of Stockholders.” The annual meeting will be held on Tuesday, May 3, 2016 at 2:00 p.m. local time at the Garden Court Hotel, 520 Cowper Street, Palo Alto, California 94301. We made this Proxy Statement available to stockholders beginning on March 23, 2016.

| Record Date |

March 7, 2016 |

| Quorum |

Holders of a majority of the voting power of all issued and outstanding shares on the record date must be present in person or represented by proxy |

| Shares Outstanding |

37,568,389 shares of common stock outstanding as of March 7, 2016 |

| Voting by Proxy |

Internet, telephone, or mail |

| Voting at the Meeting |

We encourage stockholders to vote in advance of the annual meeting, even if they plan to attend the meeting. In order to be counted, proxies submitted by Internet or telephone must be received by 11:59 p.m. Eastern Standard Time on May 2, 2016. Stockholders can vote in person during the meeting. Stockholders of record who attend the annual meeting in person may obtain a ballot. Beneficial holders who attend the annual meeting in person must obtain a proxy from their broker, bank, or other nominee prior to the date of the annual meeting and present it with their ballot. Voting in person by a stockholder during the meeting will replace any previous votes. |

| Changing Your Vote |

Stockholders of record may revoke their proxy at any time before the polls close by submitting a later-dated proxy card, by voting in person at the annual meeting, by delivering instructions to our Corporate Secretary before the annual meeting or by voting again using the Internet or telephone before the cut-off time. Your latest Internet or telephone proxy is the one that will be counted. If you hold shares through a broker, bank, or other nominee, you may revoke any prior voting instructions by contacting that firm. |

| Votes Required to Adopt Proposals |

Each share of our common stock outstanding on the record date is entitled to one vote on each of the three director nominees and one vote on the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2016. The election of directors is determined by the plurality of votes and the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm is determined by a majority of votes cast affirmatively or negatively. |

1

| Effect of Abstentions and Broker Non-Votes |

Shares voting “withhold” have no effect on the election of directors. In the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2016, abstentions and broker non-votes (shares held by brokers that do not have discretionary authority to vote on a matter and have not received voting instructions from their clients) have no effect. If you are a beneficial holder and do not provide specific voting instructions to your broker, the organization that holds your shares will not be authorized to vote on the election of directors. Accordingly, we encourage you to vote promptly, even if you plan to attend the annual meeting. |

| Voting Instructions |

If you complete and submit your proxy voting instructions, the persons named as proxies will follow your instructions. If you are a stockholder of record and you submit proxy voting instructions but do not direct how to vote on each proposal, the persons named as proxies will vote as the Board recommends on each proposal. The persons named as proxies will vote on any other matters properly presented at the annual meeting in accordance with their best judgment. Our Bylaws set forth requirements for advance notice of nominations and agenda items for the annual meeting, and we have not received timely notice of any such matters that may be properly presented for voting at the annual meeting, other than the items from the Board described in this Proxy Statement. |

| Voting Results |

We will announce preliminary results at the annual meeting. We will report final results in a filing with the U.S. Securities and Exchange Commission (“SEC”) on Form 8-K. |

2

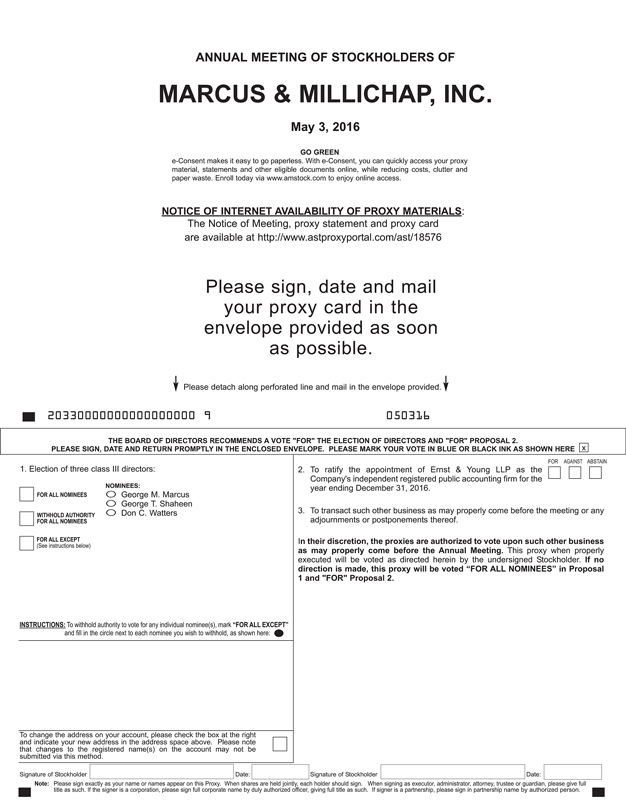

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board; Selection of Nominees

Our Board is divided into three classes serving staggered three-year terms. At the 2016 Annual Meeting of the Stockholders (the “Annual Meeting”), you and the other stockholders will elect three individuals to serve as directors for a three-year term that ends at the 2019 Annual Meeting of Stockholders.

Our Nominating and Corporate Governance Committee is charged with identifying, evaluating, and recommending to the full Board director nominees. There are no minimum qualifications for director. The Nominating and Corporate Governance Committee generally seeks individuals with broad experience at the policy-making level in business or with particular industry expertise. While we do not have a formal diversity policy for Board membership, we look for potential candidates that help ensure that the Board has the benefit of a wide range of attributes. We also look for financial oversight experience, financial community experience, and a good reputation with the financial community; business management experience; business contacts, business knowledge, and influence that may be useful to our business; and knowledge about our industry. We believe that all of our directors should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform and carry out all director duties in a responsible manner. Each director must also represent the interests of all stockholders.

When seeking new director candidates, the Nominating and Corporate Governance Committee will consider potential candidates for directors submitted by Board members, members of our management, and our stockholders, and the Committee does not evaluate candidates differently based upon the source of the nominee.

All of the nominees, George M. Marcus, George T. Shaheen and Don C. Watters, are now members of the Board whose terms will expire at the Annual Meeting.

The individuals named as proxyholders will vote your shares for the election of these three nominees unless you direct them to withhold your vote. If any nominee becomes unable to serve as a director before the Annual Meeting (or decides not to serve), the individuals named as proxyholders may vote for a substitute.

Set forth below are the names and ages of these nominees and the other continuing directors, the years they became directors, their principal occupations or employment for at least the past five years and the names of other public companies for which they serve as a director or have served as a director during the past five years. Also set forth are the specific experiences, qualifications, attributes, or skills that led our Nominating and Corporate Governance Committee to conclude that each person should serve as a director. Unless the context requires otherwise, the words “Marcus & Millichap” “we,” the “Company,” “us” and “our” refer to Marcus & Millichap, Inc. since June 2013 and Marcus & Millichap Real Estate Investment Services, Inc. before June 2013.

Nominees for Election for a Three-Year Term Ending with the 2019 Annual Meeting

George M. Marcus, 74, is our founder and has served as our chairman since 1971. Mr. Marcus is also the founder and chairman of Marcus & Millichap Company, and the chairman of various companies affiliated with Marcus & Millichap Company, including SummerHill Homes and Pacific Urban Residential. Mr. Marcus is also the founder and chairman of Essex Property Trust, a public multifamily real estate investment trust. Mr. Marcus was also one of the original directors of Plaza Commerce Bank and Greater Bay Bancorp, both of which were formerly publicly held financial institutions. From 2000 to 2012, Mr. Marcus was a member of the Board of Regents of The University of California. He is a member of the Real Estate Roundtable, Urban Land Institute, and the Fisher Center for Real Estate and Urban Economics at the University of California at Berkeley, as well as numerous other professional and community organizations. He also sits on the Board of Directors of the UCSF

3

Foundation, is an Emeritus Board Member of the Corporation of Fine Arts Museum and is a Regent Emeritus of the University of California. He received a B.A. in economics from San Francisco State University and is also a graduate of the Harvard Business School of Owners/Presidents Management Program and the Georgetown University Leadership Program. He has extensive knowledge of the Company, over 40 years of experience working in the real estate industry, and significant experience serving on boards of other public companies.

George T. Shaheen, 71, became a director in October 2013. Mr. Shaheen currently serves as chairman of the board of Korn/Ferry International, an international executive search and consulting firm. He also serves on the board of directors of NetApp, Inc., 24-7, Inc., and Green Dot Corporation, and previously served on the boards of PRA International and Univita Health. Mr. Shaheen was the chief executive officer of Siebel Systems, Inc., a CRM software company, from April 2005 until the sale of the company in January 2006. From October 1999 to April 2001, he served as the chief executive officer and chairman of the board of Webvan Group, Inc. Mr. Shaheen was previously the chief executive officer and global managing partner of Andersen Consulting, which later became Accenture, from 1988 to 1999. He has served as an IT Governor of the World Economic Forum and as a member of the board of advisors for the Northwestern University Kellogg Graduate School of Management. He has also served on the board of trustees of Bradley University. Mr. Shaheen received a B.S. in marketing and an M.B.A. in management from Bradley University. Mr. Shaheen has extensive experience as a senior executive and director of numerous companies, and he possesses significant business and leadership knowledge and experience.

Don C. Watters, 73, became a director in October 2013. Mr. Watters is a director emeritus of McKinsey & Company, the global management consulting firm, where he continues to lead training programs for consultants. During his 28 years with McKinsey & Company, Mr. Watters served primarily Fortune 500 sized private sector clients in over a dozen different industries on issues of strategy, organization, and operations. He served on the board of directors of Merant PLC, a publicly-traded company based in the United Kingdom from the late 1990s to 2004. Additionally, Mr. Watters was on the advisory board of Cunningham Communication, Inc. Mr. Watters has served on the board of directors of numerous non-profit organizations, including the San Jose Ballet, the Tech Museum of Innovation, the American Leadership Forum Silicon Valley, the American Leadership Forum National, United Way Silicon Valley, and the Bay Area Garden Railway Society. He is on the advisory board of the Markkula Center for Applied Ethics at Santa Clara University. Mr. Watters received a B.S. in engineering from the University of Michigan and an M.B.A. from Stanford University. Mr. Watters possesses substantial knowledge and experience in strategic planning, organization, operations, and leadership of complex organizations.

Recommendation of the Board

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE ABOVE NOMINEES.

Directors Continuing in Office Until the 2017 Annual Meeting

John J. Kerin, 60, has served as President and Chief Executive Officer of the Company since 2010 and as a director since March 1996. Prior to his appointment as President and CEO of the Company, Mr. Kerin was a senior vice president and managing director from 1996 to 2010, responsible for the operations of 18 offices nationwide. Mr. Kerin joined the firm as a sales professional in 1981, ranking among the top 10 sales professionals nationwide in 1985 and 1986, and was promoted to senior investment associate in 1987. In 1987, Mr. Kerin became the regional manager of the Los Angeles office, where he succeeded in making it one of the top-producing offices in the firm. He was elected first vice president in 1994 and promoted to managing director in 1996. Mr. Kerin received a B.A. in Communications from Loyola Marymount University. Mr. Kerin has extensive knowledge of the Company and over 35 years of experience working in the real estate industry.

Mr. Kerin has announced that, effective as of March 31, 2016, he will retire as President and Chief Executive Officer of the Company and a member of the Board. The Board will appoint Hessam Nadji who is

4

currently our Senior Executive Vice President to succeed Mr. Kerin, effective as of March 31, 2016, as President and CEO and a member of the Class I directors serving in office until the 2017 Annual Meeting.

Norma J. Lawrence, 61, became a director in October 2013. Ms. Lawrence served as a partner in the audit department of KPMG LLP where she specialized in real estate. Ms. Lawrence was with KPMG from 1979 through 2012 and she was a member of the National Association of Real Estate Investment Trusts, the Pension Real Estate Association, the National Council of Real Estate Investment Fiduciaries, the California Society of Certified Public Accountants, and the American Institute of Certified Public Accountants. She also was a member of the Organization of Women Executives, the Valley Development Forum, and the Los Angeles Chapter of Construction Financial Management Association. Ms. Lawrence received a B.A. in mathematics and an M.B.A. in finance and accounting from the University of California, Los Angeles. Ms. Lawrence possesses particular knowledge and expertise in accounting and financial matters in the real estate industry.

Directors Continuing in Office Until the 2018 Annual Meeting

Nicholas F. McClanahan, 71, became a director in October 2013. Mr. McClanahan served as managing director of strategic relationships at Accretive Advisor Inc. from September 2010 to February 2012. From April 1971 through April 2006, Mr. McClanahan worked at Merrill Lynch & Co. in various positions including as executive vice president of Merrill Lynch Canada and managing director of Merrill Lynch Private Banking Group from 2003 to 2005. Mr. McClanahan received a B.B.A. in finance from Florida Atlantic University and is a graduate of the Securities Industry Institute executive education program at The Wharton School at the University of Pennsylvania. Mr. McClanahan possesses particular knowledge and experience in finance, capital structure, strategic planning, management, and investment.

William A. Millichap, 72, has served as our co-chairman since 2000 and also acts in an advisory capacity to the Company. Mr. Millichap served as our president from 1986 to 2000. Mr. Millichap has also served as a board member and managing director of Marcus & Millichap Company since 1985, and was president of Marcus & Millichap Company from 1986 to 2000. He was also the managing partner of Marcus & Millichap Venture Partners. Mr. Millichap also served on the board of directors of Essex Property Trust from 1994 to 2009, and LoopNet, Inc. from 1999 to 2008. In addition, Mr. Millichap was one of the founders of San Jose National Bank and The Mid Peninsula Bank of Commerce, where he served on the board of directors. Mr. Millichap served on the board of directors of the National Multi Housing Council and is a member of the International Council of Shopping Centers, the Urban Land Institute, and the National Venture Capital Association. Mr. Millichap received a B.S. in Economics from the University of Maryland and served as an officer in the United States Navy. Mr. Millichap, co-founder of Marcus & Millichap Company, has substantial business and real estate industry expertise due to various leadership roles. He has extensive knowledge of the Company, over 40 years of experience working the real estate industry, and significant experience serving on boards of other public companies.

CORPORATE GOVERNANCE

Board Responsibilities and Structure

Our Board oversees, counsels, and directs management in the long-term interests of the Company and our stockholders. Among other things, the Board’s responsibilities include:

| • | selecting, evaluating the performance of, and determining the compensation of the CEO and other executive officers; |

| • | overseeing the risks that the Company faces; |

| • | reviewing and approving our major financial objectives and strategic and operating plans, and other significant actions; |

5

| • | overseeing the conduct of our business and the assessment of our business and other enterprise risks to evaluate whether the business is being properly managed; and |

| • | overseeing the processes for maintaining our integrity with regard to our financial statements and other public disclosures, and compliance with law and ethics. |

The Board and its committees met throughout the year on a set schedule, held special meetings, and acted by written consent from time to time as appropriate. The Board held five meetings in 2015.

The Board is divided into three classes. Currently, the Class I directors are Norma J. Lawrence and John J. Kerin; however, effective as of March 31, 2016, Mr. Kerin will step down from the Board and Mr. Nadji will be appointed in his place as a Class I director. The Class I directors will serve until the 2017 Annual Meeting of Stockholders. The Class II directors, Nicholas F. McClanahan and William A. Millichap, will serve until the 2018 Annual Meeting of Stockholders. The Class III directors, George M. Marcus, Don C. Watters and George T. Shaheen, have been nominated to be elected at this 2016 Annual Meeting of Stockholders and, if elected, their terms will expire at the 2019 Annual Meeting of Stockholders. Each class of directors will be elected for a three-year term following its respective initial term.

Our Bylaws do not dictate a particular Board structure, and the Board is free to determine whether or not to have a Chairman and, if so, to select that Chairman and our CEO in the manner it considers our best interest. Currently, the Board has selected George M. Marcus and William A. Millichap to hold the positions of Co-Chairman of the Board. Messrs. Marcus’ and Millichap’s experience at the Company has afforded them intimate knowledge of the issues, challenges, and opportunities facing the Company’s business. Accordingly, they are well positioned to focus the Board’s attention on the most pressing issues facing the Company. The Board has appointed Don C. Watters as its lead independent director. As lead independent director, Mr. Watters oversees the executive sessions of the independent directors and serves as a liaison between the independent directors and the Co-Chairmen. The Board believes its administration of its risk oversight function has not affected the Board’s leadership structure.

Director Independence

The Board is currently composed of seven directors. Under the rules of the New York Stock Exchange (the “NYSE”), independent directors must comprise a majority of a listed company’s board of directors.

The Board has undertaken a review of its composition, the composition of its committees, and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment, and affiliations, including family relationships, the Board has determined that Nicholas F. McClanahan, Don C. Watters, George T. Shaheen and Norma J. Lawrence, representing four of our seven directors, do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent,” as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the NYSE. In making this determination, the Board considered the current and prior relationships that each non-employee director has with our Company and all other facts and circumstances the Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Transactions Considered in Independence Determinations

In making its independence determinations, the Board considered transactions that occurred since the beginning of fiscal year 2015 between the Company and entities associated with the independent directors or members of their immediate family. All identified transactions that appeared to relate to the Company and a family member of, or entity with a known connection to, a director were presented to the Board for consideration.

6

Except for George M. Marcus and William A. Millichap, none of the non-employee directors were disqualified from “independent” status under the objective tests. In making its subjective determination that each of our Company’s non-employee directors other than Messrs. Marcus and Millichap are independent, the Board reviewed and discussed additional information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to the Company and the Company’s management. The Board considered the transactions in the context of the NYSE objective standards, the special standards established by the SEC for members of audit committees, and the SEC, NYSE, and U.S. Internal Revenue Service (“IRS”) standards for compensation committee members. Based on all of the foregoing, as required by the NYSE rules, the Board made a subjective determination that no relationships exist that, in the opinion of the Board, would impair these directors’ independence.

Board Committees and Charters

The Board delegates various responsibilities and authority to different Board committees. Committees regularly report on their activities and actions to the full Board. The Board currently has, and appoints the members of, a standing Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Executive Committee. Each of the Board committees has a written charter approved by the Board, and we post the charters on our web site at http://www.marcusmillichap.com/. Each committee can engage outside experts, advisors, and counsel to assist the committee in its work. The following table identifies the current committee members; however, effective as of March 31, 2016, Mr. Nadji will replace Mr. Kerin on the Executive Committee in connection with Mr. Kerin’s retirement from the Board and Mr. Nadji’s appointment to the Board.

| Name |

Audit | Compensation | Nominating and Corporate Governance |

Executive Committee | ||||

| John J. Kerin |

ü | |||||||

| Norma J. Lawrence |

Chair | ü | ||||||

| George M. Marcus |

Chair | |||||||

| Nicholas F. McClanahan |

ü | Chair | ||||||

| William A. Millichap |

ü | |||||||

| George T. Shaheen |

ü | ü | ü | |||||

| Don C. Watters |

ü | Chair | ||||||

| Number of Committee Meetings Held in 2015 |

4 | 6 | 2 | — | ||||

Audit Committee. Our Audit Committee currently consists of Norma J. Lawrence (Chair), George T. Shaheen and Don C. Watters. The Board has affirmatively determined that each of these directors meets the definition of “independent director” for purposes of the NYSE rules and the independence requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has also determined that Norma J. Lawrence qualifies as an “audit committee financial expert” under the applicable SEC rules and regulations and that she is “financially literate” as that term is defined by the NYSE corporate governance requirements. Our Audit Committee is responsible for:

| • | reviewing and approving the selection of our independent registered public accounting firm, and approving the audit and non-audit services to be performed by our independent registered public accounting firm; |

| • | monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; |

| • | reviewing the adequacy and effectiveness of our internal control policies and procedures; |

7

| • | overseeing our internal audit function; |

| • | discussing the scope and results of the audit with the independent registered public accounting firm and reviewing with management and the independent registered public accounting firm our interim and year-end operating results; and |

| • | preparing the Audit Committee Report that the SEC requires in our annual proxy statement. |

Compensation Committee. Our Compensation Committee currently consists of Don C. Watters (Chair), Nicholas F. McClanahan and George T. Shaheen. The Board has affirmatively determined that each of these directors meets the definition of “independent director” for purposes of the NYSE rules and the independence requirements of the Exchange Act. Our Compensation Committee is responsible for:

| • | overseeing our compensation policies, plans and benefit programs; |

| • | reviewing and approving for our executive officers: annual base salary, annual incentive bonus, including the specific goals and amount, equity compensation, employment agreements, severance arrangements and change in control arrangements, and any other benefits, compensation or arrangements; |

| • | preparing the Compensation Committee Report that the SEC will require to be included in our annual proxy statement; and |

| • | administering our equity compensation plans. |

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee currently consists of Nicholas F. McClanahan (Chair), Norma J. Lawrence and George T. Shaheen. The Board has affirmatively determined that each of these directors meets the definition of “independent director” for purposes of the NYSE rules and the independence requirements of the Exchange Act. Our Nominating and Corporate Governance Committee is responsible for:

| • | identifying, evaluating and recommending to the Board for nomination candidates for membership on the Board; |

| • | preparing and recommending to the Board corporate governance guidelines and policies; and |

| • | identifying, evaluating and recommending to the Board the chairmanship and membership of each committee of the Board. |

Executive Committee. Our Executive Committee currently consists of George M. Marcus, William A. Millichap and John J. Kerin; and, as noted above, Mr. Nadji will be appointed to the Executive Committee in place of Mr. Kerin effective as of March 31, 2016. The Executive Committee has all the powers of the Board except those powers reserved by law to the full Board or as limited by the Executive Committee Charter. The Executive Committee did not meet in 2015.

Attendance at Board, Committee, and Annual Stockholders’ Meetings

We expect each director to attend every meeting of the Board and the committees on which he or she serves, and we encourage them to attend the annual meetings of the stockholders. All directors attended the 2015 annual meeting of stockholders and all of the meetings of the Board and the committees on which they served in 2015, and we expect that all directors will attend the upcoming Annual Meeting.

The Board’s Role in Risk Oversight

Our Company faces a number of risks, including operational, economic, financial, legal, regulatory, and competitive risks. Our management is responsible for the day-to-day management of the risks we face. While our

8

Board, as a whole, has ultimate responsibility for the oversight of risk management, it administers its risk oversight role in part through the Board committee structure, with the Audit, Compensation and Nominating and Corporate Governance Committees being responsible for monitoring and reporting on the material risks associated with their respective subject matter areas.

The Board’s role in our risk oversight process will include receiving regular reports from members of senior management, as well as external advisors, on areas of material risk to us, including operational, economic, financial, legal, regulatory, and competitive risks. The full Board (or the appropriate committee in the case of risks that are reviewed by a particular committee) will receive these reports from those responsible for the relevant risk in order to enable it to understand our risk exposures and the steps that management may take to monitor and control these exposures. When a committee receives the report, the Chairman of the relevant committee generally will provide a summary to the full Board at the next Board meeting. This will enable the Board and its committees to coordinate the risk oversight role. The Audit Committee will assist the Board in oversight and monitoring of principal risk exposures related to financial statements, legal, regulatory, and other matters, as well as related mitigation efforts. The Compensation Committee will assess, at least annually, the risks associated with our compensation policies. The Nominating and Corporate Governance Committee will assist the Board in oversight of risks that we have relative to compliance with corporate governance standards.

Corporate Governance Guidelines and Code of Ethics

We have adopted Corporate Governance Guidelines and a Code of Ethics that apply to all of our employees, officers, and directors, including those officers responsible for financial reporting. These standards are designed to deter wrongdoing and to promote honest and ethical conduct. The Corporate Governance Guidelines and Code of Ethics are available at our website at http://www.marcusmillichap.com/. Any amendments to the Corporate Governance Guidelines and Code of Ethics, or any waivers of their requirements required to be disclosed pursuant to SEC or NYSE requirements, will be disclosed on the website.

Communications from Stockholders and Other Interested Parties to Directors

The Board recommends that stockholders and other interested parties initiate communications with the Board, any committee of the Board, or any individual director in writing to the attention of our Corporate Secretary at our principal executive office at 23975 Park Sorrento, Suite 400, Calabasas, CA 91302. This process will assist the Board in reviewing and responding to stockholder communications in an appropriate manner. The Board has instructed our Corporate Secretary to review such correspondence and, at his discretion, not to forward items if he deems them to be of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration.

9

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2016

Ernst & Young LLP has served as our independent registered public accounting firm since our spin-off in 2013. The Audit Committee has once again selected Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2016. As a matter of good corporate governance, the Audit Committee is submitting its appointment to our stockholders for ratification. If the appointment of Ernst & Young LLP is not ratified by the majority of the shares of common stock present or represented at the annual meeting and entitled to vote on the proposal, the Audit Committee will review its future appointment of an independent registered public accounting firm in light of that vote result.

The Audit Committee pre-approves and reviews audit and non-audit services performed by our independent registered public accounting firm, as well as the fees charged for such services. In its pre-approval and review of non-audit service fees, the Audit Committee considers, among other factors, the possible effect of the performance of such services on the auditor’s independence. For additional information concerning the Audit Committee and its activities with the independent registered public accounting firm, see “Corporate Governance” and “Audit Committee Report” in this Proxy Statement.

We expect that a representative of Ernst & Young LLP will attend the Annual Meeting, and the representative will have an opportunity to make a statement if he or she so chooses. The representative will also be available to respond to appropriate questions from stockholders.

Fees Billed by Independent Registered Public Accounting Firm

The following table shows the fees and related expenses for audit and other services provided by Ernst & Young LLP in 2014 and 2015. The services described in the following fee table were approved in conformity with the Audit Committee’s pre-approval process.

| 2014 | 2015 | |||||||

| Audit Fees |

$ | 599,291 | $ | 734,637 | ||||

| Audit-Related Fees |

— | — | ||||||

| Tax Fees |

494,351 | 407,797 | ||||||

| All Other Fees |

— | — | ||||||

|

|

|

|

|

|||||

| Total |

$ | 1,093,642 | $ | 1,142,434 | ||||

|

|

|

|

|

|||||

Audit Fees. This category includes fees for (i) the audit of our annual consolidated financial statements, (ii) reviews of our quarterly condensed consolidated financial statements, and (iii) services that are normally provided by our independent auditors in connection with statutory and regulatory filings or engagements.

Audit-Related Fees. This category includes fees for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Services.” These services include, but are not limited to, consultations concerning financial accounting and reporting standards and audits in connection with acquisitions.

Tax Fees. This category includes fees for professional services for tax compliance, tax advice, and tax planning. These services include assistance regarding federal, state, and international tax compliance, assistance with tax reporting requirements and audit compliance, tax planning, consulting, and assistance on business restructuring. The amounts set forth under 2014 include fees associated with a review of the tax deductibility of transaction expenses associated with our initial public offering (the “IPO”).

All Other Fees. This category includes fees for products and services other than the services reported above.

10

The Audit Committee determined that Ernst & Young LLP’s provision of these services, and the fees that we paid for these services, are compatible with maintaining the independence of the independent registered public accounting firm. The Audit Committee pre-approved all services that Ernst & Young LLP has provided since our IPO in accordance with the pre-approval policy discussed above.

Recommendation of the Board

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2016.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board consists of the three directors whose names appear below. The Audit Committee is composed exclusively of directors who are independent under the NYSE listing standards and the SEC rules.

The Audit Committee’s general role is to assist the Board in monitoring the Company’s financial reporting process and related matters. Its specific responsibilities are set forth in its charter.

The Audit Committee has reviewed the Company’s financial statements for the year ended December 31, 2015 and met with management, as well as with representatives of Ernst & Young LLP, the Company’s independent registered public accounting firm, to discuss the financial statements. The Audit Committee also discussed with members of Ernst & Young LLP the matters required to be discussed by the applicable Public Company Accounting Oversight Board and SEC requirements.

In addition, the Audit Committee received the written disclosures and the letter from Ernst & Young LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and discussed with members of Ernst & Young LLP its independence.

Based on these discussions, the financial statement review, and other matters it deemed relevant, the Audit Committee recommended to the Board that the Company’s audited financial statements for the year ended December 31, 2015 be included in the Company’s Annual Report on Form 10-K for 2015.

Norma J. Lawrence (Chair)

George T. Shaheen

Don C. Watters

11

COMPENSATION OF THE NAMED EXECUTIVE OFFICERS AND DIRECTORS

Executive Compensation

As an emerging growth company, we have opted to comply with the executive compensation disclosure rules applicable to “smaller reporting companies” as such term is defined in the rules promulgated under the Securities Act. This executive compensation section discloses the compensation awarded to, or earned by, our “named executive officers” or “NEOs” during 2014 and 2015. For 2015, our NEOs were:

| • | John J. Kerin, our President and Chief Executive Officer; |

| • | Hessam Nadji, our Senior Executive Vice President; and |

| • | Martin E. Louie, our Senior Vice President and Chief Financial Officer |

The following table sets forth information regarding the compensation awarded to, earned by, these NEOs for 2014 and 2015.

Summary Compensation Table

| Name and Principal Position |

Fiscal Year |

Salary ($) |

Bonus ($) |

Stock Awards ($)(1) |

Option Awards ($) |

Non- Equity Incentive Plan Compen- sation($)(2) |

Change in Pension Value and Non- qualified Deferred Compen- sation Earnings ($)(3) |

All Other Compen- sation ($)(4) |

Total ($) |

|||||||||||||||||||||||||||

| John J. Kerin |

2015 | 680,000 | — | — | — | 1,966,200 | 334,431 | 28,367 | 3,008,998 | |||||||||||||||||||||||||||

| President and Chief Executive Officer |

2014 | 680,000 | — | — | — | 2,720,000 | 546,785 | 29,097 | 3,975,882 | |||||||||||||||||||||||||||

| Hessam Nadji |

2015 | 441,667 | — | 1,313,600 | — | 1,491,600 | 126,078 | 26,588 | 3,399,533 | |||||||||||||||||||||||||||

| Senior Executive Vice President |

2014 | 400,000 | — | — | — | 1,200,000 | 144,692 | 30,041 | 1,774,733 | |||||||||||||||||||||||||||

| Martin E. Louie |

2015 | 350,000 | — | 656,800 | — | 550,000 | 5,140 | 27,219 | 1,589,159 | |||||||||||||||||||||||||||

| Senior Vice President and Chief Financial Officer |

||||||||||||||||||||||||||||||||||||

| (1) | The amounts shown in this column represent the aggregate grant date fair value of the restricted stock units (RSUs) awarded to Messrs. Nadji and Louie, computed in accordance with ASC 718. The fair value of these awards was calculated based on the fair market value of our common stock on the accounting measurement date multiplied by the number of shares subject to the award and may not represent the actual value that may be realized. |

| (2) | Represents amounts earned pursuant to the Company’s Non-Equity Incentive Plan for services in 2015, which amounts were paid in 2016. In 2015, if the Company achieved pre-tax net income of $60 million, each of our executive officers was eligible to receive a cash bonus. For 2015, the maximum bonus that each executive officer may be ultimately entitled was based on the Compensation Committee’s consideration of the following additional limitations and performance metrics for the executive officers: (i) Mr. Kerin was eligible for a target bonus of $1.45 million if the Company achieved pre-tax net income of approximately $97.2 million for 2015; (ii) Mr. Nadji was eligible for a target bonus of $1.1 million if the Company achieved pre-tax net income of approximately $97.2 million for 2015; and (iii) Mr. Louie was eligible for a target bonus of $550,000 if the Company achieved pre-tax net income of $97.2 million. The actual maximum bonus amount for each executive officer varied based on the achievement of the Company goals and the officer’s achievement of his individual goals. For the Company pre-tax net income performance |

12

| target, the bonus amount is determined by multiplying the calculated bonus amount at target performance by a performance multiplier, which will be 100% at target performance and will be interpolated between 61.72% of the target performance and 150% of the target performance. If achievement against a performance goal is less than 61.72% for the Company pre-tax net income performance target, no bonus is paid with respect to that performance goal. Once the maximum bonus amounts are calculated for each executive officer, individual performance is assessed in order to determine the final payout of bonuses. |

| (3) | As set forth in the below table, the amounts in this column reflect, as applicable, (i) the earnings for 2014 and 2015 on each executive’s nonqualified deferred compensation account and (ii) the aggregate increase in “appreciation value” for each executive’s SARs for 2014 and 2015. The SARs constitute deferred compensation as they will be cash-settled awards only payable upon death, disability or mutual termination and, therefore, lack an option-like feature. In connection with our IPO, all of the outstanding SARs were fully vested and frozen at a liability amount calculated as of March 31, 2013 (such liability value, the “SAR Account Balance”). The Company began to accrue interest starting on January 1, 2014 based on SAR account balances as of December 31, 2013. The increased value of the SARS for 2014 represents the accrued interest credited to the executive officer account balances based on an interest rate of 5.03% for 2014, which was based on a 10-Year Treasury Note plus 200 basis points. The increased value of the SARS for 2015 represents the accrued interest credited to the executive officer account balances based on an interest rate of 4.173% for 2015, which was based on a 10-Year Treasury Note plus 200 basis points. In 2014 and 2015, the increased value of SARs represents accrued interest. Upon a payment event, the Account Balance is paid to the executive in 10 annual installments, with the first installment due within 30 days after the end of year in which the termination occurs or, in some cases, within 30 days after the event giving rise to the redemption. Upon a termination other than for cause or a resignation other than by mutual agreement, the executive only receives 75% of the appreciation value on the vested portion. In the event of a sale of the Company, the executive officer receives the appreciation value upon the consummation of the change of control. |

| Named Executive Officer |

Fiscal Year | Nonqualified Deferred Compensation Plan Earnings ($)* |

Increased Value of SARs during Fiscal Year ($) |

Aggregate Value of SARs as of Fiscal Year End ($) |

||||||||||||

| John J. Kerin |

2015 | (8,520 | ) | 342,951 | 8,561,296 | |||||||||||

| 2014 | 153,199 | 393,586 | 8,218,345 | |||||||||||||

| Hessam Nadji |

2015 | — | 126,078 | 3,147,350 | ||||||||||||

| 2014 | — | 144,692 | 3,021,272 | |||||||||||||

| Martin E. Louie |

2015 | — | 5,140 | 128,319 | ||||||||||||

| * | See Note 4 to our consolidated financial statements for additional information on the Nonqualified Deferred Compensation Plan. |

| (4) | The following table reflects the breakout of the items included in the “All Other Compensation” column for 2015: |

| Kerin | Nadji | Louie | ||||||||||

| Auto Benefit |

$ | 23,899 | $ | 26,120 | $ | 22,751 | ||||||

| 401(k) Match |

4,000 | — | 4,000 | |||||||||

| Life Insurance |

468 | 468 | 468 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total for Other |

$ | 28,367 | $ | 26,588 | $ | 27,219 | ||||||

|

|

|

|

|

|

|

|||||||

13

Outstanding Equity Awards at Fiscal Year End

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||||

| Name and Principal Position |

Award Year |

Number of securities underlying unexercised options (#) exercisable |

Number of securities underlying unexercised options (#) unexercisable |

Equity incentive plan awards: number of securities underlying unexercised unearned options (#) |

Option exercise price ($) |

Option expiration date |

Number of shares or units of stock that have not vested (#)(1) |

Market value of shares or units of stock that have not vested ($)(2) |

Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#) |

Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($) | ||||||||||||||||||||||||||||

| John J. Kerin |

2015 | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||

| Hessam Nadji |

2015 | — | — | — | — | — | 40,000 | 1,165,600 | — | |||||||||||||||||||||||||||||

| Martin E. Louie |

2015 | — | — | — | — | — | 20,000 | 582,800 | — | |||||||||||||||||||||||||||||

| (1) | Messrs. Nadji and Louie were awarded 40,000 and 20,000 RSUs, respectively, effective January 5, 2015 that represent a right to receive one share of common stock. The RSUs vest in five equal annual installments starting on January 5, 2016. |

| (2) | Based upon the closing price of our common stock of $29.14 on December 31, 2015. |

Other than Messrs. Nadji and Louie, none of our named executive officers had any outstanding equity awards as of December 31, 2015. For further information regarding the DSUs granted to our named executive officers, see the discussion under the heading “Nonqualified Deferred Compensation.”

Employment Agreements

We entered into an employment agreement with John J. Kerin, our President and Chief Executive Officer, dated as of July 1, 2010, as amended. The employment agreement has no specific term and constitutes at-will employment. For 2015, in addition to a current annual base salary of $680,000, Mr. Kerin was eligible to receive a bonus as described in footnote (2) to the Summary Compensation Table on page 12. The employment agreement also contains non-competition and non-disclosure provisions.

Effective as of March 31, 2016, Mr. Kerin will retire from the Company as our President and CEO and Board member.

Pension Benefits

We do not maintain any defined benefit pension plans.

14

Nonqualified Deferred Compensation

The following table shows the contributions and earnings during 2015, and account balance as of December 31, 2015, for our named executive officers under the Marcus & Millichap Real Estate Investment Brokerage Company DCP (the “NQDC Plan”), the SARs or the 2013 Omnibus Equity Incentive Plan (the “2013 Equity Plan”), as the case may be:

Nonqualified Deferred Compensation—Fiscal 2015

| Name |

Plan | Executive Contributions in Last FY ($) |

Registrant Contributions in Last FY ($) |

Aggregate Earnings in Last FY ($)(1) |

Aggregate Withdrawals/ Distributions ($)(2) |

Aggregate Balance at Last FYE ($)(3) |

||||||||||||||||

| John J. Kerin |

NQDC Plan | 680,000 | — | (8,520 | ) | — | 2,761,845 | |||||||||||||||

| SARs | — | — | 342,951 | — | 8,561,296 | |||||||||||||||||

| 2013 Equity Plan | — | — | (389,489 | ) | (3,403,903 | ) | 7,275,499 | |||||||||||||||

| Hessam Nadji |

SARs | — | — | 126,078 | — | 3,147,350 | ||||||||||||||||

| 2013 Equity Plan | — | — | (161,038 | ) | (1,407,287 | ) | 3,008,005 | |||||||||||||||

| Martin E. Louie |

SARs | — | — | 5,140 | — | 128,319 | ||||||||||||||||

| 2013 Equity Plan | — | — | (242,954 | ) | (2,123,487 | ) | 4,538,669 | |||||||||||||||

| (1) | The SARs and NQDC Plan earnings are included in the Summary Compensation Table because such earnings were determined to be preferential or above-market. The earnings on the SARs represent interest on the Account Balance for the SARs during 2015. The earnings related to the 2013 Equity Plan represents the change in the value of the DSUs during 2015. |

| (2) | On November 5, 2015, 20% of DSUs were settled. The executive distribution amount under the 2013 Equity Plan represents cash value of the settled DSUs calculated based on the fair market value of the company stock on settlement date. |

| (3) | The following amounts included in this column for the NQDC Plan also have been reported in the Summary Compensation Table as compensation for 2015: Mr. Kerin, $(8,520); Mr. Nadji, $0; and Mr. Louie, $0. The following amounts included in this column for the SARs also have been reported in the Summary Compensation Table as compensation for 2015: Mr. Kerin, $342,951; Mr. Nadji, $126,078; and Mr. Louie, $5,140. The deferred equity amounts related to the DSUs included in the table above are the full cash value as determined based on the closing share price of our common stock on December 31, 2015 as reported by the NYSE, which was $29.14. |

The amounts deferred pursuant to the NQDC Plan are reflected as a bookkeeping account maintained on behalf of each participant in the NQDC Plan. The NQDC Plan is a nonqualified deferred compensation plan that allows participants to defer compensation at levels in excess of the limitations imposed on deferrals of compensation under tax-qualified retirement plans. The aggregate earnings for 2015 reflect the additions to the bookkeeping accounts for the participants based on their deemed investment elections with respect to the amounts held in their accounts. Participants can elect among lump sum and installment distribution provisions that commence on a fixed date in the future or upon termination of service.

Please refer to footnote (3) to the Summary Compensation Table for an explanation of compensation due to SARs, including how earnings are calculated and payment events.

We granted fully vested DSUs to the named executive officers under the 2013 Equity Plan in connection with our IPO to replace the existing beneficial ownership represented by the frozen SARs. The DSUs are settled in actual stock at a rate of 20% per year if the executive officer remains employed by us during that period (or otherwise all unsettled shares of stock upon termination of service will be settled five years from the termination date). In addition, all outstanding shares of stock held by our executive officers prior to the IPO are subject to

15

sales restrictions that lapse at a rate of 20% per year for five years if the executive officer remains employed by us. Additionally, in the event of death or termination of service after reaching the age of 67, 100% of the DSUs will be settled and 100% of the shares of stock will be released from the resale restriction. Further, 100% of the shares of stock will be released from the resale restriction upon the consummation of a change of control of the Company. In November 2014 and 2015, 20% of the DSUs were net settled and 20% of the restricted stock was released from the resale restriction. Shares of common stock were withheld from the distribution to pay applicable required employee statutory withholding taxes based on the market value of the shares on the settlement date.

Severance and Change in Control Benefits

In the event of a change in control of the Company, the executive officer will receive their full Account Balance related to their SARs upon the consummation of the change in control.

Stock Ownership Guidelines

We have adopted stock ownership guidelines for non-employee directors and executive officers. These guidelines call for each non-employee director to own shares of our common stock having a value equal to at least five times the non-employee director’s regular annual cash board service retainer, and for each executive officer to own shares of our common stock having a value equal to at least three times their annual base salary (or six times in the case of our CEO). Until these minimums are achieved, each non-employee director and executive officer shall retain 100% of the net after tax shares resulting from the vesting of equity awards. All of our directors and officers are currently in compliance with the ownership guidelines.

Director Compensation

Our Board previously adopted a director compensation policy. Each non-employee director receives fees for their services as follows:

| • | Board Member, including the Chairman—$50,000 per year; |

| • | Chair of Audit Committee—an additional $15,000 per year, other Audit Committee members—an additional $10,000 per year, |

| • | Chair of Compensation Committee—an additional $10,000 per year, other Compensation Committee members—and additional $5,000 per year; and |

| • | Chair of Nominating and Corporate Governance Committee—an additional $10,000 per year, other Nominating and Corporate Governance Committee members—an additional $5,000 per year. |

Each non-employee director is also entitled to receive an annual restricted stock grant on the date of our annual meeting equal to $60,000 divided by the fair market value of our common stock on the date of grant.

Director Compensation Table

The following table sets forth the total compensation for our non-employee directors for the year ended December 31, 2015:

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

All Other Compensation ($) |

Total ($) |

||||||||||||

| Norma J. Lawrence |

70,000 | 60,000 | — | 130,000 | ||||||||||||

| George M. Marcus |

50,000 | 60,000 | — | 110,000 | ||||||||||||

| Nicholas F. McClanahan |

65,000 | 60,000 | — | 125,000 | ||||||||||||

| William A. Millichap |

50,000 | 60,000 | — | 110,000 | ||||||||||||

| George T. Shaheen |

70,000 | 60,000 | — | 130,000 | ||||||||||||

| Don C. Watters |

70,000 | 60,000 | — | 130,000 | ||||||||||||

16

| (1) | This column represents the aggregate grant date fair value of restricted stock granted in 2015, computed in accordance with ASC 718. Each non-employee director received a grant of 1,685 shares of restricted stock and the value represented here is based on the 1,685 shares multiplied by the closing price of $35.59 on the grant date. These amounts reflect our calculation of the value of these awards, and do not necessarily correspond to the actual value that may ultimately be realized by the directors. The restricted stock grants vest 33-1/3% per year on the first, second and third anniversary of the date of grant. |

17

PRINCIPAL STOCKHOLDERS

The following table sets forth information regarding the beneficial ownership of our common stock as of March 7, 2016 with respect to:

| • | each of our directors and named executive officers; |

| • | all directors and executive officers as a group; and |

| • | each person who is known to own beneficially more than 5% of our common stock. |

In accordance with SEC rules, each listed person’s beneficial ownership includes:

| • | all shares the stockholder actually owns beneficially or of record; |

| • | all shares over which the stockholder has or shares voting or investment power; and |

| • | all shares the stockholder has the right to acquire within 60 days. |

Unless otherwise indicated, all shares are or will be owned directly, and the indicated person has or will have sole voting and/or investment power. The address of each person listed in the table is c/o Marcus & Millichap, Inc., 23975 Park Sorrento, Suite 400, Calabasas, California 91302.

Beneficial ownership is determined in accordance with the rules of the SEC. The applicable percentage of ownership for each stockholder is based on 37,568,389 shares of common stock outstanding as of March 7, 2016. As disclosed in the footnotes, no DSUs issued to the executive officers, as applicable, are shown in the table below because the shares issuable to the executive officers upon settlement of the DSUs cannot be received within 60 days of March 7, 2016.

| Shares Beneficially Owned | ||||||||

| Name of Beneficial Owner |

Number | Percent | ||||||

| 5% Stockholders: |

||||||||

| Phoenix Investments Holdings LLC(1) |

20,562,001 | 54.7 | % | |||||

| Named Executive Officers and Directors: |

||||||||

| John J. Kerin(2) |

968,422 | 2.6 | % | |||||

| Hessam Nadji(3) |

386,993 | 1.0 | % | |||||

| Martin E. Louie(4) |

88,923 | * | ||||||

| George M. Marcus(5) |

20,843,028 | 55.5 | % | |||||

| William A. Millichap(6) |

43,833 | * | ||||||

| Norma J. Lawrence |

9,228 | * | ||||||

| George T. Shaheen |

10,499 | * | ||||||

| Don C. Watters |

10,499 | * | ||||||

| Nicholas F. McClanahan |

10,499 | * | ||||||

|

|

|

|

|

|||||

| All executive officers and directors as a group (11 persons)(7) |

23,215,718 | 61.8 | % | |||||

|

|

|

|

|

|||||

| * | Indicates beneficial ownership of less than 1%. |

| (1) | George M. Marcus owns substantially all of the membership interests of Phoenix Investments Holdings LLC (“Phoenix”). Mr. Marcus has voting and investment power with respect to the shares held by Phoenix of which Ionian Investments Manager LLC is the managing member, for which Mr. Marcus serves as the managing member. Mr. Marcus disclaims beneficial ownership of shares held by Phoenix except to the extent of his pecuniary interest therein. |

| (2) | Excludes 249,674 shares issuable upon the settlement of DSUs. Mr. Kerin holds 44,046 shares. The Kerin Family Trust dated January 5, 2001 holds 924,376 shares, and Mr. Kerin may be deemed to have beneficial ownership over these shares as co-trustee. |

| (3) | Excludes 103,226 shares issuable upon the settlement of DSUs. |

18

| (4) | Excludes 155,755 shares issuable upon the settlement of DSUs. |

| (5) | Comprised of (i) 20,562,001 shares held by Phoenix, (ii) 270,528 shares held by The George and Judy Marcus Family Foundation (the “Marcus Foundation”) and (ii) 10,499 shares held by Mr. Marcus. Mr. Marcus has voting and/or investment power with respect to the shares held by Phoenix and the Marcus Foundation as co-trustee. Mr. Marcus disclaims beneficial ownership of shares held by the Marcus Foundation and Phoenix, except to the extent of his pecuniary interest in Phoenix. In 2014, Phoenix pledged 6,000,000 shares beneficially owned by it as collateral for a credit facility. Phoenix reduced the number of pledged shares to 3,500,000 in 2015. There have been no borrowings under this credit facility. |

| (6) | Excludes 50,000 shares issuable upon the settlement of DSUs. |

| (7) | Excludes 1,008,093 shares issuable upon the settlement of DSUs. |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Since January 1, 2015, there has not been any transaction or series of similar transactions to which we were or are a party in which the amount involved exceeded or exceeds $120,000 and in which any of our directors or executive officers, any holder of more than 5% of any class of our voting securities or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest, other than the transactions described below, some of which represent continuing transactions from prior periods.

Relationship with Marcus & Millichap Company

The following are certain related party transactions between MMC and us. Prior to the spin-off of MMC’s real estate investment services business (the “Spin-Off”), MMC was our majority shareholder and was controlled by George M. Marcus, our co-Chairman. Upon the completion of the Spin-Off in October 2015, we entered into a transition services agreement with MMC. The transition services agreement grants us the right to continue to use some of MMC’s services and resources related to our corporate functions, including employee benefits administration, corporate legal services, and accounting systems management. We incurred $257,000 for these services during 2015 based on MMC’s costs of providing the transition services, without any markup.

Under the agreement, we are able to use MMC’s services for a fixed term established on a service-by-service basis, which may be extended by mutual written agreement. We may terminate the agreement or any of the specified services for any reason with 60 days prior written notice to MMC. We do not have any obligation to continue to use MMC’s services after the agreement expires. Generally, each party agreed to indemnify the other party and their respective directors, officers, employees, and agents against losses resulting from the transition services, except to the extent of the service provider’s gross negligence or intentional misconduct, not to exceed the amount of fees paid to the service provider.

We occasionally represent MMC or its affiliates in sales and financing transactions and receive real estate brokerage commissions and financing fees from MMC or its affiliates for these transactions. In 2015, we recorded real estate brokerage commissions and financing fees of $2.7 million from subsidiaries of MMC related to these services, and we incurred costs of services of $1.6 million related to these services.

We lease our office in Palo Alto, which is a single story office building covering approximately 12,000 square feet, from MMC under a lease that expires in May 2022. In 2015, we incurred $693,500 in rent expense under this lease.

Tax Matters Agreement

Responsibility for taxes. We entered into a tax matters agreement with MMC immediately prior to the completion of our IPO that governs the parties’ respective rights, responsibilities, and obligations with respect to

19

tax liabilities and benefits, tax attributes, the preparation and filing of tax returns, the control of audits, and other tax proceedings and other matters regarding taxes. In general, under the agreement:

| • | MMC is responsible for all income taxes of the MMC affiliated group (and any related interest, penalties or audit adjustments and including those taxes attributable to our business) allocable to any tax period ending on or before the last date on which we qualify as a member of the affiliated group (as defined in Section 1504 of the Code of which MMC is the common parent (the “Deconsolidation Date”) (or the portion of a period before the Deconsolidation Date in the case of a tax period beginning before and ending after the Deconsolidation Date). In this regard, MMC is responsible for any income taxes resulting from gain from any deferred intercompany transactions or excess loss account that arises as a result of MMC’s distribution to its shareholders, on a pro rata basis, of at least 80% of the equity interest in our shares (the “Distribution”). MMC and its subsidiaries other than us and our subsidiaries are responsible for all taxes other than income taxes that they incur for all periods; and |

| • | we are responsible for income taxes (and any related interest, penalties or audit adjustments) attributable to us and our subsidiaries for any tax period beginning after the Deconsolidation Date (or the portion of a period after the Deconsolidation Date in the case of a tax period beginning before and ending after the Deconsolidation Date). We and our subsidiaries are also responsible for all taxes other than income taxes that we incur for all periods. |

MMC generally has exclusive authority to control tax contests related to any income tax returns covering periods prior to the Deconsolidation Date. We have exclusive authority to control tax contests with respect to tax returns relating to taxes for which we or our subsidiaries have the payment responsibility under the agreement.

Preservation of the tax-free status of the Contribution, the Debt-for-Equity Exchange, and the Distribution. We and MMC intended that MMC’s contribution of its MMREIS common stock and preferred stock to us, which we refer to as the Contribution, the Debt-for-Equity Exchange, and the Distribution, would qualify as a “reorganization” pursuant to which no gain or loss would be recognized by us, MMC, or the MMC shareholders for federal income tax purposes under Sections 355, 368(a)(1)(D), and related provisions of the Code.

MMC received a private letter ruling from the IRS to the effect that, among other things, the Contribution, the Debt-for-Equity Exchange, and the Distribution qualified as a transaction that was tax-free for U.S. federal income tax purposes under Sections 355, 368(a)(1)(D), and related provisions of the Code. In addition, MMC received an opinion of counsel regarding the tax-free status of these transactions.

We and MMC are prohibited from taking any action, or failing to take any action, (i) where such action or failure to act is inconsistent with any representation made in obtaining the IRS private letter ruling or the opinion of counsel referred to above, or (ii) which adversely affects or could reasonably be expected to adversely affect the tax-free status of the Contribution, the Debt-for-Equity Exchange, or the Distribution.

We have agreed to indemnify MMC and its affiliates against any and all tax-related liabilities incurred by them relating to the Contribution, the Debt-for-Equity Exchange, or the Distribution to the extent caused by a breach of our tax-related restrictions described in the preceding paragraph. This indemnification provision will apply even if MMC has permitted us to take an action that would otherwise have been prohibited under such restrictions. Likewise, MMC has agreed to indemnify us and our affiliates against all tax-related liabilities incurred by us or our affiliates relating to the Contribution, the Debt-for-Equity Exchange, or the Distribution to the extent caused by a breach of MMC’s tax-related restrictions.

Separation Agreement

We entered into a separation agreement with MMC immediately prior to the completion of our IPO that governs our relationship with MMC.

20

Indemnification. Generally, each party agreed to indemnify, defend, and hold harmless the other party and its subsidiaries (and each of their affiliates) and their respective officers, employees, and agents from and against any and all losses relating to, arising out of, or resulting from: (i) liabilities assumed by the indemnifying party, and (ii) any breach by the indemnifying party or its subsidiaries of the separation agreement and the other agreements described in this section (unless such agreement provides for separate indemnification). The separation agreement also specified procedures with respect to claims subject to indemnification.

Mutual releases. Generally, each of MMC and us agreed to release the other party from any and all liabilities. The liabilities released included liabilities arising under any contract or agreement, existing or arising from any acts or events occurring or failing to occur, or any conditions existing before the completion of the IPO.

Term. The separation agreement will continue unless terminated by us and MMC.

Agreements with Management

Sale Restriction Agreements

In connection with our 2013 IPO, we entered into sale restriction agreements (“Sale Restriction Agreements”) with each of our executive officers: John J. Kerin, Martin E. Louie, Gene A. Berman, William E. Hughes, Jr., and Hessam Nadji. The Sale Restriction Agreements provided for vesting acceleration as to all outstanding shares of restricted shares held by the executive officers and termination of the existing Buy-Sell Agreements entered into between us and our executive officers prior to the IPO in exchange for the executive officers’ agreement to limit their ability to sell, transfer, hypothecate, encumber, or in any way alienate any of their shares (the “Sale Restriction”). The Sale Restriction lapses as to 20% of the executive officer’s shares subject to the Sale Restriction annually over a five-year period on each anniversary of the effective date of the agreement unless modified by the Board, subject to the executive officer’s continued service through each lapse date. Additionally, unless modified by the Board, the Sale Restriction shall lapse as to 100% of the shares subject to the Sale Restriction on an executive officer’s death, termination of an executive officer’s service after age 67, a change in control of the Company, or the fifth anniversary of the date an executive officer ceases to be a service provider of the Company. The Sale Restriction Agreements also contain certain covenants, including non-solicitation and non-competition provisions, restricting the executive officers for three years after all of the shares have been released from the Sale Restriction.

Compensation Arrangements with Management

For information about compensation arrangements with our management, see “Compensation of the Named Executive Officers and Directors.”

Policies and Procedures for Related Party Transactions

Our Board adopted a written related person transaction policy that sets forth the policies and procedures for the review and approval or ratification of related person transactions. This policy covers any transaction, arrangement, or relationship, or any series of similar transactions, arrangements, or relationships in which we were or are to be a participant, the amount involved exceeds $120,000, and a related person had or will have a direct or indirect material interest, including, without limitation, purchases of goods or services by, or from, the related person or entities in which the related person has a material interest, indebtedness, guarantees of indebtedness, or employment by us of a related person.

21

ADDITIONAL MEETING INFORMATION