Filed Pursuant to Rule 424(B)(5)

Registration No. 333-201924

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale thereof is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 10, 2015

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus dated February 25, 2015)

4,000,000 Shares

Common Stock

$ per share

The selling stockholders named in this prospectus supplement are offering 4,000,000 shares of our common stock. Marcus & Millichap, Inc. is not selling any shares of common stock under this prospectus supplement and will not receive any proceeds from the sale of the common stock by the selling stockholders.

One of the selling stockholders has granted the underwriters an option to purchase up to 600,000 additional shares.

Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “MMI.” On March 9, 2015, the last reported sale price of our common stock on the NYSE was $37.38 per share.

Investing in our common stock involves risks. See “Risk Factors” beginning on page S-13.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting Discount(1) |

$ | $ | ||||||

| Proceeds to the selling stockholders (before expenses) |

$ | $ | ||||||

| (1) | Please see the section entitled “Underwriting” for a complete description of the compensation payable to the underwriters. |

The underwriters expect to deliver the shares to purchasers on or about , 2015 through the book-entry facilities of The Depository Trust Company.

Joint Book-Running Managers

| Citigroup | Barclays | Wells Fargo Securities |

Co-Managers

| William Blair | JMP Securities |

, 2015

| Page | ||||

| S-1 | ||||

| S-13 | ||||

| S-13 | ||||

| S-14 | ||||

| S-14 | ||||

| S-15 | ||||

| S-16 | ||||

| S-22 | ||||

| S-22 | ||||

| S-22 | ||||

| S-23 | ||||

PROSPECTUS

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 |

In this prospectus supplement we use the terms “Marcus & Millichap,” “MMI,” “we,” “us,” “our,” and “our company” and similar phrases to refer to Marcus & Millichap, Inc., a Delaware corporation, and its consolidated subsidiaries, unless otherwise specified. References to our “common stock” refer to the common stock, $0.0001 par value per share, of Marcus & Millichap, Inc.

None of us, the selling stockholders, or the underwriters have authorized anyone to provide you with additional or different information from that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectus we may authorize to be delivered to you. The selling stockholders and the underwriters are offering to sell, and seeking offers to buy, our shares only in jurisdictions where offers and sales thereof are permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus or in any free writing prospectus we may authorize to be delivered to you is accurate only as of their respective dates or on the date or dates which are specified in such documents, and that any information in documents that we have incorporated by reference is accurate only as of the date of such document incorporated by reference. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

S-i

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus dated February 25, 2015, including the documents incorporated by reference therein, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference that was filed with the U.S. Securities and Exchange Commission (the “SEC”), before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date (for example, a document incorporated by reference in this prospectus supplement or in the accompanying prospectus) the statement in the document having the later date modifies or supersedes the earlier statement.

S-ii

This summary does not contain all of the information that you should consider before investing in shares of our common stock. You should read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein carefully before making an investment decision, especially the risks discussed under “Risk Factors” and our financial statements and the related notes which are incorporated by reference herein from our Annual Report on Form 10-K for the year ended December 31, 2014, before you decide to invest in shares of our common stock.

Overview

Marcus & Millichap, Inc. is a leading national brokerage firm specializing in commercial real estate investment sales, financing, research and advisory services. We have been the top broker in the United States based on the number of investment transactions over the last 10 years. As of December 31, 2014, we had nearly 1,500 investment sales and financing professionals in 78 offices in the United States and Canada that provide investment brokerage and financing services to sellers and buyers of commercial real estate. We also offer market research, consulting and advisory services to developers, lenders, owners and investors. In 2014, we closed more than 7,600 sales, financing and other transactions with total volume of approximately $33.1 billion.

We divide the commercial real estate market into three major segments by investment size:

| • | Private client segment: properties with prices under $10 million; |

| • | Hybrid segment: properties with prices equal to or greater than $10 million and less than $20 million; and |

| • | Institutional segment: properties with prices of $20 million and above. |

We focus primarily on the private client segment, which consistently comprises over 80% of the total number of property transactions in the commercial real estate market.

We were founded in 1971 and are committed to building the leading national investment brokerage business. To achieve that goal, we underwrite, market and sell commercial real estate properties for our private clients in a manner that maximizes value for sellers and provides buyers with the largest and most diverse inventory of commercial properties. Our business model is based on several key attributes: a focus on investment brokerage services, a critical mass of sales professionals providing consistent services and exclusive client representation, a national platform based on information sharing and powered by proprietary technology, a management team with investment brokerage experience, a financing team that is integrated with our investment sales force and research and advisory services tailored for our clients.

We devote our expertise and focus to the investment brokerage and financing business as opposed to other businesses, such as leasing or property management. Accordingly, our business model is unique from our national competitors, who focus primarily on the institutional real estate segment, and from our local and regional competitors, who lack a broad national platform. As the leading investment sales and financing firm in our segment, we believe we are ideally positioned to capture significant growth opportunities in our market.

Our sales professionals are specialized by property type and by local market area, as we believe a focused expertise brings value to our clients. Our model and footprint provide an unparalleled level of connectivity to the marketplace. We operate 78 offices in the United States and Canada. We have 61 offices concentrated in 48 major markets consisting of metropolitan areas with a population of at least one million and 17 offices in 17 mid-market locations consisting of metropolitan areas with a population of less than one million. Our broad geographic coverage, property expertise, and significant relationships with both buyers and sellers provide connectivity and increase liquidity in the markets we serve. By closing more transactions annually than any other

S-1

firm (based on data from CoStar Group, Inc. and Real Capital Analytics that includes apartment, retail, office, and industrial sales), our sales professionals are able to provide clients with a broad and deep perspective on the investment real estate market locally, regionally and nationally.

We generate revenues by collecting commissions upon the sale and financing of commercial properties. These fees consist of commissions collected upon the sale of an asset, based upon the sales price of the property, and fees collected by our financing subsidiary from the placement of loans. In 2014, approximately 92% of our revenues were generated from real estate brokerage commissions, 6% from financing fees and 2% from other revenues, including consulting and advisory services.

Marcus & Millichap Investment Sales, Financing and Other Transactions by Property Type

The following tables show the number and dollar volume (in billions) of investment sales, financing and other transactions in 2014 compared to 2013 by property type and investor segment:

| 2013 Transactions |

2014 Transactions |

Change Increase (Decrease) |

||||||||||||||||||||||

| Property Type |

Number | Volume | Number | Volume | Number | Volume | ||||||||||||||||||

| Multifamily |

2,892 | $ | 12.9 | 3,142 | $ | 16.1 | 250 | $ | 3.2 | |||||||||||||||

| Retail |

2,396 | 6.3 | 2,948 | 10.3 | 552 | 4.0 | ||||||||||||||||||

| Office |

470 | 1.5 | 480 | 1.8 | 10 | 0.3 | ||||||||||||||||||

| Hospitality |

130 | 0.5 | 240 | 1.1 | 110 | 0.6 | ||||||||||||||||||

| Land |

128 | 0.2 | 173 | 0.5 | 45 | 0.3 | ||||||||||||||||||

| Industrial |

145 | 0.5 | 172 | 0.7 | 27 | 0.2 | ||||||||||||||||||

| Self-Storage |

109 | 0.5 | 160 | 0.7 | 51 | 0.2 | ||||||||||||||||||

| Manufactured Housing |

84 | 0.4 | 90 | 0.4 | 6 | — | ||||||||||||||||||

| Seniors Housing |

73 | 0.6 | 61 | 0.7 | (12 | ) | 0.1 | |||||||||||||||||

| Mixed—Use / Other |

181 | 0.6 | 201 | 0.8 | 20 | 0.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

6,608 | $ | 24.0 | 7,667 | $ | 33.1 | 1,059 | $ | 9.1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 2013 Transactions |

2014 Transactions |

Change Increase (Decrease) |

||||||||||||||||||||||

| Investor Segment |

Number | Volume | Number | Volume | Number | Volume | ||||||||||||||||||

| Private Client $1 to $10 Million |

4,312 | $ | 12.8 | 5,198 | $ | 15.6 | 886 | $ | 2.8 | |||||||||||||||

| Private Client <$1 Million |

1,876 | 1.1 | 1,861 | 1.1 | (15 | ) | — | |||||||||||||||||

| Hybrid |

263 | 3.5 | 392 | 5.4 | 129 | 1.9 | ||||||||||||||||||

| Institutional |

157 | 6.6 | 216 | 11.0 | 59 | 4.4 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

6,608 | $ | 24.0 | 7,667 | $ | 33.1 | 1,059 | $ | 9.1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Competitive Strengths

We believe the following strengths provide us with a competitive advantage and opportunities for success:

National Platform Focused on Investment Brokerage. We are committed to building the leading national investment brokerage business. To achieve our goal, we focus on investment brokerage as opposed to other businesses such as leasing or property management. We combine proprietary technology and processes to market investment real estate with highly qualified sales professionals in 78 offices across the United States and Canada. Our commitment to specialization is also reflected in how we organize our sales professionals by property type and market area, which enhances our skills, relationships and market knowledge required for achieving the best results for our clients.

S-2

Market Leader in the Private Client Segment. We are the leading commercial real estate investment broker in the United States based on the number of transactions. We focus primarily on the private client segment of the market, consisting of transactions with prices under $10 million, which accounted for over 90% of the number of our transactions in 2014. This segment represents the vast majority of the number of commercial properties in the United States and is characterized by high asset turnover rates due to personal circumstances and business reasons, such as death, divorce and changes in partnership and other personal or financial circumstances. The private client brokerage industry is highly fragmented and characterized by high barriers to entry. These barriers include the need for a large, specialized sales force prospecting private clients, the difficulty in identifying and establishing relationships with such investors and the challenge of serving their needs locally, regionally and nationally. For transactions in the $1 million to $10 million range nationally, the top 10 brokerage firms represented just 21.1% (includes apartment, retail, office, and industrial sales) of commercial property sales in 2013. We believe our core business is the least covered segment by national firms, and is significantly underserved by local and regional firms that lack a multi-market platform.

Platform Built for Maximizing Investor Value. We have built our business to maximize value for real estate investors through an integrated set of services geared toward our clients’ needs. Within investment sales, we are committed to an investment brokerage specialization, providing the largest sales force in the industry, fostering a culture and policy of information sharing on each asset we represent and using proprietary technology that facilitates real-time buyer-seller matching. Our investment sales organization underwrites, positions and markets investment real estate to the largest pool of qualified buyers. We coordinate proactive marketing campaigns that access the investor relationships and resources of the entire firm, far beyond the capabilities of an individual listing agent. These efforts produce wide exposure to investors who we identify as high-probability bidders for each asset.

We have one of the largest teams of financing professionals in the investment brokerage industry through our subsidiary, Marcus & Millichap Capital Corporation (“MMCC”). MMCC provides financing expertise and access to debt capital by securing competitive loan pricing and terms for our clients. In 2014, MMCC closed more than 1,300 financings with an aggregate loan value of approximately $3.8 billion, making us a leading mortgage broker in the industry. Finally, our market research analyzes the latest local and national economic and real estate trends, enabling our clients to make informed investment and financing decisions. These integrated services enable us to facilitate transactions for our clients across different property types and markets.

Management with Significant Investment Brokerage Experience. The majority of our regional managers are former senior sales professionals of the firm who now focus on management and do not compete with our sales force. As executives of the firm dedicated to hiring, training, developing and supporting our sales professionals, their investment brokerage background is extremely valuable. Our top sales professionals are trained, developed and supported by our regional managers. Our comprehensive training and development programs rely greatly on the regional managers’ personal involvement. Their past experience as senior sales professionals plays a key role in helping our junior professionals establish technical and client service skills. Our regional managers also coach our sales professionals in setting up, developing and growing their relationships with clients. We believe this management structure has helped the firm create a competitive advantage and achieve better results for our clients.

Growth Strategy

We have a long track record of successful growth in our core business driven by opening new offices and by hiring, training and developing new sales and financing professionals. Since the implementation of our long-term growth plan in 1995, our revenue has increased sevenfold and we have grown from approximately 416 sales professionals in 22 offices to nearly 1,500 sales and financing professionals in 78 offices in the United States and

S-3

Canada. To drive our future growth, we continually seek to expand our national footprint and optimize the size, product segmentation and specialization of our team of sales and financing professionals. The key strategies of our growth plan include:

Increase Market Share in Our Core Business. Our core business is focused on the highly fragmented private client segment. The top 10 brokerage firms accounted for only 21.1% (includes apartment, retail, office, and industrial sales) of 2013 sales in the $1 million to $10 million range. Our industry leading market share of 7.4% in this segment creates significant opportunity for us to expand our market presence and bring our unique client service offerings to a larger portion of the segment. We leverage our existing platform, relationships and brand recognition among private clients to grow through expanded marketing and coverage. Our growth plan includes the following components:

| • | Grow in Targeted Locations. Our plan targets specific markets and calls for both expansion of existing offices and opening additional offices. We have assigned key executives and managers to these markets and our recruiters have begun to hire additional experienced sales professionals. We have targeted markets based on population, employment, commercial real estate sales, inventory and competitive landscape. In addition, we have developed optimal office plans to capitalize on these factors by tailoring sales force size, coverage and composition by office and business activity. We expect this intensified focus on target markets, coupled with new marketing campaigns, reassigned geographic boundaries and team development, to result in significant growth. |

| • | Grow in Specialty Property Types. We believe that specialty property types, including hospitality, multifamily tax credit and affordable housing, student housing, manufactured housing, seniors housing and self-storage, offer significant room for growth. To take advantage of these opportunities, we are increasing our property type expertise by continuing to add regional directors who can bring added management capacity, business development and sales professional support. These executives will work with our regional and group managers to increase sales professional hiring, training, development and redeployment, and to execute various branding and marketing campaigns to expand our presence in key property types. |

| • | Increase Sales Professional Hiring. We grow our business by hiring, training and developing sales professionals. Recently, we increased our focus on hiring experienced sales professional through our recruiting department, specialty directors and regional managers. Our new sales professionals are trained in all aspects of real estate fundamentals and client service through formal training and apprenticeship programs. As these sales professionals mature, we continue to provide best practices and specialty training. When hiring more experienced sales professionals, we have focused on cultural fit. We believe this model creates a high level of teamwork, as well as operational and client service consistency. |

Grow Financing Services. We are focused on growing our financing services provided through MMCC. We are taking steps that we believe will substantially increase our internal loan business capture rate. We intend to execute our growth strategy by expanding financing services in markets currently served by us and by increasing the capacity of financing professionals in offices we currently serve and in offices that do not have an MMCC presence or an MMCC presence is underutilized. In addition, in order to continue to increase our internal loan capture rate we are enhancing our cross-selling training, education and internal branding. We also plan to enhance MMCC’s service platform and explore expanding our revenue sources by developing other services such as mezzanine financing, HUD products, equity placement and conduit financing.

Expand Our Market Share of Larger Transactions. Our extensive relationships with private clients have enabled us to capture a greater portion of commercial real estate transactions in excess of $10 million and bridge the private and institutional capital markets in recent years. Our ability to connect private capital with institutional assets plays a major role in differentiating our services. In 2011, we introduced a division dedicated

S-4

to serving major investors branded as Institutional Property Advisors, in the multifamily sector. This strategy has met with great success and market acceptance and provides a vehicle for growth by delivering our unique service platform within the hybrid and institutional multifamily, institutional retail and office sectors.

Market and Industry

Overview of the Commercial Real Estate Investment Industry

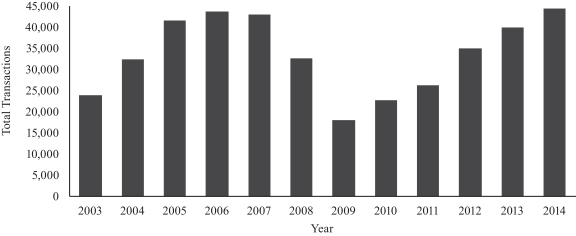

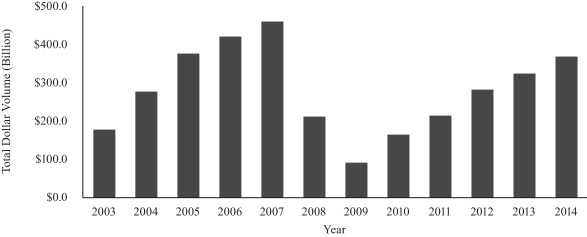

We estimate the total value of U.S. commercial real estate assets to be $12.4 trillion at the end of 2014 based on data provided by CoStar Group, Inc. and Real Capital Analytics. Property sales in the commercial real estate sector for the four major categories of multifamily, retail, office and industrial properties priced at $1 million and above reached nearly $370 billion, or approximately 44,500 transactions, in 2014. This was a 14.3% increase in dollar volume and 11.6% increase in the number of transactions over 2013, following a 15.0% increase in dollar volume and a 13.5% increase in the number of transactions over 2012. The following graphs show the total number of transactions and dollar volume of transactions in the commercial real estate industry from 2003 to 2014:

U.S. Commercial Real Estate Transactions, 2003-2014*

Total Transactions

| * | Includes sales $1 million and greater. Sources: CoStar Group, Inc. and Real Capital Analytics. 2014 includes preliminary estimate for the fourth quarter of 2014. |

S-5

Total Dollar Volume*

| * | Includes sales $1 million and greater. Sources: CoStar Group, Inc. and Real Capital Analytics. 2014 includes preliminary estimate for the fourth quarter of 2014. |

We divide the commercial real estate market into three major segments by investment size:

| • | Private client segment: properties with prices under $10 million; |

| • | Hybrid segment: properties with prices equal to or greater than $10 million and less than $20 million; and |

| • | Institutional segment: properties with prices of $20 million and above. |

Private client segment transactions generally involve high net worth individuals, partnerships and private funds. Hybrid segment transactions primarily involve larger private investors. Institutional segment transactions tend to be dominated by pension funds, insurance companies, private equity firms, endowments and real estate investment trusts.

The table below shows the number and volume of transactions by property price segment as well as the estimated commission pool for each segment.

Commercial Real Estate Transaction Breakdown, 2014*

| Segment |

Transactions | Percentage of Transactions |

Volume (Billions) |

Percentage of Volume |

Estimated Commission Pool (Billions) |

Estimated Percentage of Commission Pool |

||||||||||||||||||

| Private Client |

37,166 | 83.6 | % | $ | 111 | 30.2 | % | $ | 4.1 | 60.4 | % | |||||||||||||

| Hybrid |

3,792 | 8.5 | % | $ | 53 | 14.4 | % | $ | 1.1 | 15.6 | % | |||||||||||||

| Institutional |

3,520 | 7.9 | % | $ | 204 | 55.4 | % | $ | 1.6 | 24.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

44,478 | 100.0 | % | $ | 368 | 100.0 | % | $ | 6.8 | 100.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| * | Sources (other than commissions): CoStar Group, Inc. and Real Capital Analytics. Commission data is based on our estimate of average industry commission rates as follows: Private client segment—3.7%; Hybrid segment—2.0%; Institutional segment—0.8%. Commission rates are typically inversely correlated with property value and subject to individual negotiation with clients. Private client segment data does not include transactions of $1 million or less. |

S-6

The commercial real estate market experienced a significant downturn from the 2007 peak to a trough in 2009, representing the most severe downturn in property sales since at least 1990, the earliest period for which data is available. Since 2009, commercial property sales have increased by 146% and dollar volume has increased by 305%. This cyclical upturn has been, and we believe will continue to be supported by attractive yields and improving property fundamentals, based on data from CoStar Group, Inc., Real Capital Analytics and MPF Research.

Growth in the Commercial Real Estate Industry

Historically, the U.S. commercial real estate industry has tended to be cyclical and closely correlated with the flow of capital into the sector, the condition of the economy as a whole, the perceptions and confidence of market participants as to the economic outlook, supply/demand balance, changes to tax laws and regulatory factors. Employment growth or contraction in particular exhibits a strong correlation with demand for various types of commercial space, and vacancy rates tend to move up and down with a natural lag behind employment and construction cycles. Changes in interest rates, credit and liquidity issues and disruptions in capital markets are all factors that may also affect the industry.

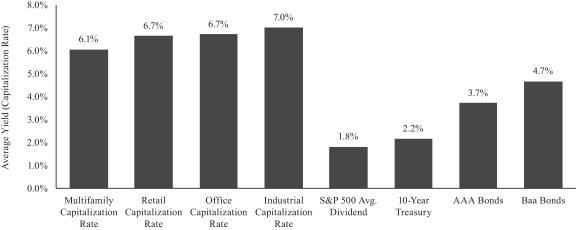

Attractive Yields. According to Real Capital Analytics, average commercial real estate yields (capitalization rates) by the four major property types currently range from 6.1% to 7.0%, which compare favorably to alternative investments such as stocks and bonds, as shown below. We believe these attractive yields are a key driver of improving capital inflows for commercial real estate investments.

Average Yields *

| * | Average real estate yields are for transactions of $2.5 million and above during the fourth quarter of 2014. All other yields as of December 31, 2014. Sources: Real Capital Analytics and Bloomberg. |

S-7

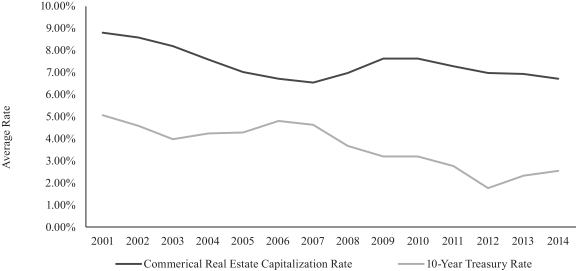

Commercial Real Estate Capitalization Rate vs. 10-Year Treasury Rate *

| * | Average real estate yields are for transactions of $2.5 million and above for multifamily, retail, office and industrial properties. The average Commercial Real Estate Capitalization Rate and average Ten Year Treasury Rate during the period presented were 7.4% and 3.6%, respectively. Sources: Real Capital Analytics and Bloomberg. |

Improving Property Fundamentals. We believe property fundamentals have improved since 2009, with each of the four major property sectors demonstrating continued improvement in occupancy rates. This improvement is supported, in part, by a favorable supply/demand balance as new construction deliveries have represented a steady, modest percent of existing inventory.

| Occupancy Rates | ||||||||||||||||||||

| Property Type |

2010 | 2011 | 2012 | 2013 | 2014 | |||||||||||||||

| Multifamily |

93.5 | % | 94.7 | % | 94.9 | % | 95.0 | % | 95.3 | % | ||||||||||

| Retail |

92.2 | % | 92.3 | % | 92.5 | % | 92.9 | % | 93.4 | % | ||||||||||

| Office |

82.9 | % | 83.3 | % | 83.7 | % | 84.1 | % | 84.7 | % | ||||||||||

| Industrial |

89.6 | % | 90.4 | % | 91.1 | % | 92.0 | % | 92.8 | % | ||||||||||

Source: CoStar Group, Inc. and MPF Research

| New Construction Completions as a Percentage of Inventory |

||||||||||||||||||||

| Property Type |

2010 | 2011 | 2012 | 2013 | 2014 | |||||||||||||||

| Multifamily |

0.9 | % | 0.5 | % | 0.7 | % | 1.2 | % | 1.6 | % | ||||||||||

| Retail |

0.5 | % | 0.5 | % | 0.5 | % | 0.6 | % | 0.6 | % | ||||||||||

| Office |

0.7 | % | 0.4 | % | 0.5 | % | 0.6 | % | 0.7 | % | ||||||||||

| Industrial |

0.2 | % | 0.3 | % | 0.4 | % | 0.6 | % | 1.0 | % | ||||||||||

Source: CoStar Group, Inc. and MPF Research

S-8

Corporate Information

Our principal executive offices are located at 23975 Park Sorrento, Suite 400, Calabasas, California 91302. Our telephone number at this location is (818) 212-2250. Our website address is www.marcusmillichap.com. The information on our website is not part of, and is not incorporated into, this prospectus supplement.

S-9

| Common stock offered by the selling stockholders |

4,000,000 shares |

| Underwriters’ option to purchase additional shares of common stock |

One of the selling stockholders has granted the underwriters a 30-day option to purchase up to an additional 600,000 shares. |

| Common stock to be outstanding after this offering |

36,918,442 shares |

| Use of proceeds |

We will not receive any of the proceeds from the sale of shares of common stock by the selling stockholders. |

| New York Stock Exchange Symbol |

MMI |

Unless we indicate otherwise or the context requires, all information in this prospectus supplement:

| • | assumes no exercise of the underwriters’ option to purchase additional shares of our common stock; and |

| • | excludes, as of December 31, 2014, an additional (i) 4,991,965 shares reserved for issuance upon exercise of stock options, deferred stock units (“DSUs”), restricted stock units (“RSUs”) or other equity awards that may be granted under the 2013 Omnibus Equity Incentive Plan, which includes (A) DSUs for an aggregate of 1,820,596 shares and (B) RSUs for an aggregate of 947,716 shares, and (ii) 341,356 shares reserved for issuance under the 2013 Employee Stock Purchase Plan. |

S-10

Summary Selected Financial and Other Data

The summary selected financial and other data set forth below should be read in conjunction with the section of this prospectus supplement entitled “Summary,” as well as the other information we have filed with the SEC and incorporated by reference herein. The selected financial data presented in the following table includes consolidated statements of income data for the years ended December 31, 2014, 2013 and 2012, and consolidated balance sheet data at December 31, 2014 and 2013. Such financial data are derived from our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2014, which is incorporated by reference herein. Our historical results are not necessarily indicative of our results in any future period.

| Year Ended December 31, | ||||||||||||

| 2012 | 2013 | 2014 | ||||||||||

| (in thousands except per share, sales and financing professional and sales volume amounts) |

||||||||||||

| Statements of Income Data: |

||||||||||||

| Total revenues |

$ | 385,716 | $ | 435,895 | $ | 572,188 | ||||||

| Cost of services |

230,248 | 264,637 | 350,102 | |||||||||

| Stock-based and other compensation in connection with IPO(1) |

— | 31,268 | — | |||||||||

| Operating income |

49,008 | 21,286 | 84,606 | |||||||||

| Provision for income taxes(2) |

21,507 | 13,735 | 33,452 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income |

$ | 27,934 | $ | 8,206 | $ | 49,531 | ||||||

| Less: Net (loss) income attributable to Marcus & Millichap Real Estate Investment Services, Inc. prior to initial public offering on October 31, 2013 |

27,934 | (1,045 | ) | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Net income attributable to Marcus & Millichap, Inc. subsequent to initial public offering |

$ | — | $ | 9,251 | $ | 49,531 | ||||||

|

|

|

|

|

|

|

|||||||

| Earnings per share(3) |

||||||||||||

| Basic |

$ | 0.24 | $ | 1.27 | ||||||||

| Diluted |

$ | 0.24 | $ | 1.27 | ||||||||

| Weighted average common shares outstanding(3) |

||||||||||||

| Basic |

38,787 | 38,851 | ||||||||||

| Diluted |

38,815 | 38,978 | ||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 3,107 | $ | 100,952 | $ | 149,159 | ||||||

| Total assets |

89,733 | 167,309 | 233,604 | |||||||||

| Long-term liabilities(4) |

13,650 | 48,052 | 49,591 | |||||||||

| Total liabilities(4) |

68,103 | 104,812 | 116,795 | |||||||||

| Total stockholders’ equity |

21,630 | 62,497 | 116,809 | |||||||||

| Other Data: |

||||||||||||

| Adjusted EBITDA(5) |

$ | 59,708 | $ | 61,286 | $ | 92,824 | ||||||

| Sales & financing professionals |

1,066 | 1,313 | 1,494 | |||||||||

| Sales volume ($ millions) |

$ | 22,014 | $ | 23,975 | $ | 33,139 | ||||||

| (1) | Consists of non-cash stock based compensation and other compensation charges incurred in connection with our initial public offering in October 2013 (the “IPO”). See Note 10—“Stock-Based Compensation Plans” of our Notes to Consolidated Financial Statements set forth in Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2014. |

S-11

| (2) | Prior to the IPO in October 2013, we were subject to a tax-sharing agreement whereby we provided for income taxes using an effective tax rate of 43.5%. As part of the IPO, the tax-sharing agreement with our prior parent company, Marcus & Millichap Company was terminated. See Note 11—“Income Taxes” of our Notes to Consolidated Financial Statements set forth in Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2014. |

| (3) | Earnings per share information has not been presented for periods prior to the IPO as amounts were not meaningful. See Note 13—“Earnings Per Share” of our Notes to Consolidated Financial Statements set forth in Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2014 for additional information on earnings per share. |

| (4) | 2014 and 2013 includes Stock Appreciation Rights (“SARs”) liability and notes payable to former stockholders incurred in connection with the IPO. See Note 4—“Selected Balance Sheet Data” and Note 6—“Notes Payable to Former Stockholders” of our Notes to Consolidated Financial Statements set forth in Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2014. |

| (5) | We define Adjusted EBITDA as net income before (i) interest income/expense, (ii) income tax expense, (iii) depreciation and amortization and (iv) stock-based compensation expense. We use Adjusted EBITDA in our business operations to, among other things, evaluate the performance of our business, develop budgets and measure our performance against those budgets. We also believe that analysts and investors use Adjusted EBITDA as supplemental measures to evaluate our overall operating performance. However, Adjusted EBITDA has material limitations as an analytical tool and should not be considered in isolation, or as a substitute for analysis of our results as reported under generally accepted accounting principles in the United States (“U.S. GAAP”). We find Adjusted EBITDA as a useful tool to assist in evaluating performance because it eliminates items related to capital structure and taxes and non-cash stock-based compensation charges. In light of the foregoing limitations, we do not rely solely on Adjusted EBITDA as a performance measure and also consider our U.S. GAAP results. Because Adjusted EBITDA is not calculated in the same manner by all companies, it may not be comparable to other similarly titled measures used by other companies. |

A reconciliation of the most directly comparable U.S. GAAP financial measure, net income, to Adjusted EBITDA is as follows (in thousands):

| Year Ended December 31, | ||||||||||||

| 2012 | 2013 | 2014 | ||||||||||

| Net income |

$ | 27,934 | $ | 8,206 | $ | 49,531 | ||||||

| Adjustments: |

||||||||||||

| Interest income and other(a) |

(166 | ) | 356 | (50 | ) | |||||||

| Interest expense |

4 | 105 | 1,651 | |||||||||

| Provision for income taxes |

21,507 | 13,735 | 33,452 | |||||||||

| Depreciation and amortization |

2,981 | 3,043 | 3,206 | |||||||||

| Stock-based compensation(b) |

7,448 | 35,841 | 5,034 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 59,708 | $ | 61,286 | $ | 92,824 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) | The year ended December 31, 2013 includes employer taxes related to DSUs and restricted stock in connection with the IPO. |

| (b) | The year ended December 31, 2013 includes non-cash stock-based compensation charges of $30.9 million in connection with the IPO. |

S-12

Investing in our common stock involves risks. You should carefully consider the risks and uncertainties described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, which is incorporated by reference herein. You should also carefully consider the other information contained or incorporated by reference in this prospectus supplement and in the accompanying prospectus before acquiring any shares of our common stock. These risks could materially affect our business, results of operations or financial condition and cause the value of our common stock to decline. You could lose all or part of your investment.

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference include forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| • | market trends in the commercial real estate market or the general economy; |

| • | our ability to attract and retain qualified managers, sales and financing professionals; |

| • | the effects of increased competition on our business; |

| • | our ability to successfully enter new markets or increase our market share; |

| • | our ability to successfully expand our services and businesses and to manage any such expansions; |

| • | our ability to retain existing clients and develop new clients; |

| • | our ability to keep pace with changes in technology; |

| • | any business interruption or technology failure and any related impact on our reputation; |

| • | changes in tax laws, employment laws or other government regulation affecting our business; and |

| • | other risk factors included under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014. |

In addition, in this prospectus supplement, the words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “predict,” “potential” and similar expressions, as they relate to our company, our business and our management, are intended to identify forward-looking statements. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus supplement may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

Forward-looking statements speak only as of the date of this prospectus supplement. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

S-13

We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders, including from any exercise by the underwriters of their option to purchase additional shares.

PRICE RANGE OF SHARES AND DIVIDEND HISTORY

Our common stock has been listed on the NYSE under the symbol “MMI” since October 31, 2013. Prior to that date, there was no public trading market for our common stock. Our initial public offering was priced at $12.00 per share on October 31, 2013. The following table sets forth, for the periods indicated, the high and low sales prices of our shares on the NYSE from and after October 31, 2013:

| Price Per Share | ||||||||

| High | Low | |||||||

| Year Ended December 31, 2013 |

||||||||

| Fourth Quarter (beginning October 31) |

$ | 15.70 | $ | 13.09 | ||||

| Year Ended December 31, 2014 |

||||||||

| First Quarter |

$ | 18.51 | $ | 13.56 | ||||

| Second Quarter |

$ | 26.64 | $ | 15.61 | ||||

| Third Quarter |

$ | 31.32 | $ | 22.30 | ||||

| Fourth Quarter |

$ | 34.00 | $ | 25.16 | ||||

| Year Ended December 31, 2015 |

||||||||

| First Quarter (through March 9, 2015) |

$ | 39.92 | $ | 30.89 | ||||

On March 9, 2015, the last reported sale price of our shares on the NYSE was $37.38 per share.

We do not pay a regular dividend. We will evaluate our dividend policy in the future. Any declaration and payment of future dividends to holders of our common stock will be at the discretion of the board of directors and will depend on many factors, including our financial condition, earnings, cash flows, capital requirements, level of indebtedness, statutory and contractual restrictions applicable to the payment of dividends and other considerations that our board of directors deems relevant.

S-14

PRINCIPAL AND SELLING STOCKHOLDERS

The following table and accompanying footnotes set forth information regarding the beneficial ownership of our common stock as of March 10, 2015, before and after giving effect to this offering (assuming no exercise of the underwriters’ option to purchase additional shares of our common stock from one of the selling stockholders), by (1) each person known to us to beneficially own more than 5% of any class of the outstanding voting securities of Marcus & Millichap, Inc., (2) each of our directors and named executive officers, (3) all of our directors and executive officers as a group and (4) each selling stockholder.

Beneficial ownership is determined in accordance with the rules of the SEC. Percentages are calculated based on 36,918,442 shares outstanding as of March 10, 2015. Except as otherwise noted, the address of each person listed in the table is c/o Marcus & Millichap, Inc., 23975 Park Sorrento, Suite 400, Calabasas, California 91302.

| Prior to this Offering Shares Beneficially Owned |

Number of Shares to be Sold |

After this Offering Shares Beneficially Owned |

||||||||||||||||||

| Name and Address of Beneficial Owner |

Number | Percent | Number | Percent | ||||||||||||||||

| Selling Stockholders: |

||||||||||||||||||||

| Phoenix Investments Holdings LLC(1) |

24,362,001 | 66.0 | % | 3,200,000 | 21,162,001 | 57.3 | % | |||||||||||||

| The Marcus Family Foundation(2) |

800,000 | 2.2 | % | 800,000 | 0 | * | ||||||||||||||

| Named Executive Officers and Directors: |

||||||||||||||||||||

| John J. Kerin(3) |

1,038,472 | 2.8 | % | 0 | 1,038,472 | 2.8 | % | |||||||||||||

| Gene A. Berman(4) |

567,407 | 1.5 | % | 0 | 567,407 | 1.5 | % | |||||||||||||

| Hessam Nadji(5) |

364,971 | * | 0 | 364,971 | * | |||||||||||||||

| George M. Marcus(6) |

25,170,815 | 68.2 | % | 4,000,000 | (7) | 21,170,815 | 57.3 | % | ||||||||||||

| William A. Millichap(8)(9) |

25,481 | * | 0 | 25,481 | * | |||||||||||||||

| Norma J. Lawrence(9) |

8,814 | * | 0 | 8,814 | * | |||||||||||||||

| George T. Shaheen(9) |

8,814 | * | 0 | 8,814 | * | |||||||||||||||

| Don C. Watters(9) |

8,814 | * | 0 | 8,814 | * | |||||||||||||||

| Nicholas F. McClanahan(9) |

8,814 | * | 0 | 8,814 | * | |||||||||||||||

| All executive officers and directors as a group |

27,484,044 | 74.4 | % | 4,000,000 | 23,484,044 | 63.6 | % | |||||||||||||

| * | Indicates beneficial ownership of less than 1%. |

| (1) | George M. Marcus owns substantially all of the membership interests of Phoenix Investments Holdings LLC (“Phoenix”). Mr. Marcus has voting and investment power with respect to the shares held by Phoenix of which Ionian Investments Manager LLC is the managing member, for which Mr. Marcus serves as the managing member. Mr. Marcus disclaims beneficial ownership of shares held by Phoenix except to the extent of his pecuniary interest therein. Phoenix has granted the underwriters a 30-day option to purchase up to an additional 600,000 shares. The address for all of the above mentioned entities and persons is 777 S. California Avenue, Palo Alto, CA 94304. |

| (2) | Mr. Marcus and his spouse are the co-trustees of The Marcus Family Foundation. The address for all of the above mentioned entities and persons is 777 S. California Avenue, Palo Alto, CA 94304. |

| (3) | Excludes 332,899 shares issuable upon the settlement of DSUs. |

| (4) | Excludes 458,982 shares issuable upon the settlement of DSUs. |

| (5) | Excludes 137,634 shares issuable upon the settlement of DSUs. |

| (6) | Comprised of (i) 24,362,001 shares held by Phoenix, (ii) 800,000 shares held by The Marcus Family Foundation and (iii) 8,814 shares held by Mr. Marcus. Mr. Marcus has voting and investment power with respect to the shares held by Phoenix. Mr. Marcus disclaims beneficial ownership of shares held by Phoenix except to the extent of his pecuniary interest therein. Phoenix has pledged 6,000,000 shares beneficially owned by it as collateral for a credit facility. Mr. Marcus is the co-trustee of The Marcus Family Foundation and disclaims beneficial ownership of the shares held by it. |

| (7) | Represents shares to be sold by Phoenix and The Marcus Family Foundation. |

| (8) | Excludes 66,667 shares issuable upon the settlement of DSUs. |

| (9) | Includes 7,147 shares of unvested restricted stock. |

S-15

Citigroup Global Markets Inc., Barclays Capital Inc. and Wells Fargo Securities, LLC are acting as joint book-running managers of the offering and as representatives of the underwriters named below. Subject to the terms and conditions stated in the underwriting agreement dated the date of this prospectus supplement, each underwriter named below has severally agreed to purchase, and the selling stockholders have agreed to sell to that underwriter, the number of shares set forth opposite the underwriter’s name.

| Underwriter |

Number of Shares |

|||

| Citigroup Global Markets Inc. |

||||

| Barclays Capital Inc. |

||||

| Wells Fargo Securities, LLC |

||||

| William Blair & Company, L.L.C. |

||||

| JMP Securities LLC |

||||

|

|

|

|||

| Total |

4,000,000 | |||

|

|

|

|||

The underwriting agreement provides that the obligations of the underwriters to purchase the shares included in this offering are subject to approval of legal matters by counsel and to other conditions. The underwriters are obligated to purchase all the shares (other than those covered by the underwriters’ option to purchase additional shares described below) if they purchase any of the shares.

Shares sold by the underwriters to the public will initially be offered at the public offering price set forth on the cover of this prospectus supplement. Any shares sold by the underwriters to securities dealers may be sold at a discount from the public offering price not to exceed $ per share. If all the shares are not sold at the offering price, the underwriters may change the offering price and the other selling terms.

One of the selling stockholders, Phoenix, has granted to the underwriters an option, exercisable for 30 days from the date of this prospectus supplement, to purchase up to 600,000 additional shares at the public offering price less the underwriting discount. To the extent the option is exercised, each underwriter must purchase a number of additional shares approximately proportionate to that underwriter’s initial purchase commitment. Any shares issued or sold under the option will be issued and sold on the same terms and conditions as the other shares that are the subject of this offering.

We, our officers and directors and the selling stockholders have agreed, subject to certain exceptions, that, for a period of 60 days, or in the case of the selling stockholders, 90 days, from the date of this prospectus supplement, we and they will not, without the prior written consent of Citigroup Global Markets Inc., dispose of or hedge any shares or any securities convertible into or exchangeable for our common stock. Citigroup Global Markets Inc. in its sole discretion may release any of the securities subject to these lock-up agreements at any time without notice. These lock-up agreements do not prohibit the sale of up to 127,500 shares of our common stock by certain of our executive officers pursuant to trading plans established pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or to the sale of up to 21,640 shares of our common stock by one of our other officers.

The shares are listed on the New York Stock Exchange under the symbol “MMI .”

The following table shows the underwriting discounts and commissions that the selling stockholders are to pay to the underwriters in connection with this offering. These amounts are shown assuming both no exercise and full exercise of the underwriters’ option to purchase additional shares.

| No Exercise | Full Exercise | |||||||

| Per share |

$ | $ | ||||||

| Total |

$ | $ | ||||||

S-16

The selling stockholders will pay all of their and our third party expenses in connection with this offering, which are estimated to be approximately $450,000. The selling stockholders have also agreed to reimburse the underwriters for certain of their expenses in an amount up to $15,000.

In connection with the offering, the underwriters may purchase and sell shares in the open market. Purchases and sales in the open market may include short sales, purchases to cover short positions, which may include purchases pursuant to the underwriters’ option to purchase additional shares, and stabilizing purchases.

| • | Short sales involve secondary market sales by the underwriters of a greater number of shares than they are required to purchase in the offering. |

| • | “Covered” short sales are sales of shares in an amount up to the number of shares represented by the underwriters’ option to purchase additional shares. |

| • | “Naked” short sales are sales of shares in an amount in excess of the number of shares represented by the underwriters’ option to purchase additional shares. |

| • | Covering transactions involve purchases of shares either pursuant to the underwriters’ option to purchase additional shares or in the open market in order to cover short positions. |

| • | To close a naked short position, the underwriters must purchase shares in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the shares in the open market after pricing that could adversely affect investors who purchase in the offering. |

| • | To close a covered short position, the underwriters must purchase shares in the open market or must exercise the option to purchase additional shares. In determining the source of shares to close the covered short position, the underwriters will consider, among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase shares through the underwriters’ option to purchase additional shares. |

| • | Stabilizing transactions involve bids to purchase shares so long as the stabilizing bids do not exceed a specified maximum. |

Purchases to cover short positions and stabilizing purchases, as well as other purchases by the underwriters for their own accounts, may have the effect of preventing or retarding a decline in the market price of the shares. They may also cause the price of the shares to be higher than the price that would otherwise exist in the open market in the absence of these transactions. The underwriters may conduct these transactions on the New York Stock Exchange, in the over-the-counter market or otherwise. If the underwriters commence any of these transactions, they may discontinue them at any time.

Conflicts of Interest

The underwriters are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, principal investment, hedging, financing and brokerage activities. The underwriters and their respective affiliates have in the past performed commercial banking, investment banking and advisory services for us from time to time for which they have received customary fees and reimbursement of expenses and may, from time to time, engage in transactions with and perform services for us in the ordinary course of their business for which they may receive customary fees and reimbursement of expenses. In the ordinary course of their various business activities, the underwriters and their respective affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (which may include bank loans and/or credit default swaps) for their own account and for the accounts of their customers and may at any time hold long and short positions in such securities and instruments. Such investments and securities activities may involve securities and/or instruments of ours or our affiliates. In addition, an affiliate of Wells Fargo Securities,

S-17

LLC is the sole lender under our credit facility. The underwriters and their affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

We and the selling stockholders have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act, or to contribute to payments the underwriters may be required to make because of any of those liabilities.

Notice to Prospective Investors in the European Economic Area

In relation to each member state of the European Economic Area that has implemented the Prospectus Directive (each, a relevant member state), with effect from and including the date on which the Prospectus Directive is implemented in that relevant member state (the relevant implementation date), an offer of shares described in this prospectus supplement may not be made to the public in that relevant member state other than:

| • | to any legal entity which is a qualified investor as defined in the Prospectus Directive; |

| • | to fewer than 100 or, if the relevant member state has implemented the relevant provision of the 2010 PD Amending Directive, 150 natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the relevant Dealer or Dealers nominated by us for any such offer; or |

| • | in any other circumstances falling within Article 3(2) of the Prospectus Directive, |

provided that no such offer of shares shall require us or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive.

For purposes of this provision, the expression an “offer of securities to the public” in any relevant member state means the communication in any form and by any means of sufficient information on the terms of the offer and the shares to be offered so as to enable an investor to decide to purchase or subscribe for the shares, as the expression may be varied in that member state by any measure implementing the Prospectus Directive in that member state, and the expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the relevant member state) and includes any relevant implementing measure in the relevant member state. The expression 2010 PD Amending Directive means Directive 2010/73/EU.

The sellers of the shares have not authorized and do not authorize the making of any offer of shares through any financial intermediary on their behalf, other than offers made by the underwriters with a view to the final placement of the shares as contemplated in this prospectus supplement. Accordingly, no purchaser of the shares, other than the underwriters, is authorized to make any further offer of the shares on behalf of the sellers or the underwriters.

Notice to Prospective Investors in the United Kingdom

This prospectus supplement and the accompanying prospectus are only being distributed to, and are only directed at, persons in the United Kingdom that are qualified investors within the meaning of Article 2(1)(e) of the Prospectus Directive that are also (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (ii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (each such person being referred to as a “relevant person”). This prospectus supplement and its contents are confidential and should not be distributed, published or reproduced (in whole or in part) or disclosed by recipients to any other persons in the United Kingdom. Any person in the United Kingdom that is not a relevant person should not act or rely on this document or any of its contents.

S-18

Notice to Prospective Investors in France

Neither this prospectus supplement nor any other offering material relating to the shares described in this prospectus supplement has been submitted to the clearance procedures of the Autorité des Marchés Financiers or of the competent authority of another member state of the European Economic Area and notified to the Autorité des Marchés Financiers. The shares have not been offered or sold and will not be offered or sold, directly or indirectly, to the public in France. Neither this prospectus supplement nor any other offering material relating to the shares has been or will be:

| • | released, issued, distributed or caused to be released, issued or distributed to the public in France; or |

| • | used in connection with any offer for subscription or sale of the shares to the public in France. |

Such offers, sales and distributions will be made in France only:

| • | to qualified investors (investisseurs qualifiés) and/or to a restricted circle of investors (cercle restreint d’investisseurs), in each case investing for their own account, all as defined in, and in accordance with articles L.411-2, D.411-1, D.411-2, D.734-1, D.744-1, D.754-1 and D.764-1 of the French Code monétaire et financier; |

| • | to investment services providers authorized to engage in portfolio management on behalf of third parties; or |

| • | in a transaction that, in accordance with article L.411-2-II-1°-or-2°-or 3° of the French Code monétaire et financier and article 211-2 of the General Regulations (Règlement Général) of the Autorité des Marchés Financiers, does not constitute a public offer (appel public à l’épargne). |

The shares may be resold directly or indirectly, only in compliance with articles L.411-1, L.411-2, L.412-1 and L.621-8 through L.621-8-3 of the French Code monétaire et financier.

Notice to Prospective Investors in Switzerland

The shares of common stock may not be publicly offered in Switzerland and will not be listed on the SIX Swiss Exchange (“SIX”) or on any other stock exchange or regulated trading facility in Switzerland. This document has been prepared without regard to the disclosure standards for issuance prospectuses under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of the SIX Listing Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither this document nor any other offering or marketing material relating to the shares of common stock or the offering may be publicly distributed or otherwise made publicly available in Switzerland. Neither this document nor any other offering or marketing material relating to the offering, the issuer or the shares of common stock has been or will be filed with or approved by any Swiss regulatory authority. In particular, this document will not be filed with, and the offer of the shares of common stock will not be supervised by, the Swiss Financial Market Supervisory Authority, and the offer of shares of common stock has not been and will not be authorized under the Swiss Federal Act on Collective Investment Schemes (the “CISA”). The investor protection afforded to acquirers of interests in collective investment schemes under the CISA does not extend to acquirers of shares of common stock.

Notice to Prospective Investors in Hong Kong

The shares may not be offered or sold in Hong Kong by means of any document other than (i) in circumstances which do not constitute an offer to the public within the meaning of the Companies Ordinance (Cap. 32, Laws of Hong Kong), or (ii) to “professional investors” within the meaning of the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) and any rules made thereunder, or (iii) in other circumstances which do not result in the document being a “prospectus” within the meaning of the Companies Ordinance (Cap. 32, Laws of Hong Kong) and no advertisement, invitation or document relating to the shares may be issued or

S-19

may be in the possession of any person for the purpose of issue (in each case whether in Hong Kong or elsewhere), which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the laws of Hong Kong) other than with respect to shares which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” within the meaning of the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) and any rules made thereunder.

Notice to Prospective Investors in Japan

The shares offered in this prospectus supplement have not been and will not be registered under the Financial Instruments and Exchange Law of Japan. The shares have not been offered or sold and will not be offered or sold, directly or indirectly, in Japan or to or for the account of any resident of Japan (including any corporation or other entity organized under the laws of Japan), except (i) pursuant to an exemption from the registration requirements of the Financial Instruments and Exchange Law and (ii) in compliance with any other applicable requirements of Japanese law.

Notice to Prospective Investors in Singapore

This prospectus supplement has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this prospectus supplement and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the shares may not be circulated or distributed, nor may the shares be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor under Section 274 of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”), (ii) to a relevant person pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA, in each case subject to compliance with conditions set forth in the SFA.

Where the shares are subscribed or purchased under Section 275 of the SFA by a relevant person which is:

| • | a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or |

| • | a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, |

shares, debentures and units of shares and debentures of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the shares pursuant to an offer made under Section 275 of the SFA except:

| • | to an institutional investor (for corporations, under Section 274 of the SFA) or to a relevant person defined in Section 275(2) of the SFA, or to any person pursuant to an offer that is made on terms that such shares, debentures and units of shares and debentures of that corporation or such rights and interest in that trust are acquired at a consideration of not less than S$200,000 (or its equivalent in a foreign currency) for each transaction, whether such amount is to be paid for in cash or by exchange of securities or other assets, and further for corporations, in accordance with the conditions specified in Section 275 of the SFA; |

| • | where no consideration is or will be given for the transfer; or |

| • | where the transfer is by operation of law. |

S-20

Notice to Prospective Investors in Australia

No prospectus or other disclosure document (as defined in the Corporations Act 2001 (Cth) of Australia (“Corporations Act”)) in relation to the common shares has been or will be lodged with the Australian Securities & Investments Commission (“ASIC”). This document has not been lodged with ASIC and is only directed to certain categories of exempt persons. Accordingly, if you receive this document in Australia:

| • | you confirm and warrant that you are either: |

| • | a “sophisticated investor” under section 708(8)(a) or (b) of the Corporations Act; |

| • | a “sophisticated investor” under section 708(8)(c) or (d) of the Corporations Act and that you have provided an accountant’s certificate to us which complies with the requirements of section 708(8)(c)(i) or (ii) of the Corporations Act and related regulations before the offer has been made; |

| • | a person associated with the company under section 708(12) of the Corporations Act; or |

| • | a “professional investor” within the meaning of section 708(11)(a) or (b) of the Corporations Act, and to the extent that you are unable to confirm or warrant that you are an exempt sophisticated investor, associated person or professional investor under the Corporations Act any offer made to you under this document is void and incapable of acceptance; and |

| • | you warrant and agree that you will not offer any of the common shares for resale in Australia within 12 months of such common shares being issued unless any such resale offer is exempt from the requirement to issue a disclosure document under section 708 of the Corporations Act. |

Notice to Prospective Investors in Chile

The shares are not registered in the Securities Registry (Registro de Valores) or subject to the control of the Chilean Securities and Exchange Commission (Superintendencia de Valores y Seguros de Chile). This prospectus supplement and other offering materials relating to the offer of the shares do not constitute a public offer of, or an invitation to subscribe for or purchase, the shares in the Republic of Chile, other than to individually identified purchasers pursuant to a private offering within the meaning of Article 4 of the Chilean Securities Market Act (Ley de Mercado de Valores) (an offer that is not “addressed to the public at large or to a certain sector or specific group of the public”).

S-21

The validity of the shares of common stock offered hereunder will be passed upon for the selling stockholders by Orrick, Herrington & Sutcliffe LLP, San Francisco, California. Certain legal matters will be passed upon for the underwriters by Latham & Watkins LLP, Los Angeles, California.

The consolidated financial statements of Marcus & Millichap, Inc. appearing in Marcus & Millichap, Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2014 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act of 1933, as amended with respect to the shares of common stock offered by this prospectus supplement. This prospectus supplement and the accompanying prospectus, and any document incorporated by reference into this prospectus supplement and the accompanying prospectus, filed as part of the registration statement, does not contain all of the information set forth in the registration statement and its exhibits and schedules, portions of which have been omitted as permitted by the rules and regulations of the SEC. For further information about us and shares of our common stock, we refer you to the registration statement and to its exhibits. Statements in this prospectus supplement and the accompanying prospectus about the contents of any contract, agreement or other document are not necessarily complete and in each instance we refer you to the copy of such contract, agreement or document filed as an exhibit to the registration statement, which each such statement being qualified in all respects by reference to the document to which it refers.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You can also inspect, read, and copy these reports, proxy statements and other information at the public reference facilities the SEC maintains at:

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

You can also obtain copies of these materials from the public reference facilities of the SEC at prescribed rates. You can obtain information on the operation of the public reference facilities by calling the SEC at 1-800-SEC-0330. Our SEC filings are also available over the Internet at the SEC’s website at http://www.sec.gov, which contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

You may also obtain information about us at our Internet website at http://www.marcusmillichap.com. However, the information on our website does not constitute a part of this prospectus supplement.

S-22

CERTAIN DOCUMENTS INCORPORATED BY REFERENCE

In this document, we “incorporate by reference” the information we file with the SEC, which means that we can disclose important information to you by referring to that information. The information incorporated by reference is considered to be a part of this prospectus supplement, and later information filed with the SEC will update and supersede this information. Notwithstanding this statement, however, you may rely on information that has been filed at the time you made your investment decision. We incorporate by reference the documents listed below:

| (a) | Our Annual Report on Form 10-K for the fiscal year ended December 31, 2014; and |

| (b) | The description of our capital stock in our registration statement on Form 8-A (File No. 001- 36155) filed October 28, 2013. |

We also incorporate by reference all future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or (1) after the date of the filing of the registration statement containing this prospectus supplement and prior to the effectiveness of such registration statement and (2) after the date of this prospectus supplement and prior to the termination of any offering made hereby.

You may request a copy of these filings, at no cost, by writing or telephoning us at the following address or phone number:

Marcus & Millichap, Inc.

23975 Park Sorrento, Suite 400

Calabasas, CA 91302

Attention: Chief Financial Officer

Telephone: (818) 212-2250

You should rely only on the information provided in this document or incorporated in this document by reference. We have not authorized anyone to provide you with different information. You should not assume that the information in this document, including any information incorporated herein by reference, is accurate as of any date other than that on the front of the document. Any statement incorporated herein shall be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

S-23

PROSPECTUS

4,600,000 Shares

Common Stock

Phoenix Investments Holdings LLC (“Phoenix Investments”) and George M. Marcus, our Co-Chairman (together with Phoenix Investments, the “selling stockholders”) may offer and sell up to 4,600,000 shares of our common stock from time to time, in amounts, at prices and on terms that will be determined at the time these shares of common stock are offered. We are not selling any shares of common stock under this prospectus and will not receive any proceeds from the sale of shares by the selling stockholders.

We will provide more specific terms regarding any offering of the shares of common stock in supplements to this prospectus or in one or more documents incorporated by reference into this prospectus. The prospectus supplements and documents incorporated by reference into this prospectus may also add, update or change information contained in this prospectus. You should read this prospectus, including any documents incorporated by reference into this prospectus, and the applicable prospectus supplement carefully before you invest.

The selling stockholders may sell all or a portion of the shares directly to purchasers or through underwriters, brokers-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions. These sales may occur at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market price, at varying prices determined at the time of sale or at negotiated prices. See the section titled “Plan of Distribution” in this prospectus for a more complete description of the ways in which the shares may be sold.