UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-36155

MARCUS & MILLICHAP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 35-2478370 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

23975 Park Sorrento, Suite 400, Calabasas, California, 91302

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (818) 212-2250

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.0001 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 28, 2013, the last business day of the registrant’s most recently completed second fiscal quarter, the registrant’s stock was not publicly traded.

As of March 14, 2014, there were 36,600,897 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement to be delivered to stockholders in connection with the annual meeting of stockholders to be held on May 6, 2014 are incorporated by reference into Part III of this Annual Report on Form 10-K. Such Proxy Statement will be filed with the United States Securities and Exchange Commission (the “SEC”) within 120 days of the registrant’s fiscal year ended December 31, 2013.

MARKET, INDUSTRY AND OTHER DATA

Unless otherwise indicated, information contained in this annual report concerning the commercial real estate industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources and on our knowledge of the commercial real estate market. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe our market position, market opportunity and market size information included in this annual reports on Form 10-K is generally reliable, such information is inherently imprecise. Unless indicated otherwise, the industry data included herein is based on 2012 data since 2013 data has not yet been published.

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| • | market trends in the commercial real estate market or the general economy; |

| • | our ability to attract and retain qualified managers, sales and financing professionals; |

| • | the effects of increased competition on our business; |

| • | our ability to successfully enter new markets or increase our market share; |

| • | our ability to successfully expand our services and businesses and to manage any such expansions; |

| • | our ability to retain existing clients and develop new clients; |

| • | our ability to keep pace with changes in technology; |

| • | any business interruption or technology failure and any related impact on our reputation; |

| • | changes in tax laws, employment laws or other government regulation affecting our business; and |

| • | other risk factors included under “Risk Factors” in this Annual Report on Form 10-K. |

In addition, in this Annual Report, the words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “predict,” “potential” and similar expressions, as they relate to our company, our business and our management, are intended to identify forward-looking statements. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

Forward-looking statements speak only as of the date of this Annual Report on Form 10-K. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

3

PART I

Unless the context requires otherwise, the words “Marcus & Millichap,” “Marcus & Millichap Real Estate Investment Services,” “MMREIS,” “we,” the “company,” “us” and “our” refer to Marcus & Millichap, Inc., Marcus & Millichap Real Estate Investment Services, Inc. and its other consolidated subsidiaries.

Overview

Marcus & Millichap, Inc., a Delaware corporation, or MMI, is a leading national brokerage firm specializing in commercial real estate investment sales, financing, research and advisory services. We have been the top broker in the United States based on the number of investment transactions over the last 10 years. As of December 31, 2013, we had more than 1,300 investment sales and financing professionals in 76 offices that provide investment brokerage and financing services to sellers and buyers of commercial real estate. We also offer market research, consulting and advisory services to developers, lenders, owners and investors. In 2013, we closed more than 6,600 sales, financing and other transactions with total volume of approximately $24 billion.

We divide the commercial real estate market into three major segments by investment size and focus primarily on the private client segment:

| • | Private client segment: properties with prices under $10 million; |

| • | Hybrid segment: properties with prices equal to or greater than $10 million and less than $20 million; and |

| • | Institutional segment: properties with prices of $20 million and above. |

We focus primarily on the private client segment, which consistently comprises over 80% of the total number of property transactions in the commercial real estate market.

We were founded in 1971 and are committed to building the leading national investment brokerage business. To achieve that goal, we underwrite, market and sell commercial real estate properties for our private clients in a manner that maximizes value for sellers and provides buyers with the largest and most diverse inventory of commercial properties. Our business model is based on several key attributes: a focus on investment brokerage services, a critical mass of sales professionals providing consistent services and exclusive client representation, a national platform based on information sharing and powered by proprietary technology, a management team with investment brokerage experience, a financing team that is integrated with our investment sales force and research and advisory services tailored for our clients.

We devote our expertise and focus to the investment brokerage and financing business as opposed to other businesses, such as leasing or property management. Accordingly, our business model is unique from our national competitors, who focus primarily on the institutional real estate segment, and from our local and regional competitors, who lack a broad national platform. As the leading investment sales and financing firm in our segment, we believe we are ideally positioned to capture significant growth opportunities in our market.

Our sales professionals are specialized by property type and by local market area, as we believe a focused expertise brings value to our clients. Our model and footprint provide an unparalleled level of connectivity to the marketplace. We operate 76 offices, including 62 offices in 49 major markets, which we define as metropolitan areas with a population of at least 1 million, and 14 offices in mid-market locations, which we define as metropolitan areas with a population of less than 1 million. Our broad geographic coverage, property expertise, and significant relationships with both buyers and sellers provide connectivity and increase liquidity in our markets. By closing more transactions annually than any other firm (based on data from CoStar and Real Capital Analytics), our sales professionals are able to provide clients with a broad and deep perspective on the investment real estate market locally, regionally and nationally.

4

We generate revenues by collecting commissions upon the sale and financing of commercial properties. These fees consist of commissions collected upon the sale of an asset, based upon the value of the property, and fees collected by our financing subsidiary from the placement of loans. In 2013, approximately 90% of our revenues were generated from real estate brokerage commissions, 6% from financing fees and 4% from other fees, including consulting and advisory services.

The following tables show our investment sales, financing and other transactions in 2013 by property type and investor segment:

Marcus & Millichap Investment Sales, Financing and Other Transactions by Property Type (2013)

| Property Type | Transactions | Volume (Billion) |

Percent of Total Transactions |

|||||||||

| Multifamily |

2,892 | $ | 12.9 | 43.8 | % | |||||||

| Retail |

2,396 | 6.3 | 36.3 | |||||||||

| Office |

470 | 1.5 | 7.1 | |||||||||

| Industrial |

145 | 0.5 | 2.2 | |||||||||

| Land |

128 | 0.2 | 1.9 | |||||||||

| Self-Storage |

109 | 0.5 | 1.6 | |||||||||

| Hospitality |

130 | 0.5 | 2.0 | |||||||||

| Seniors Housing |

73 | 0.6 | 1.1 | |||||||||

| Manufactured Housing |

84 | 0.4 | 1.3 | |||||||||

| Mixed – Use / Other |

181 | 0.6 | 2.7 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

6,608 | $ | 24.0 | 100.0 | % | |||||||

|

|

|

|

|

|

|

|||||||

Marcus & Millichap Investment Sales and Other and Financing Transactions by Investor Segment (2013)

| Private Client Segment | Hybrid Segment | Institutional Segment |

Total | |||||||||||||||||

| < $1 Million | $1 - $10 Million | |||||||||||||||||||

| Transactions |

||||||||||||||||||||

| Investment Sales and Other |

1,450 | 3,603 | 239 | 151 | 5,443 | |||||||||||||||

| MMCC – Financing |

426 | 709 | 24 | 6 | 1,165 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

1,876 | 4,312 | 263 | 157 | 6,608 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dollar Volume (Billions) |

||||||||||||||||||||

| Investment Sales and Other |

$ | 0.8 | $ | 10.9 | $ | 3.2 | $ | 6.4 | $ | 21.3 | ||||||||||

| MMCC – Financing |

0.3 | 1.9 | 0.3 | 0.2 | 2.7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 1.1 | $ | 12.8 | $ | 3.5 | $ | 6.6 | $ | 24.0 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Corporate Information and Initial Public Offering

We were formed as a sole proprietorship in 1971, incorporated in California on August 26, 1976 as G. M. Marcus & Company, and we were renamed as Marcus & Millichap, Inc. in August 1978, Marcus & Millichap Real Estate Investment Brokerage Company in September 1985, and Marcus & Millichap Real Estate Investment Services, Inc., or MMREIS, in February 2007. Prior to the completion of our initial public offering (“IPO”), MMREIS was majority-owned by Marcus & Millichap Company (“MMC”) and all of MMREIS’ preferred and common stock outstanding was held by MMC and its affiliates or officers and employees of MMREIS. In June 2013, in preparation for the spin-off of its real estate investment services business, or the Spin-Off, MMC formed a holding company called Marcus & Millichap, Inc. in Delaware. Prior to the completion of our IPO, the shareholders of MMREIS contributed the shares of MMREIS for common stock of Marcus & Millichap, Inc., and MMREIS became a wholly owned subsidiary of Marcus & Millichap, Inc.

5

On November 5, 2013, we completed our IPO of 6,900,000 shares of common stock at a price to the public of $12.00 per share. We sold 4,173,413 shares of common stock in the IPO, including 900,000 shares of common stock pursuant to the exercise of the underwriters’ option to purchase additional shares. Certain selling stockholders sold an aggregate of 2,726,587 shares in the IPO at the same price to the public. We did not receive any proceeds from the sale of the shares by the selling stockholders. The IPO generated net proceeds to us of $42.3 million, including the underwriters’ full exercise of their option to purchase additional shares and after deducting total expenses of $7.8 million, consisting of $3.5 million of underwriters’ discounts and commissions and IPO related expenses of $4.3 million.

Our principal executive offices are located at 23975 Park Sorrento, Suite 400, Calabasas, California 91302. Our telephone number at this location is (818) 212-2250.

Competitive Strengths

We believe the following strengths provide us with a competitive advantage and opportunities for success:

National Platform Focused on Investment Brokerage. We are committed to building the leading national investment brokerage business. To achieve our goal, we focus on investment brokerage as opposed to other businesses such as leasing or property management. In addition, we combine proprietary technology and processes to market investment real estate with highly qualified sales professionals in 76 offices nationwide. Our commitment to specialization is also reflected in how we organize our sales professionals by property type and market area, further deepening the skills, relationships and market knowledge required for achieving the best results for our clients.

Market Leader in the Private Client Segment. We are the leading commercial real estate investment broker in the United States based on the number of transactions. We focus primarily on the private client segment of the market, consisting of transactions with prices under $10 million, which accounted for over 90% of our number of transactions in 2013. This segment, representing the vast majority of the number of commercial properties in the United States, has high asset turnover rates due to personal circumstances and business reasons, such as death, divorce and changes in partnership and other personal or financial circumstances. The private client brokerage industry is highly fragmented and characterized by high barriers to entry. These barriers include the need for a large, specialized sales force prospecting private clients, the difficulty in identifying and establishing relationships with such investors and the challenge of serving their needs locally and nationally. For transactions in the $1 million to $10 million range nationally, the top 10 brokerage firms represented just 21% of commercial property sales in 2012. We believe our core business is the least covered segment by national firms, in addition to being significantly underserved by local and regional firms that lack a multi-market platform.

Platform Built for Maximizing Investor Value. We have built our business to maximize value for real estate investors through an integrated set of services geared toward our clients’ needs. Within investment sales, we are committed to investment brokerage specialization, providing the largest sales force in the industry, fostering a culture and policy of information sharing on each asset we represent and using proprietary technology that facilitates real-time buyer-seller matching. Our investment sales organization underwrites, positions and markets investment real estate to the largest pool of qualified buyers. We coordinate proactive marketing campaigns that access the investor relationships and resources of the entire firm, far beyond the capabilities of an individual listing agent. These efforts produce wide exposure to investors who we identify as high-probability bidders for each asset.

We have one of the largest teams of financing professionals in the investment brokerage industry through Marcus & Millichap Capital Corporation, or MMCC. MMCC provides financing expertise and access to debt capital by securing competitive loan pricing and terms for our clients. In 2013, MMCC closed more than 1,100 financings with an aggregate loan value of over $2.7 billion, making us a leading mortgage broker in the industry. Finally, our market research analyzes the latest local and national economic and real estate trends, enabling our clients to make informed investment and financing decisions. These integrated services enable us to facilitate transactions for our clients across different property sectors and markets.

6

Management with Significant Investment Brokerage Experience. The majority of our managers are former senior sales professionals of the firm who now focus on management and do not compete with our sales force. As executives of the firm dedicated to hiring, training, developing and supporting our professionals, their investment brokerage background is extremely valuable. Almost all of our top sales professionals were hired without prior experience and were trained, developed and supported by our regional managers. Our comprehensive training and development programs rely greatly on the regional managers’ personal involvement. Their past experience as senior sales professionals plays a key role in helping our junior professionals establish technical and client service skills. Our regional managers also coach our sales professionals in setting up, managing and growing their business. We believe this management structure has helped the firm create a competitive advantage and achieve better results for our clients.

Growth Strategy

We have a long track record of successful growth in our core business driven by opening new offices and by hiring, training and developing new sales and financing professionals. Since the implementation of our long-term growth plan in 1995, our revenue has increased sevenfold and we have grown from approximately 416 sales professionals in 22 offices to more than 1,300 sales and financing professionals in 76 offices. To drive our future growth, we continually seek to expand our national footprint and optimize the size, product segmentation and specialization of our team of sales and financing professionals. The key strategies of our growth plan include:

Increase Market Share in Our Core Business. The private client segment is highly fragmented, with the top 10 brokerage firms accounting for only 21% of 2012 sales in the $1 million to $10 million range. Despite our industry-leading market share of 6.9%, we believe there are opportunities to substantially enhance our position in the segment. We believe the largest opportunities are in private client multi-tenant office and industrial properties in which our 2012 market share was 2.5% and 0.5%. In addition, we believe there is still significant room for growth in multifamily and retail properties, where we had 2012 market share of 12.7% and 9.3%, respectively. We leverage our existing platform, relationships and brand recognition among private clients to grow through expanded marketing and coverage. Our growth plan includes the following components:

| • | Grow in Targeted Locations. Our plan targets specific markets and calls for both expansion of existing offices and opening additional offices. We have assigned key executives and managers to these markets and our recruiters have begun to hire additional experienced sales professionals. We have targeted markets based on population, employment, commercial real estate sales, inventory and competitive landscape. In addition, we have developed optimal office plans to capitalize on these factors by tailoring sales force size, coverage and composition by office and business segment. We expect this intensified focus on target markets, coupled with new marketing campaigns, reassigned geographic boundaries and team development, to result in significant growth. Recent initiatives have shown that concentrated efforts can produce marked results. For example, a recent initiative to grow our New York office sales force led to an increase in business volume and made it our top grossing office in 2013. |

| • | Grow in Specialty Property Segments. We believe that specialty property segments, including hospitality, multifamily tax credit and affordable housing, student housing, manufactured housing, seniors housing and self-storage, offer significant room for growth. To take advantage of these opportunities, we are increasing our property type expertise by adding regional directors who can bring added management capacity, business development and sales professional support. These executives will work with our regional and group managers to increase sales professional hiring, training, development and redeployment, and to execute various branding and marketing campaigns to expand our presence in key property segments. |

| • | Increase Sales Professional Hiring. We grow our business by hiring, training and developing sales professionals. We have implemented several initiatives to increase both new and experienced sales professional hiring through our recruiting department, specialty directors and regional managers. Our new sales professionals are trained in all aspects of real estate fundamentals and client service through |

7

| formal training and apprenticeship programs. As these sales professionals mature, we continue to provide best practices and specialty training. When hiring more experienced sales professionals, we have focused on cultural fit. We believe this model creates a high level of teamwork, as well as operational and client service consistency. |

Grow Financing Services. We are focused on growing our financing services provided through MMCC. Our mortgage brokerage business placed $2.7 billion of financings in 2013, and we are taking steps that we believe will substantially increase our internal loan business capture rate. Our internal loan business capture rate increased from 4.7% of buy-side investment sales in 2012 to 7.1% of buy-side investment sales in 2013. We intend to execute our growth strategy by adding financing professionals in 16 offices that currently do not have an MMCC presence and enhancing our cross-selling training, education and internal branding. We also plan to enhance MMCC’s service platform and expand our revenue sources by developing other services such as mezzanine financing, HUD products, equity placement and conduit financing.

Expand Our Market Share of Larger Transactions. Our extensive relationships with private clients have enabled us to capture a greater portion of commercial real estate transactions in excess of $10 million and bridge the private and institutional capital markets in recent years. Our ability to connect private capital with institutional assets plays a major role in differentiating our services. In 2011, we introduced a division dedicated to serving major investors branded as Institutional Property Advisors, or IPA, in the multifamily sector. As a result, we rose from the 7th-ranked investment brokerage firm by dollar volume in the $25 million and above multifamily sector in 2010 to the 4th-ranked firm in 2012. This strategy has met with great success and market acceptance and provides a vehicle for further growth within the institutional multifamily segment. This strategy also provides a model for expansion into institutional retail and office sectors.

8

Our Company

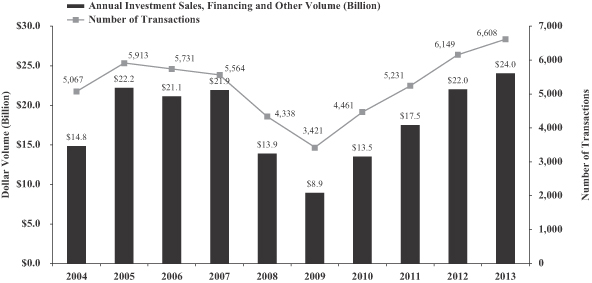

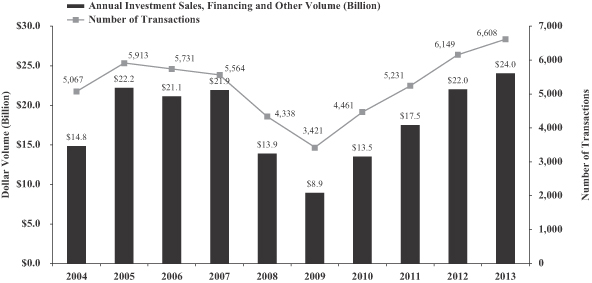

We provide investment brokerage and financing services to investors of all types and sizes of commercial real estate assets. We are a leading national investment brokerage company primarily focused on private clients transacting in the under $10 million price range. This is the largest and most active market segment and comprised over 80% of total U.S. commercial property sales over the last ten years. We have offices across the United States, with more than 1,300 sales and financing professionals in 76 offices, including 62 offices in major metropolitan markets and 14 offices in mid-market locations, which are in secondary and smaller metropolitan areas. We leverage our relationships with investors and use proprietary marketing tools to match properties with qualified buyers. Our financing professionals obtain competitive debt financing for buyers of our properties and owners who need to refinance or restructure their positions. The following graph shows our transactions in investment sales, financing and other from 2004 to 2013:

Investment Sales, Financing and Other Transactions, 2004-2013

Company History. We opened our first office in Palo Alto, California in 1971, and expanded our Northern California footprint and established a presence in Arizona, Colorado and Texas in the late 1970s. During the 1980s, we opened offices in Southern California and the Midwest. In 1995, we established our long-term growth plan and began our full national expansion. Our revenues grew quickly through 2006 with a compounded annual growth rate of 24.9% from 1996 to 2006. In 2007, the global credit markets began to show signs of distress resulting in a shortage of liquidity in some financing markets, including real estate. Beginning in late 2008, the credit crisis and recession greatly affected the commercial real estate industry, resulting in a dramatic revenue decline. Despite the severity of the market downturn, we maintained all of our offices and services, enabling us to take advantage of the market recovery and resume our growth quickly thereafter. As the real estate and financing markets recovered after 2009, our transaction volume has grown significantly, and our revenues grew at a compounded annual growth rate of 28.7% from 2009 to 2013.

9

Geographic Locations. We have offices across the United States in 36 states and Canada, with more than 1,300 sales and financing professionals in 62 offices in major metropolitan markets and 14 offices in mid-market locations. Set forth below is a map reflecting the geographic location of our offices as of December 31, 2013.

Our Services. We offer two primary services to our clients: commercial real estate investment brokerage and financing.

Commercial Real Estate Investment Brokerage. Our primary business and source of revenue is the representation of commercial property owners as their exclusive investment broker in the sale of their properties. Commissions from investment sales accounted for approximately 90% of our revenues in 2013. Sales are generated by maintaining relationships with property owners, providing market information and trends to them during their investment or “hold” period and being selected as their representative when they decide to sell or exchange their commercial property with a similar asset. We collect commissions upon the sale of each asset based on a percentage of property value. These commission percentages are typically inversely correlated with property value and thus are generally higher for smaller transactions. Our sales professionals also represent buyers in fulfilling their investment real estate acquisition needs; however, the vast majority of our investment sales business is generated from our exclusive representation of sellers.

10

Our core business concentration is aligned with the largest market segment as illustrated in the charts below. These charts show the number of transactions by investor segment in 2013 and the number of multifamily, retail, office and industrial property sales in 2012, for properties priced at $1 million or greater in the commercial real estate industry:

Number of Transactions by Investor Segment*

| Marcus & Millichap | Commercial Real Estate Industry | |

|

|

|

| * | Includes multifamily, retail, office and industrial sales $1 million and greater. Sources: CoStar Group, Inc. and Real Capital Analytics. |

In 2013, we closed 4,634 investment sales transactions in a broad range of commercial property types, with a total transaction value of approximately $17.3 billion. In the last 10 years, we have closed more transactions than any other firm. We have significantly diversified our business beyond our historical focus on multifamily properties. The following table shows the various property types included in our sales transactions in 2013:

Marcus & Millichap Investment Sales Transactions by Property Type (2013)

| Property Type |

Transactions | Volume (Billion) |

Percent of Total Transactions |

|||||||||

| Multifamily |

1,839 | $ | 9.0 | 39.7 | % | |||||||

| Retail |

1,899 | 5.1 | 41.0 | |||||||||

| Office |

296 | 0.9 | 6.4 | |||||||||

| Industrial |

105 | 0.3 | 2.3 | |||||||||

| Land |

111 | 0.2 | 2.4 | |||||||||

| Self-Storage |

83 | 0.3 | 1.8 | |||||||||

| Hospitality |

95 | 0.4 | 2.0 | |||||||||

| Seniors Housing |

55 | 0.5 | 1.2 | |||||||||

| Manufactured Housing |

55 | 0.3 | 1.2 | |||||||||

| Mixed-use / Other |

96 | 0.3 | 2.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

4,634 | $ | 17.3 | 100 | % | |||||||

We are building on our track record of growth by expanding our coverage of various property types. These include self-storage, hospitality, seniors housing, multifamily tax credit and affordable housing and manufactured housing, where we are already a leading broker but have significant room for additional growth due to market size and opportunity. We are also expanding our specialty group management and support infrastructure, specialized branding and business development customized to each of these segments and intensifying our recruiting efforts, which we believe will result in increased business in the various property types.

We underwrite, value, position and market properties to reach the largest and most qualified pool of buyers. We offer our clients the industry’s largest team of investment sales professionals operating with a culture and policy of information sharing, powered by our proprietary system, MNet, which enables real-time buyer-seller matching. We use a proactive marketing campaign that leverages the investor relationships of our entire sales

11

force, direct marketing and a suite of proprietary web-based tools that connects each asset with the right buyer pool. We strive to maximize value for the seller by generating high demand for each asset. Our approach also provides a diverse, consistently underwritten inventory of investment real estate for buyers. When a client engages one of our sales professionals, he or she is engaging an entire system, structure and organization committed to maximizing value for our clients.

Financing. MMCC is a leading broker of debt financing for commercial properties in the under $10 million market segment. MMCC has approximately 73 financing professionals in 33 offices, the most among national investment sales brokerage firms. We generate revenue in the form of financing fees collected from the placement of loans from banks, insurance companies, agencies and commercial mortgage backed securities, or CMBS, conduits. MMCC’s financing fees vary by loan amount. In 2013, MMCC completed more than 1,100 financing transactions with a value of $2.7 billion and accounted for 6% of our revenues. MMCC’s size, market reach and business volume enables us to establish long-term relationships and special programs with various capital sources. This in turn improves MMCC’s value proposition to borrowers seeking competitive financing rates and terms. MMCC is not limited to promoting in-house or exclusive capital sources and seeks the most competitive financing solution for each client’s specific needs and circumstances. We place loans for refinancing not involving a sale as well as acquisition financing for individual assets and portfolios. During 2013, 61% of MMCC’s revenues came from refinance activities while 39% were derived from placing acquisition financing.

MMCC is fully integrated with our investment sales force under the supervision of our regional managers, which promotes cross selling, information sharing, business referrals and better client service. By leveraging our national network of sales professionals, we are able to provide clients with the latest property markets and capital markets information and partner with national and regional lenders to secure loan packages that meet our clients’ financial objectives. During 2013, 55% of MMCC’s revenue was generated through the firm’s investment sales force and 45% was generated through direct marketing to borrowers.

In the future, we plan to expand the MMCC business to include mezzanine financing, HUD products, raising and placing equity and conduit financing. To do this, we intend to hire experienced individuals and capital markets teams in these areas and establish relationships with capital sources that specialize in these segments.

Other Services: Research and Advisory. Our research and advisory services are designed to assist clients in forming their investment strategy and making transaction decisions. Our research is fully integrated with our sales professionals’ client dialogue, client relationship development and maintenance and transaction execution. Our advisory services are coordinated with both our sales and financing professionals and are designed to provide customized analysis and increase customer loyalty and long-term transaction volume.

Our research division produces more than 900 publications and client presentations per year and has become a leading source of information for the industry as well as the general business media. We provide research on 13 commercial property segments covering: multifamily, retail, office, industrial, capital markets/financing, single-tenant net lease, seniors housing, student housing, self-storage, hospitality, medical office, manufactured housing and tax credit low income housing. We are regularly quoted in regional and national publications and media, and deliver content directly to the real estate investment community through print, electronic publications and video. This research includes analysis and forecasting of the economy, capital markets, real estate fundamentals, investment, pricing and yield trends, and is designed to assist investors in their strategy formation and decisions relating to specific assets, helping our sales professionals develop and maintain relationships with clients.

We also provide a wide range of advisory and consulting services to developers, lenders, owners, real estate investment trusts, high net worth individuals, pension fund advisors and other institutions. Our advisory services include opinions of value, operating and financial performance benchmarking analysis, specific asset buy-sell strategies, market and submarket analysis and ranking, portfolio strategies by property type, market strategy, and development and redevelopment feasibility studies.

12

Competition

We compete in investment brokerage and financing within the commercial real estate industry on a national, regional and local basis. Competition is based on a number of critical factors, including the quality and expertise of our sales and financing professionals, our execution skills, agent support, brand recognition and our business reputation. We primarily compete with other brokerage and financing firms that seek investment brokerage and financing business from real estate owners and investors. To a lesser extent, we compete with in-house real estate departments, owners who may transact without using a brokerage firm, direct lenders, consulting firms and investment managers, some of which may have greater financial resources than we do. Our relative competitive position also varies across geographies, property types and services. In investment sales, our competitors on a national level include CBRE Group, Inc., Colliers International, NAI, Cushman & Wakefield, Cassidy Turley, Lee & Associates, ONCOR, Coldwell Banker, CORFAC, HFF, Inc. and Jones Lang LaSalle. Our major financing competitors include HFF, Inc., CBRE Group, Inc., Jones Lang LaSalle, Johnson Capital, Berkadia Commercial Mortgage LLC, Grandbridge Real Estate Capital, and NorthMarq Capital, LLC. The investment sales firms mainly focus on larger sales and institutional investors and are not heavily concentrated in our main area of focus, which is the under $10 million private client market. However, there is cross over and competition between us and these firms. There are also numerous local and regional competitors in our markets, as well as competitors specializing in certain property segments. Despite recent consolidation, the commercial real estate services industry remains highly fragmented and competitive.

Competition to attract and retain qualified professionals is also intense in each of our markets. We offer what we believe to be competitive compensation and support programs to our professionals. Our ability to continue to compete effectively will depend on retaining, motivating and appropriately compensating our professionals.

Technology

We have a long-standing tradition of technological orientation, innovation and advancement. Our efforts include the development of proprietary applications designed to make the process of matching buyer and sellers faster and more efficient as well as state-of-the art communication technology, infrastructure, internet presence and electronic marketing.

We have a proprietary internal marketing system, MNet, which allows our professionals to share listing information with investors across the country. MNet is an integrated tool that contains our entire national property inventory, which allows sales professionals to search for properties based on investors’ acquisition criteria. This system is an essential part of connecting buyers and sellers through our national platform. Our policies require information sharing among our sales professionals, and the MNet system automates the process of matching each property we represent to the largest pool of qualified buyers tracked by our national sales force. A part of MNet called Buyer Needs enables our sales professionals to register the investment needs of various buyers which are then matched to our available inventory on a real-time basis.

We have also developed a proprietary system for automating the production of property marketing materials and launching marketing campaigns, which we call iMpact. iMpact allows our sales professionals to input data into a listing proposal or marketing package, automatically imports property information, data on comparable properties and other information, and then dynamically populates our e-marketing, print, and Internet media. This system allows sales professionals to rapidly create professionally branded and designed materials for marketing properties on behalf of our clients in an efficient and timely manner.

Marketing and Branding

Our 42 years of investment brokerage specialization and concentration in the private client segment have established our brand as the leading broker of investment real estate as well as a trusted source of market research and financing solutions. In recent years, the company has also garnered recognition among larger private investors and institutions due to our integrated platform and capability of linking private and institutional capital. We

13

continue to strengthen and broaden the firm’s name recognition and credibility by executing a variety of marketing and branding strategies. Locally, our offices engage in numerous events, direct mail campaigns, investor symposiums and participate in real estate conferences and organizations for various market segments. Our regional managers and agents develop long-term client relationships and promote the firm’s brand through these avenues.

In addition, we frequently have featured speaking roles in key regional and national industry events, and produce over 900 research reports, semi-monthly economic and real estate market briefs and semi-annual market overview videocasts. All of this content is tailored and disseminated by property type to our clients and the real estate investment community. Our transactional and market research expertise result in significant print, television and online media coverage including most major real estate publications as well as local market and major national news outlets. This creates significant exposure and name recognition for our firm. Nationally, our specialty group and capital markets executives actively participate in various trade organizations, many of which focus on specific property sectors and provide an effective vehicle for client relationship development and branding. The firm takes a proactive stance with its marketing program through multiple channels including our website, timely e-mail and print marketing, as well as agent-driven personal client interactions.

Intellectual Property

We hold various trademarks and trade names, which include the “Marcus & Millichap” name. Although we believe our intellectual property plays a role in maintaining our competitive position in a number of the markets that we serve, we do not believe we would be materially, adversely affected by expiration or termination of our trademarks or trade names or the loss of any of our other intellectual property rights other than the Marcus & Millichap name. With respect to the Marcus & Millichap name, we maintain trademark registrations for these service marks.

In addition to trade names, we have developed proprietary technologies for the provision of real estate investment services, such as MNet and iMpact. We also offer proprietary research to clients through our research division. While we seek to secure our rights under applicable intellectual property protection laws in these and any other proprietary assets that we use in our business, we do not believe any of these other items of intellectual property are material to our business in the aggregate.

Government Regulation

We are subject to various real estate regulations. The company is licensed as a mortgage broker and a real estate broker in 42 states in the United States and three provinces in Canada. We are a licensed broker in each state in which we have an office, as well as those states where we frequently do business. We are also subject to numerous other federal, state and local laws and regulations that contain general standards for, and prohibitions on, the conduct of real estate brokers and sales associates, including agency duties, collection of commissions, telemarketing and advertising and consumer disclosures.

Employees and Sales and Financing Professionals

As of December 31, 2013, we had 1,248 sales and financing professionals, who are exclusive independent contractors.

We also had 593 employees as December 31, 2013, consisting of 65 financing professionals, 33 financing support, 15 in marketing, 18 in research, and 462 in sales management and support and general and administrative functions. We believe our employee relations are good.

Most of the company’s sales professionals are classified as independent contractors under state and IRS guidelines. As such, the company generally does not pay for the professional’s expenses or benefits or withhold payroll taxes; rather they are paid from the commissions earned by the company upon the closing of a transaction, and these individuals do not earn a salary from which taxes are withheld. Almost all of the sales

14

professionals hold applicable real estate broker licenses and execute a “Salespersons Agreement” setting out the relationship between the professional and the company. Each professional is obligated to provide brokerage services exclusively to the company, and is provided access to the company’s information technology, research and other support and business forms. Each professional generally reports on their activities to either the local company manager, or in some cases to product specialty managers.

Our sales and financing professionals are located in offices throughout the United States, each led by a regional manager with previous investment brokerage experience and an active brokerage license. We have 48 regional managers, who are responsible for hiring, developing and deploying sales professionals, managing regional and mid-market offices, and supervising MMCC originators and support staff in their region. We also have six group managers who oversee regional managers and multiple offices; group managers hire, develop, and support our regional managers and provide additional leadership and support for our sales force. Finally, our management structure includes national specialty directors who lead each property segment. Our national specialty directors develop our national and local brand in each property sector, develop major accounts and coordinate multi-market assignments on behalf of large clients.

Traditionally, our growth has been driven by hiring, training and developing new sales professionals. Our new sales professionals are trained in our technical and client service standards through a comprehensive program starting with pre-training, formal training and apprenticeship programs. While continuing to improve the hiring, training and developing of new sales professionals remains a major priority, we have also expanded our hiring strategy to include more experienced sales professionals who fit our culture and values. Over the past several years, experienced sales professionals, including some top performers previously with national competitors, have joined the firm and have become productive members of our team. As sales professionals mature, we continue with specialized training and best practices sessions by tenure, which are conducted by senior management, regional managers, leading sales professionals and our national specialty directors. The goal of this rigorous approach to training is to continually improve our team’s skill set and client services. Our sales force conducts business the same way across the country to deliver a high level of consistency, professionalism and reliability to our clients who often buy and sell investments in variety of locations and/or property types.

As of December 31, 2013, approximately 32% of our sales professionals have been with the company for less than one year, 21% have been with us for one to three years, 10% for three to five years, and 37% for more than five years. Our sales professionals receive a percentage of the commission received by the company. As sales professionals become more senior, they receive a larger percentage of the commission based on tenure and production. Depending on the price of the property, a portion of the sales professional’s commission may be deferred for three years.

Emerging Growth Company Status

We currently are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. If we take advantage of any of these exemptions, we do not know if some investors will find our common stock less attractive as a result.

We have irrevocably elected to opt out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act, and therefore, we are subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

15

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Available Information

Our website address is www.marcusmillichap.com. Information on our website does not constitute part of this report and inclusions of our internet address in this Annual Report on Form 10-K are inactive textual references only. We make available free of charge through a link provided at such website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, Forms 3, 4 and 5 filed by or on behalf of directors, executive officers and certain large stockholders, and any amendments to those documents filed or furnished pursuant to the Exchange Act. Such reports are available as soon as reasonably practicable after they are filed with the SEC.

We are required to file current, annual and quarterly reports, proxy statements and other information required by the Exchange Act, with the SEC. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements and other information regarding the Company that we file electronically with the SEC at www.sec.gov.

We also make available on our website and will provide print copies to stockholders upon request, (i) our corporate governance guidelines, (ii) our code of ethics, and (iii) the charters of the audit, compensation, and corporate governance and nominating committees of our board of directors.

From time to time, we may announce key information in compliance with Regulation FD by disclosing that information on our website at www.marcusmillichap.com.

16

Investing in our securities involves a high degree of risk. You should consider carefully the following risk factors and the other information in this Annual Report on Form 10-K, including our consolidated financial statements and related notes, before making any investment decisions regarding our securities. If any of the following risks actually occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of our securities could decline and you may lose part or all of your investment.

Risks Related to Our Business

General economic conditions and commercial real estate market conditions have had and may in the future have a negative impact on our business.

We may be negatively impacted by periods of economic slowdowns, recessions and disruptions in the capital markets; credit and liquidity issues in the capital markets, including international, national, regional and local markets; and corresponding declines in the demand for commercial real estate investment and related services. Historically, commercial real estate markets, and in particular the U.S. commercial real estate market, have tended to be cyclical and related to the flow of capital to the sector, the condition of the economy as a whole and to the perceptions and confidence of the market participants as to the relevant economic outlook. Cyclicality in the real estate markets may lead to cyclicality in our earnings and significant volatility in our stock price. Real estate markets may “lag” the broader economy. This means that even when underlying economic fundamentals improve in a given market, it may take additional time for these improvements to translate into strength in the real estate markets. The “lag” may be exacerbated when banks delay their resolution of commercial real estate assets whose values are less than their associated loans.

Negative economic conditions, changes in interest rates, credit and liquidity issues in the capital markets, disruptions in capital markets and/or declines in the demand for commercial real estate investment and related services in international or domestic markets or in significant markets in which we do business, have had and could have in the future a material adverse effect on our business, results of operations and/or financial condition. In particular, the commercial real estate market is directly impacted by the lack of debt and/or equity for commercial real estate transactions, increased interest rates and changes in monetary policies by the Federal Reserve, changes in the perception that commercial real estate is an accepted asset class for portfolio diversification, and slowdowns in economic activity that could cause residential and commercial tenant demand to decline, which would adversely affect the operation and income of commercial real estate properties.

These and other types of events could lead to a decline in transaction activity as well as a decrease in values, which would likely in turn lead to a reduction in brokerage commissions and financing fees relating to such transactions. These effects would likely cause us to realize lower revenues from our transaction service fees, including investment sales commissions, which fees usually are tied to the transaction value and are payable upon the successful completion of a particular transaction. Such declines in transaction activity and value would likely also significantly reduce our financing activities and revenues. For example, the disruptions and dislocations in the global credit markets during 2008 and 2009 created significant restrictions in the availability of credit, especially on transitional assets and in the secondary and tertiary markets. In turn, the volume and pace of commercial real estate transactions were significantly reduced, as were property values, which generally peaked in 2007 and fell through 2010.

Fiscal uncertainty as well as significant changes and volatility in the financial markets and business environment, and in the global political, security and competitive landscape, make it increasingly difficult for us to predict our revenue and earnings into the future. As a result, any revenue or earnings guidance or outlook which we might give may be overtaken by events or may otherwise turn out to be inaccurate.

If we are unable to attract and retain qualified and experienced managers, sales and financing professionals, our growth may be limited and our business and operating results could suffer.

Our most important asset is our people, and our continued success is highly dependent upon the efforts of our managers, sales and financing professionals. If these managers or sales and financing professionals leave our

17

company, we will lose the substantial time and resources we have invested in training and developing those individuals and our business, financial condition and results of operations may suffer. Additionally, such events may have a disproportionate adverse effect on our operations if the most experienced sales and financing professionals do not remain with us or if these events occur in geographic areas where substantial amounts of our brokerage revenues are generated. Furthermore, if the commission structure changes in the market, our commission compensation may become relatively less attractive to sales professionals.

In addition, our competitors may attempt to recruit our sales and financing professionals. The exclusive independent contractor arrangements we have entered into or may enter into with our sales professionals may not prevent our sales professionals from departing and competing against us. We may not be able or attempt to renew these agreements prior to their expiration. Additionally, we currently do not have employment agreements with most key employees, and there is no assurance that we will be able to retain their services.

A component of our growth has also occurred through the recruiting, hiring, training and retention of key experienced sales and financing professionals. Any future growth through recruiting these types of professionals will be partially dependent upon the continued availability of qualified candidates fitting the culture of our firm at reasonable employment terms and conditions. However, individuals whom we would like to hire may not be available upon reasonable employment terms and conditions. In addition, the hiring of new personnel involves risks that the persons acquired will not perform in accordance with expectations and that business judgments concerning the value, strengths and weaknesses of persons acquired will prove incorrect.

If we lose the services of our executive officers or certain other members of our senior management team, we may not be able to execute our business strategy.

Our success depends in a large part upon the continued service of our senior management team, who are critical to our vision, strategic direction and culture. Our current long-term business strategy was developed in large part by our senior-level officers and depends in part on their skills and knowledge to implement, and also includes a focus on new growth and investment initiatives that may require additional management expertise to successfully execute our strategy. We may not be able to offset the impact on our business of the loss of the services of our senior management or other key officers or employees or recruit additional talent.

Our business could be hurt if we are unable to retain our business philosophy and culture of information-sharing and efforts to retain our philosophy and culture could adversely affect our ability to maintain and grow our business.

Our policy of information-sharing and matching properties with large pools of investors defines our business philosophy as well as the emphasis that we place on our clients, our people and our culture. Our status as a public company could adversely affect this culture. If we do not continue to develop and implement the right processes and tools to manage our changing enterprise and maintain this culture, our ability to compete successfully and achieve our business objectives could be impaired, which could negatively impact our business, financial condition and results of operations.

The concentration of sales among our top sales professionals could lead to greater or more concentrated losses if we are unable to retain them.

Our most successful sales professionals are responsible for a significant percentage of our revenues. They also serve as mentors and role models, as well as provide invaluable training for younger professionals, which is an integral part of our culture. This concentration of sales and value among our top sales professionals can lead to greater and more concentrated risk of loss if we are unable to retain them, and have a material adverse impact on our business and financial condition. Furthermore, many of our sales professionals work in teams. If a team leader or manager leaves our company, his or her team members may leave with the team leader.

18

We may fail to successfully differentiate our brand from those of our competitors, which could adversely affect our revenues.

The value of our brand and reputation is one of our most important assets. An inherent risk in maintaining our brand is we may fail to successfully differentiate the scope and quality of our service and product offerings from those of our competitors, or we may fail to sufficiently innovate or develop improved products or services that will be attractive to our clients. Additionally, given the rigors of the competitive marketplace in which we operate, there is the risk we may not be able to continue to find ways to operate more productively and more cost-effectively, including by achieving economies of scale, or we will be limited in our ability to further reduce the costs required to operate on a nationally coordinated platform.

We have numerous significant competitors and potential future competitors, some of which may have greater resources than we do, and we may not be able to continue to compete effectively.

We compete in investment sales and financing within the commercial real estate industry. Our investment sales focus is on the private client segment, which is highly fragmented. The fragmentation of our market makes it challenging to effectively gain market share. While we have a competitive advantage over other national firms in the private investor segment, we also face competition from local and regional service providers who have existing relationships with potential clients. Furthermore, transactions in the private investor segment are smaller than many other commercial real estate transactions. Although the brokerage commissions in this segment are generally a higher percentage of the sales price, the smaller size of the transactions requires us to close many more transactions to sustain revenues. If the commission structure or the velocity of transactions were to change, we could be disproportionately affected by changes compared to other companies that focus on larger transactions, institutional clients and other segments of the commercial real estate market.

There is no assurance that we will be able to continue to compete effectively or maintain our current fee arrangements with our private clients or margin levels or we will not encounter increased competition. The services we provide to our clients are highly competitive on a national, regional and local level. Depending on the geography, property type or service, we face competition from, including, but not limited to, commercial real estate service providers, in-house real estate departments, private owners and developers, commercial mortgage servicers, institutional lenders, research and consulting firms, and investment managers, some of whom are clients and many of whom may have greater financial resources than we do. In addition, future changes in laws and regulations could lead to the entry of other competitors. Many of our competitors are local, regional or national firms. Although most are substantially smaller than we are, some of these competitors are larger on a local, regional or national basis, and we believe more national firms are exploring entry into or expansion in the under $10 million private investor segment. We may face increased competition from even stronger competitors in the future due to a trend toward consolidation, especially in times of severe economic stress. We are also subject to competition from other large national and multi-national firms as well as regional and local firms that have similar service competencies to ours. Our existing and future competitors may choose to undercut our fees, increase the levels of compensation they are willing to pay to their employees and either recruit our employees or cause us to increase our level of compensation necessary to retain our own employees or recruit new employees. These occurrences could cause our revenue to decrease or negatively impact our target ratio of compensation-to-operating revenue, both of which could have an adverse effect on our business, financial condition and results of operations.

Our attempts to expand our services and businesses may not be successful and we may expend significant resources without corresponding returns.

We intend to expand our specialty groups, particularly multi-tenant retail, office, industrial and hospitality, as well as various niche segments, including multifamily tax credit, affordable housing, student housing, manufactured housing, seniors housing and self-storage. We also plan to grow our financing services provided through our subsidiary, Marcus & Millichap Capital Corporation, or MMCC. We expect to incur expenses relating to training, and expanding our markets and services. The planned expansion of services and platforms

19

requires significant resources, and there can be no assurance we will compete effectively, hire or train a sufficient number of professionals to support the expansion, or operate these businesses profitably. We may incur significant expenses for these plans without corresponding returns, which would harm our results of operations.

If we experience significant growth in the future, such growth may be difficult to sustain and may place significant demands on our administrative, operational and financial resources.

If we experience significant growth in the future, such growth could place additional demands on our resources and increase our expenses, as we will have to commit additional management, operational and financial resources to maintain appropriate operational and financial systems to adequately support expansion. There can be no assurance we will be able to manage our expanding operations effectively or we will be able to maintain or accelerate our growth, and any failure to do so could adversely affect our ability to generate revenue and control our expenses, which could adversely affect our business, financial condition and results of operations. Moreover, we may have to delay, alter or eliminate the implementation of certain aspects of our growth strategy due to events beyond our control, including, but not limited to, changes in general economic conditions and commercial real estate market conditions. Such delays or changes to our growth strategy may adversely affect our business.

Our brokerage operations are subject to geographic and commercial real estate market risks, which could adversely affect our revenues and profitability.

Our real estate brokerage offices are located in and around large metropolitan areas as well as mid-market regions throughout the United States. Local and regional economic conditions in these locations could differ materially from prevailing conditions in other parts of the country. We have more offices and realize more of our revenues in California, the Northeast (New York, New Jersey, Massachusetts, Connecticut, Pennsylvania, and Washington DC), Florida, Texas, Washington and Northern Illinois than in other regions in the country. In 2013, we realized approximately 30%, 15%, 12%, 10%, 6% and 6% of our revenues from California, the Northeast, Florida, Texas, Washington and Northern Illinois, respectively. In particular, we are subject to risks related to the California economy and real estate markets. In addition to economic conditions, this geographic concentration means that California-specific legislation, taxes and regional disasters such as earthquakes could disproportionately affect us. A downturn in investment real estate demand or economic conditions in these regions could result in a further decline in our total gross commission income and profitability and have a material adverse effect on us.

If we are unable to retain existing clients and develop new clients, our financial condition may be adversely affected.

We are substantially dependent on long-term client relationships and on revenue received for services provided for them. Our listing agreements generally expire within six months and depend on the cooperation of the client during the pendency of the agreement, as is typical in the industry. In this competitive market, if we are unable to maintain these relationships or are otherwise unable to retain existing clients and develop new clients, our business, results of operations and/or financial condition may be materially adversely affected. The global economic downturn and continued weaknesses in the markets in which our clients and potential clients compete have led to a lower volume of transactions and fewer real estate clients generally, which makes it more difficult to maintain existing and establish new client relationships. These effects have moderated, but they could increase again in the wake of the continuing political and economic uncertainties in the United States and in other countries.

A change in the tax laws relating to like-kind exchanges could adversely affect our business and the value of our stock.

Section 1031 of the Internal Revenue Code of 1986, as amended, or the Code, provides for tax-free exchanges of real property for other real property. Legislation has been proposed on several occasions that would repeal or restrict the application of Section 1031. If tax-free exchanges under Section 1031 were to be limited or

20

unavailable, our clients or prospective clients may decide not to purchase or sell property that they would have otherwise purchased or sold due to the tax consequences of the transaction, thus reducing the commissions we would have otherwise received. Any repeal or significant change in the tax rules pertaining to like-kind exchanges could have a substantial adverse impact on our business and the value of our stock.

Seasonal fluctuations in the investment real estate industry could adversely affect our business and make comparisons of our quarterly results difficult.

Our revenue and profits have historically tended to be significantly higher in the fourth quarter of each year than in the first quarter. This is a result of a general focus in the real estate industry on completing or documenting transactions by calendar-year-end and because certain expenses are constant through the year. Historically, we have reported relatively lower earnings in the first quarter and then increasingly larger earnings during each of the following three quarters. The seasonality of our business makes it difficult to determine during the course of the year whether planned results will be achieved, and thus to adjust to changes in expectations.

If we do not respond to technological changes or upgrade our technology systems, our growth prospects and results of operations could be adversely affected.

To remain competitive, we must continue to enhance and improve the functionality and features of our technological infrastructure. Although we currently do not have specific plans for any infrastructure upgrades that would require significant capital investment outside of the normal course of business, in the future we will need to improve and upgrade our technology, database systems and network infrastructure in order to allow our business to grow in both size and scope. Without such improvements, our operations might suffer from unanticipated system disruptions, slow performance or unreliable service levels, any of which could negatively affect our ability to provide rapid customer service. We may face significant delays in introducing new services, sales professional tools and enhancements. If competitors introduce new products and services using new technologies, our proprietary technology and systems may become less competitive, and our business may be harmed. In addition, the expansion and improvement of our systems and infrastructure may require us to commit substantial financial, operational and technical resources, with no assurance that our business will improve.

The Internet could devalue our information services and lead to reduced client relationships, which could reduce the demand for our services.

The dynamic nature of the Internet, which has substantially increased the availability and transparency of information relating to commercial real estate listings and transactions, could change the way commercial real estate transactions are done. This has occurred to some extent in the residential real estate market as online brokerage companies have eroded part of the market for traditional residential real estate brokerage firms. The proliferation of large amounts of data on the Internet could also devalue the information that we gather and disseminate as part of our business model and may harm certain aspects of our investment brokerage business in the event that principals of transactions prefer to transact directly with each other. The rapid dissemination and increasing transparency of information, particularly for public companies, increases the risks to our business that could result from negative media or announcements about ethics lapses or other operational problems, which could lead clients to terminate or reduce their relationships with us.

Interruption or failure of our information technology, communications systems or data services could hurt our ability to effectively provide our services, which could damage our reputation and harm our operating results.

Our business requires the continued operation of information technology and communication systems and network infrastructure. Our ability to conduct our national business may be adversely impacted by disruptions to these systems or infrastructure. Our information technology and communications systems are vulnerable to damage or disruption from fire, power loss, telecommunications failure, system malfunctions, computer viruses,

21

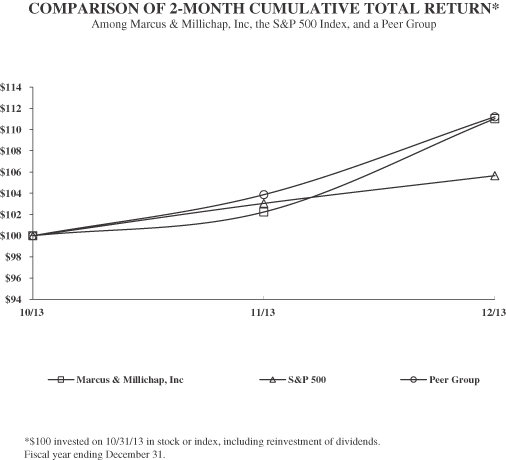

natural disasters such as hurricanes, earthquakes and floods, acts of war or terrorism, or other events which are beyond our control. In addition, the operation and maintenance of these systems and networks is in some cases dependent on third-party technologies, systems and service providers for which there is no certainty of uninterrupted availability. Any of these events could cause system interruption, delays, and loss of critical data or intellectual property and may also disrupt our ability to provide services to or interact with our clients, and we may not be able to successfully implement contingency plans that depend on communication or travel. We have disaster recovery plans and backup systems to reduce the potentially adverse effect of such events, but our disaster recovery planning may not be sufficient and cannot account for all eventualities. A catastrophic event that results in the destruction or disruption of any of our data centers or our critical business or information technology systems could severely affect our ability to conduct normal business operations and, as a result, our future operating results could be adversely affected. Our business relies significantly on the use of commercial real estate data. We produce much of this data internally, but a significant portion is purchased from third-party providers for which there is no certainty of uninterrupted availability. A disruption of our ability to provide data to our professionals and/or clients could damage our reputation, and our operating results could be adversely affected.